Тechnical analysis of currency pairs (Anton Hanzenko)

Forex indicators used in Technical analysis: MACD, RSI, Ichimoku Kinko Hyo, Equal-channel, Fibonacci lines, Price Levels.

Earn with the help of the trade service on the news Erste News!

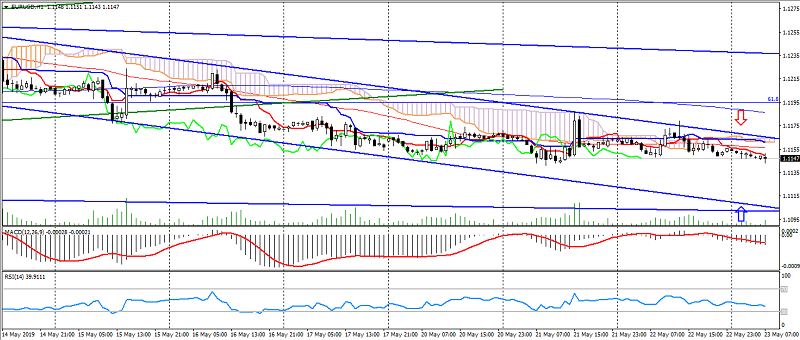

EUR USD (current price: 1.1140)

- Support levels: 1.1350, 1.1200, 1.1100.

- Resistance levels: 1.1450, 1.1550, 1.1650.

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is below 0, the signal line in the body of the histogram. RSI (14) in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): Tenkan-sen line is lower than Kijun-sen, the price is below the cloud.

- The main recommendation: sale entry is from 1.1180, 1.1200, 1.1230.

- Alternative recommendation: buy entry is from 1.1130, 1.1100, 1.1080.

A pair of euro dollar is traded in the flat, keeping the downward trend and limited to the downward trend.

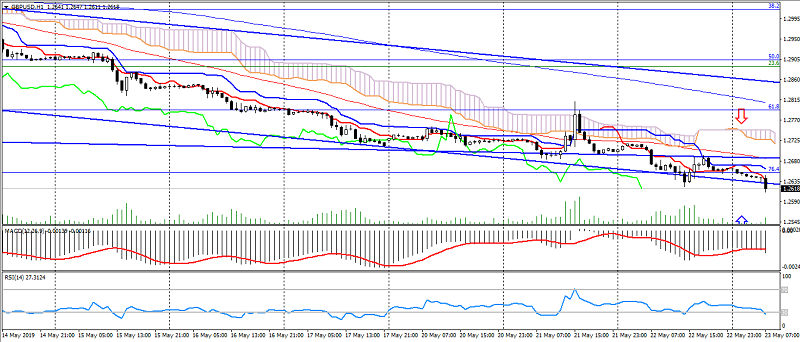

GBP USD (current price: 1.2620)

- Support levels: 1.2500, 1.2300, 1.2100.

- Resistance levels: 1.3300, 1.3600, 1.4000.

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is below 0, the signal line in the body of the histogram. RSI (14) in the oversold area. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): Tenkan-sen line is below the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is from 1.2680, 1.2700, 1.2730.

- Alternative recommendation: buy entry is from 1.2600, 1.2580, 1.2550.

The British Pound trades with a decrease in the preservation of political risks around Brexit, limited to oversold.

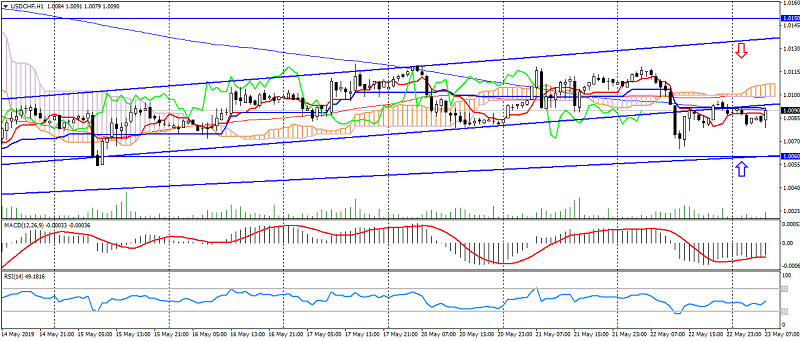

USD CHF (current price: 1.0080)

- Support levels: 0.9850, 0.9750, 0.9650.

