U.S. data

- Initial jobless claims, fact 210K, forecast 211K.

- Philadelphia Fed manufacturing index (Oct), fact 22.2, forecast 19.7.

- Philadelphia Fed employment index (Oct.), fact 19.5, previous value 17.6.

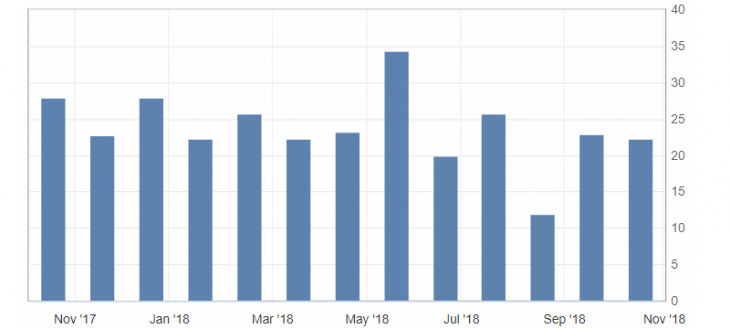

Published news block on the USA turned out to be very optimistic. Particularly positive was the report on initial jobless claims, that despite a slight increase, remains near multi-year lows. At the same time, positive data on manufacturing activity from the Federal Reserve Bank of Philadelphia, despite skeptical forecasts, have a more significant impact on the market. The indicator itself remains in a downtrend, but demonstrates attempts to slow the decline.

Fig. 1. Philadelphia Fed manufacturing activity index chart

The US dollar index reacted very cautiously to published statistics, remaining in the power of sentiment and technical factors. Thus, the dollar index remains in an uptrend, but is limited to the trading range from 95.50 to 95.70-80.

Fig. 2. The US dollar index chart. The current price is 95.60 (10-year government bonds yield is the blue line)

Read also: “Features of Trade on Bollinger Lines”

Hanzenko Anton

Earn with the help of the trade service on the news Erste News!

Topical articles of the trader’s blog:

- Prospects for recovery of emerging markets.

- Trump presidency results (1/2).

- Trump presidency results (1/1).

Current Investment ideas: