Теорія циклів на ринку FOREX. Коротко про все.

Теорія циклів ринку – це дуже велика наука, що включає в себе безліч понять і теорій. На теорії циклів засновано безліч стратегій і такі теорії як теорія Хвиль Еліота і більш прості фігури технічного аналізу. Всі вони в тій чи іншій мірі пов’язані з теорією циклів.

Відразу хотілося зазначити основний недолік теорії циклів – відсутність симетрії, що значно ускладнює застосування даної теорії в життя, оскільки приклади дуже рідко збігаються з реальним життям. Пам’ятаючи про факт, що РИНОК ВРАХОВУЄ ВСЕ, така дрібниця як симетрія відразу розіб’ється в реаліях ринку. Найменша заява глави ЦБ, зміни в макроекономічних показниках, політичні скандали або навіть можливості будь-яких ризиків відразу будуть враховані ринком. І це мізерна частина того, що впливає на ринок і сильно заважає прояву коректної роботи теорії циклів.

Але, незважаючи на бочку дьогтю, ложка меду в даній теорії залишається. А можливі похибки ринку в теорії циклів зміщують в сторону більш значимого тренда, який визначається вищезгаданими факторами.

Засновником теорії циклів вважають Д. Херста, який опублікував книгу «Таємниче мистецтво своєчасних операцій на фондових ринках» в 1970 році. Книга стала основою для даної теорії. Заглиблюватися в дані теорії в цій публікації ми не будемо.

Розглянемо основне поняття теорії циклів на формуванні тренду, яким можуть відповідати як великі тренди на денному і тижневому графіку, так і дрібні, аж до хвилинного графіка.

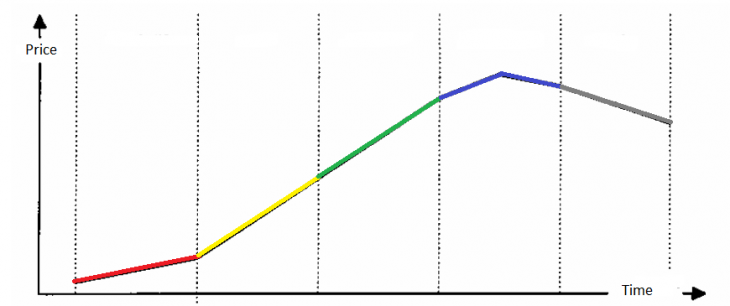

Теорія циклів виділяє п’ять фаз одного циклу:

- введення (накопичення),

- зростання (основний рух),

- зрілість (основний рух),

- насичення (формування максимуму)

- і відкат (корекція).

Червона лінія – введення, жовта лінія – зростання, зелена лінія – зрілість, синя лінія – насичення, сіра лінія – відкат.

Дана модель однакова, може бути застосована як для висхідного, так і спадного тренда.

Фаза введення (накопичення) характеризується відносним флетом. У цій фазі ведеться якесь протистояння між покупцями і продавцями, перемога одного з учасників в результаті і визначає подальший тренд.

Зростання (основний рух) – сильний рух розвиваючого тренда. Найчастіше в цій фазі з’являються фундаментальні фактори або новини, які дають поштовх ринку.

Зрілість (основний рух) відповідає основному руху, як правило, тут максимальні обсяги торгів. Це може навіть прискорити рух тренду.

Насичення (формування максимуму) вказує на те, що тренд підходить до логічного кінця і варто очікувати корекції. У цій фазі формується екстремум, який в подальшому може виступати значущим рівнем.

Відкат (корекція) – закінчення тренду, який вказує на закінчення даного руху та очікування формування нового тренду. Відкат є невід’ємною частиною будь-якого тренду, який в силу обставин може по-різному проявитися.

На прикладі даного циклу будується більшість рухів ринку Forex, але в силу обставин вони мають власні особливості, які тільки схематично відповідають даній моделі руху. Навіть на основі даної моделі можна сформувати власну стратегію або поліпшити існуючу.

Антон Ганзенко