Тechnical analysis of currency pairs (Anton Hanzenko)

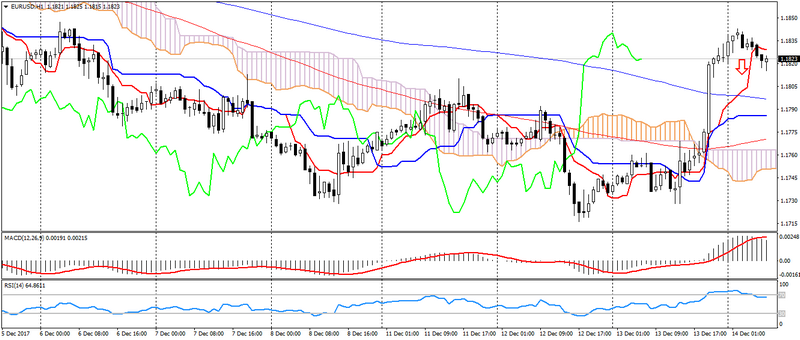

EUR USD (current price: 1.1820)

- Support levels: 1.1700 (August 2015 maximum), 1.1600 (2016 maximum), 1.1470.

- Levels of resistance: 1.2000, 1.2100, 1.2270 (November 2014 minimum).

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is above 0, the signal line has left the body of the histogram. RSI (14) is in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): the Tenkan-sen line is above the Kijun-sen line, the price is higher than the cloud.

- The main recommendation: sale entry is started from 1.1840, 1.1860, 1.1880.

- Alternative recommendation: buy entry is started from 1.1800 (MA 200), 1.1780, 1.1760.

The euro weakened slightly earlier in the day due to the correction of the American and the ECB meeting, thereby preserving the potential for correction.

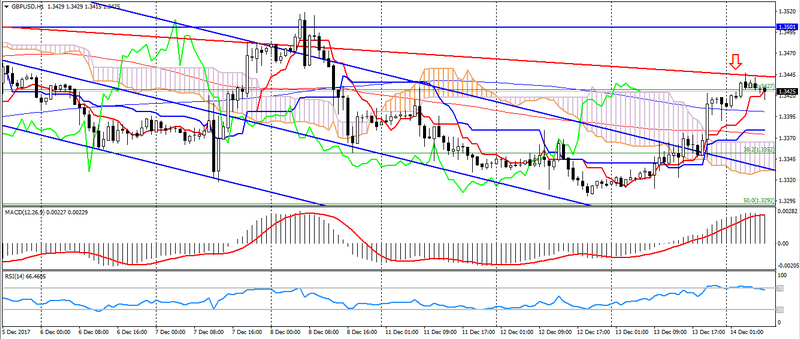

GBP USD (current price: 1.3420)

- Support levels: 1.3140, 1.2900, 1.2740 (August 2017 minimum).

- Resistance levels: 1.3500, 1.3660, 1.3830 (February 2016 minimum).

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is above 0, the signal line is in the body of the histogram. RSI (14) is in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): the Tenkan-sen line is above the Kijun-sen line, the price is higher than the cloud.

- The main recommendation: sale entry is started from 1.3450, 1.3470, 1.3500.

- Alternative recommendation: buy entry is started from 1.3400 (MA 200), 1.3370 (MA 100), 1.3350.

The British pound is trading with strengthening on the weakness of the American, waiting for the meeting of the Bank of England. At the same time, it is limited to a downward trend.

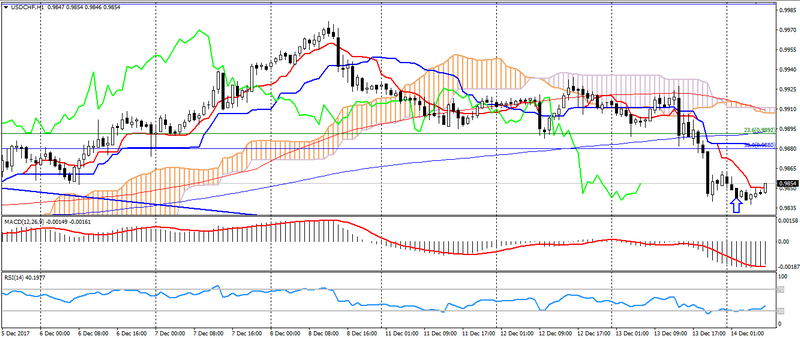

USD CHF (current price: 0.9850)

- Support levels: 0.9700, 0.9600, 0.9530.

