How long will last the US trade war against all?!

The US trade war since April of this year has actually remained the main source of risks in the market. It was periodically replaced by scandalous statements by Trump and short economic risks. As the administration of the White House itself calls it – the main goal of the US trade confrontation is to reduce the US trade deficit.

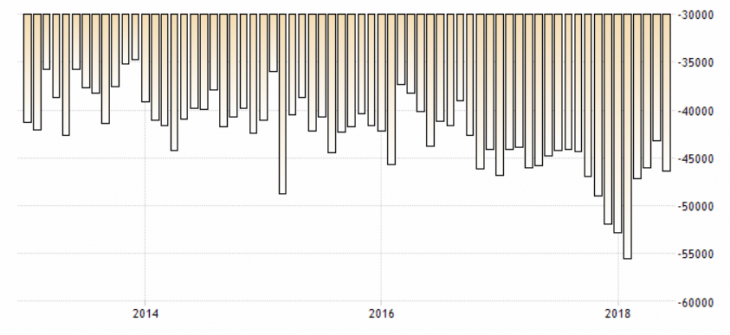

The US trade balance since the startof the year has receded from the lows of ten years, which was traced at the start of the year and was caused by a number of fundamental factors, among which Trump’s policy plays a role.

Fig. 1. US Trade Balance Chart

At the same time, according to these indicators, the policy to reduce the trade balance deficit has solved only an abnormal decline, the cause of which has partly become. The general dynamics of the US trade balance for the last five years remains downward and since 2016 has shown acceleration.

US exports and imports over the past year have increased significantly.

Fig. 2. US Export Chart

Fig. 3. US imports chart

At the same time, imports continue to outpace exports both in volume and growth. And overcoming the growth in the deficit of the US trade balance at the end of 2017 beginning of 2018 was overcome to the accelerated growth of exports.

On the other hand, the slowdown in US imports remains a positive factor, which remains at the level of February 2018 and is a kind of psychological point. Updating this point will indicate the preservation of existing dynamics, aimed at increasing the deficit.

Trade War and the US Dollar

Trump’s new statements regarding the aggravation of the trade war or new duties, or even failures in the negotiations on trade agreements, end with the ubiquitous growth of the American dollar, amid the investors’ flight from risks and a decline in the US state’s bonds yield.

Logically it contradicts the goal of reducing the US trade deficit and, moreover, makes US exports longer. Trump tried to fight it with the help of the Fed’s rhetoric and a strong dollar. This helped in part, but any verbal intervention that is not backed up by the Central Bank’s actions carries a short-term effect. So it was also with Trump’s comments on the strong dollar.

Negotiations on the revision of the NAFTA trade agreement between the US and Canada have reached a deadlock. It was previously reported that the United States and Mexico found “points of contact”. In parallel with the aggravation of negotiations with Canada, the trade conflict between the US and China worsened. Thus, Trump said that he was preparing to raise duties on Chinese goods to $ 200 billion, which is an unprecedented amount.

This indicates, at least, for several more months of US trade confrontation, which, after China, continues to switch to other US trading partners. This will serve as an excuse for further growth of the US dollar against the backdrop of tightening of the Fed monetary policy.

Anton Hanzenko