- Resistance levels: 1.0000, 1.0060, 1.0150.

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is below 0, the signal line in the body of the histogram. RSI (14) in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): Tenkan-sen line is below the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is from 1.0100, 1.0130, 1.0150.

- Alternative recommendation: buy entry is from 1.0080, 1.0050, 1.0030.

The US dollar Swiss franc remains under the pressure on increasing risks, slowing the upward trend.

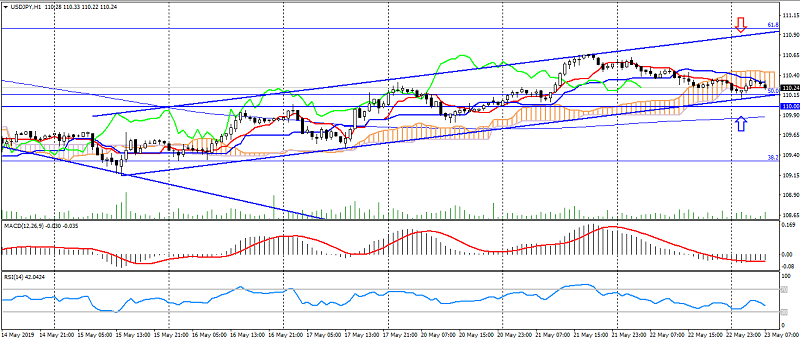

USD JPY (current price: 110.20)

- Support levels: 104.50, 103.00, 100.50.

- Resistance levels: 110.00, 112.00, 115.00.

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is below 0, the signal line in the body of the histogram. RSI (14) in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – flat): Tenkan-sen line near Kijun-sen line, the price is in the cloud.

- The main recommendation: sale entry is from 110.60, 110.80, 111.00.

- Alternative recommendation: buy entry is from 110.00, 109.80, 109.50.

A pair of the US dollar Japanese yen has weakened slightly since the beginning of the day for correction, maintaining upward momentum.

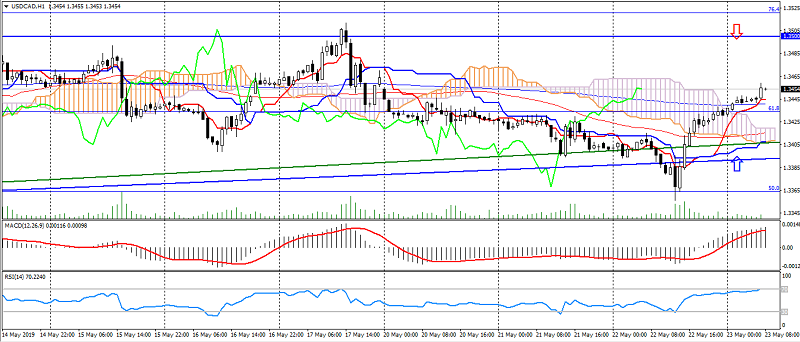

USD CAD (current price: 1.3460)

- Support levels: 1.3100, 1.3000, 1.2900.

- Resistance levels: 1.3300, 1.3500, 1.3700.

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is above 0, the signal line in the body of the histogram. RSI (14) in the overbought zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): Tenkan-sen line is above the Kijun-sen line, the price is above the cloud.

- The main recommendation: sale entry is from 1.3470, 1.3500, 1.3520.

- Alternative recommendation: buy entry is from 1.3440, 1.3420, 1.3400.

A pair of US dollars Canadian dollar returned to an upward trend, limited to overbought.

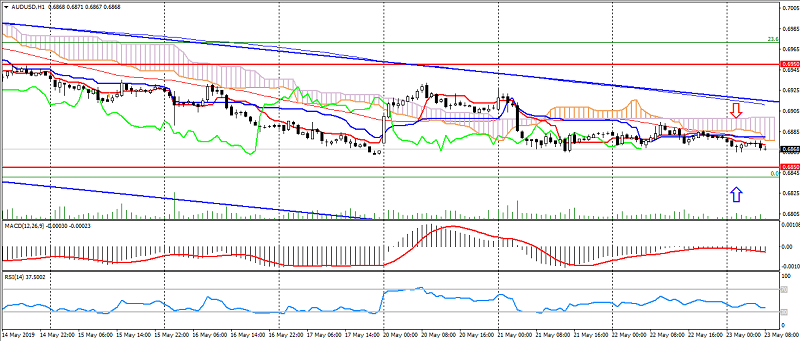

AUD USD (current price: 0.6870)

- Support levels: 0.7050, 0.6950, 0.6850.

- Resistance Levels: 0.7200, 0.7300, 0.7400.

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is below 0, the signal line in the body of the histogram. RSI (14) in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): Tenkan-sen line is below the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is from 0.6900, 0.6930, 0.6950.

- Alternative recommendation: buy entry is from 0.6850, 0.6820, 0.6800.

The Australian dollar maintains a moderate movement in the flat, keeping the overall downward trend.

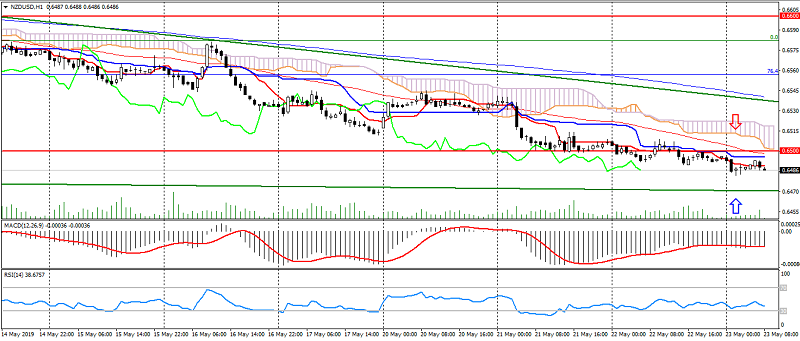

NZD USD (current price: 0.6490)

- Support levels: 0.6700, 0.6600, 0.6500.

- Resistance levels: 0.6880, 0.6950, 0.7050.

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is below 0, the signal line in the body of the histogram. RSI (14) in the oversold area. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): Tenkan-sen line is below the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is from 0.6500, 0.6530, 0.6550.

- Alternative recommendation: buy entry is from 0.6480, 0.6450, 0.6430.

The New Zealand dollar remains under the pressure on maintaining risks.

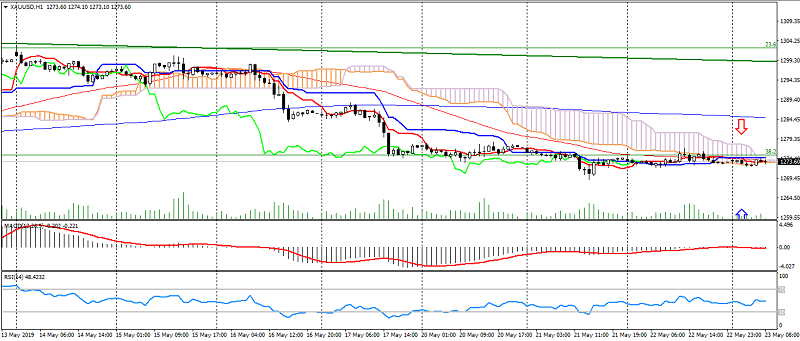

XAU USD (current price: 1273.00)

- Support levels: 1300.00, 1335.00, 1360.00.

- Resistance levels: 1265.00, 1240.00, 1220.00.

- Computer analysis: MACD (12, 26, 9) (signal – flat): indicator near 0. RSI (14) in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – flat): Tenkan-sen line near Kijun-sen line, the price is in the cloud.

- The main recommendation: sale entry is from 1280.00, 1285.00, 1290.00.

- Alternative recommendation: buy entry is from 1270.00, 1265.00, 1260.00.

Gold is trading at the open of the day, keeping flat and limited to the downward trend.