- Resistance levels: 1.0000, 1.0050, 1.0100 (May maximum).

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is below 0, the signal line is in the body of the histogram. RSI (14) is in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): the Tenkan-sen line is below the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is started from 0.9860, 0.9880 (Fibo.50.0 from the high of November 2016), 0.9900.

- Alternative recommendation: buy entry is started from 0.9830, 0.9800, 0.9770 (Fibo, 38.2 from the high of November 2016).

The Swiss franc is trading with the strengthening, but retains the potential for correction.

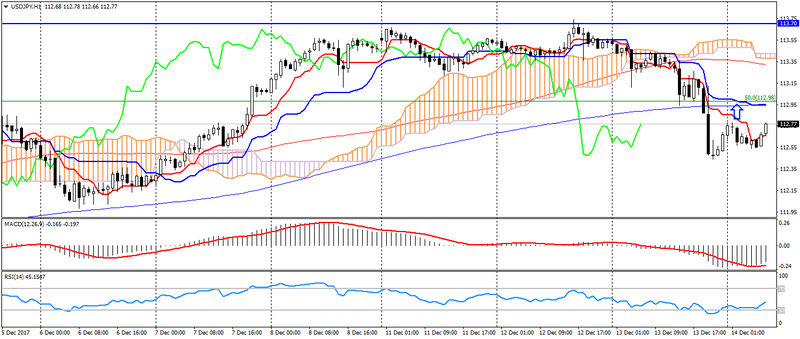

USD JPY (current price: 112.70)

- Support levels: 108.90, 108.10 (April 2017 minimum), 107.30 (2017 minimum).

- Resistance levels: 113.70, 114.50 (July 2017 maximum), 115.00.

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is below 0, the signal line has left the body of the histogram. RSI (14) is in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): the Tenkan-sen line is below the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is started from 112.90 (Fibo.50.0 from the maximum of November 2016), 113.30, 113.70.

- Alternative recommendation: buy entry is started from 112.40, 112.00, 111.80.

The Japanese yen is trading at the opening level of the day, keeping the potential to decline.

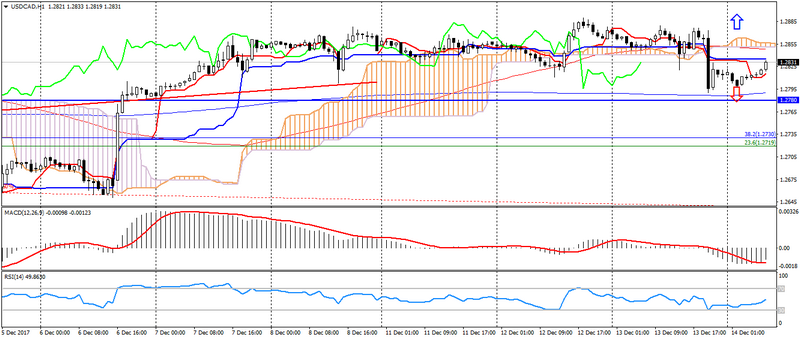

USD CAD (current price: 1.2830)

- Support levels: 1.2200, 1.2060 (2017 minimum), 1.1950 (2015 minimum).

- Resistance levels: 1.2780 (August 2017 maximum), 1.3000, 1.3160.

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is below 0, the signal line has left the body of the histogram. RSI (14) is in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): the Tenkan-sen line is below the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is started from 1.2850 (MA 100), 1.2890, 1.2910.

- Alternative recommendation: buy entry is started from 1.2800, 1.2780 (MA 200), 1.2760.

The Canadian dollar is trading lower, returning to the sideways trend.

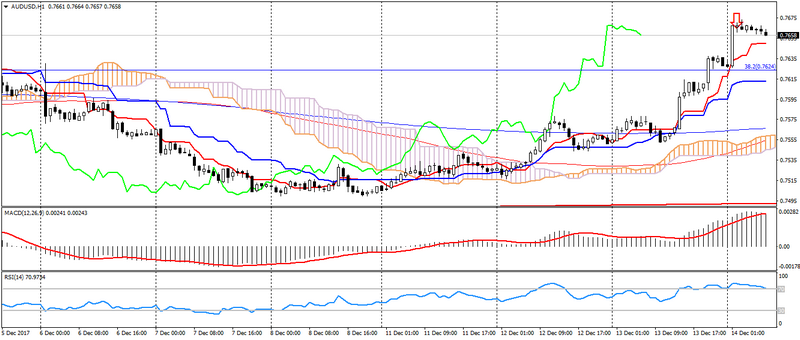

AUD USD (current price: 0.7660)

- Support levels: 0.7740, 0.7320 (2017 minimum), 0.7120.

- Resistance levels: 0.8120 (2017 maximum), 0.8200, 0.8290 (2014 maximum).

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is above 0, the signal line is in the body of the histogram. RSI (14) is in the overbought zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): the Tenkan-sen line is above the Kijun-sen line, the price is higher than the cloud.

- The main recommendation: sale entry is started from 0.7680, 0.7700, 0.7720.

- Alternative recommendation: buy entry is started from 0.7630, 0.7600, 0.7570.

The Australian maintains a positive attitude based on positive statistics on Australia, but is limited to a noticeable overbought.

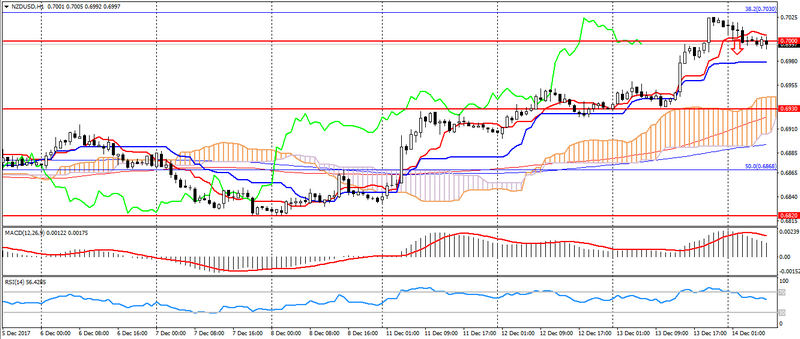

NZD USD (current price: 0.6990)

- Support levels: 0.7000, 0.6930, 0.6820 (the minimum of the current year).

- Resistance levels: 0.7380, 0.7450, 0.7550 (2017 maximum).

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is above 0, the signal line has left the body of the histogram. RSI (14) is in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): the Tenkan-sen line is above the Kijun-sen line, the price is higher than the cloud.

- The main recommendation: sale entry is started from 0.7020, 0.7030, 0.7060.

- Alternative recommendation: buy entry is started from 0.6980, 0.6850, 0.6830 (MA 200).

The New Zealand dollar also maintains an upward trend, but is limited by overbought and upcoming correction.

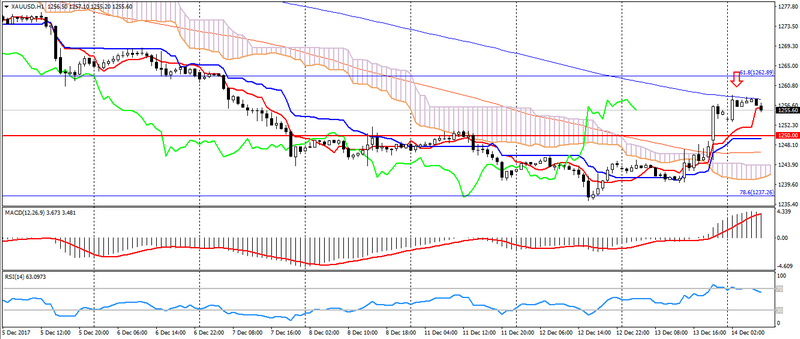

XAU USD (current price: 1255.00)

- Support levels: 1250.00, 1226.00, 1200.00.

- Resistance levels: 1340.00, 1355.00, 1374.00 (2016 maximum).

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is above 0, the signal line is in the body of the histogram. RSI (14) is in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): the Tenkan-sen line is above the Kijun-sen line, the price is higher than the cloud.

- The main recommendation: sale entry is started from 1260.00, 1262.00 (Fibo 61.8 from the July low), 1268.00.

- Alternative recommendation: buy entry is started from 1252.00, 1248.00, 1241.00.

Gold remains in the correction phase, while maintaining a downtrend.