Технический анализ валютных пар (Антон Ганзенко)

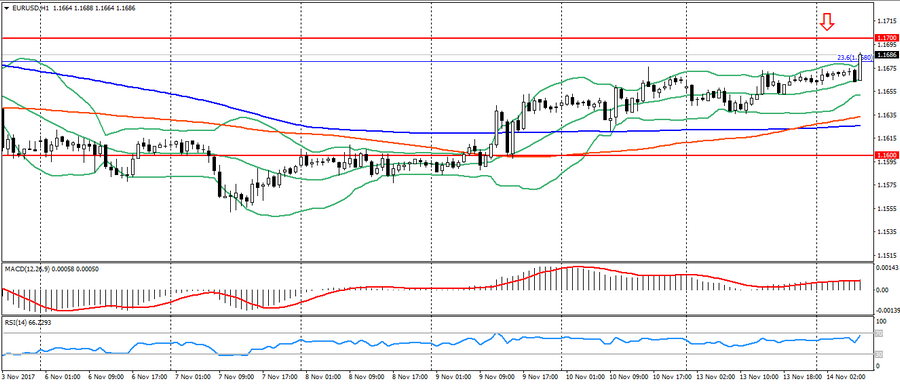

EUR USD (текущая цена: 1.1680)

- Уровни поддержки: 1.1700 (максимум августа 2015 года), 1.1600(максимум 2016 года), 1.1470.

- Уровни сопротивления: 1.2000, 1.2100, 1.2270 (минимум ноября 2014 года).

- Компьютерный анализ: MACD (сигнал – восходящее движение): индикатор выше 0, сигнальная линия в теле гистограммы. RSI в зоне перекупленности. Bollinger Bands (период 20): перекупленность, растущая волатильность.

- Основная рекомендация: вход на продажу от 1.1680 (Фибо. 23.6 от минимума декабря 2016 года), 1.1700, 1.1730.

- Альтернативная рекомендация: вход на покупку от 1.1650, 1.1620 (MA 200), 1.1600.

Евро укрепилось в начале дня на публикации позитивных предварительных данных по ВВП Германии. В результате чего данной паре удалось приблизиться к значимым уровням сопротивления, но торговый канал продолжает оставаться актуальным и не стоит забывать о предстоящих новостях.

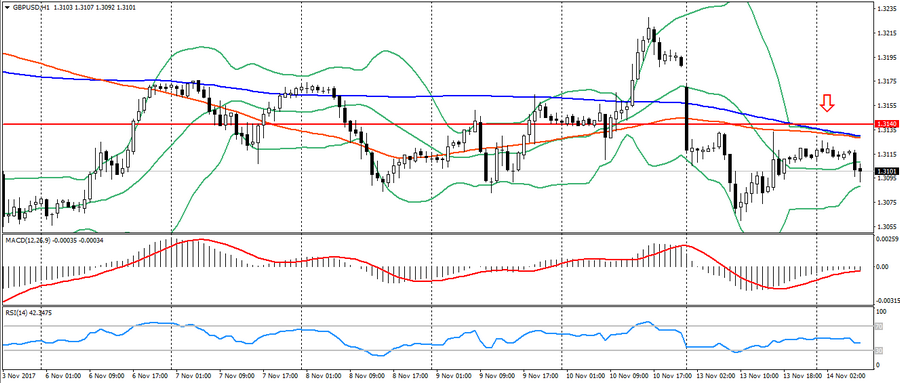

GBP USD (текущая цена: 1.3100)

- Уровни поддержки: 1.3140, 1.2900, 1.2740 (минимум августа 2017 года).

- Уровни сопротивления: 1.3500, 1.3660, 1.3830(минимум февраля 2016 года).

- Компьютерный анализ: MACD (сигнал – нисходящее движение): индикатор ниже 0, сигнальная линия в теле гистограммы. RSI в нейтрально зоне. Bollinger Bands (период 20): нейтрально, низкая волатильность.

- Основная рекомендация: вход на продажу от 1.3140, 1.3170, 1.3220.

- Альтернативная рекомендация: вход на покупку от 1.3090, 1.3060, 1.3030.

Британский фунт остаётся под давлением, несмотря на вчерашнее восстановление. В результате чего возможно возобновление нисходящей динамики. На сегодня по Великобритании ожидается значительное количество новостей.

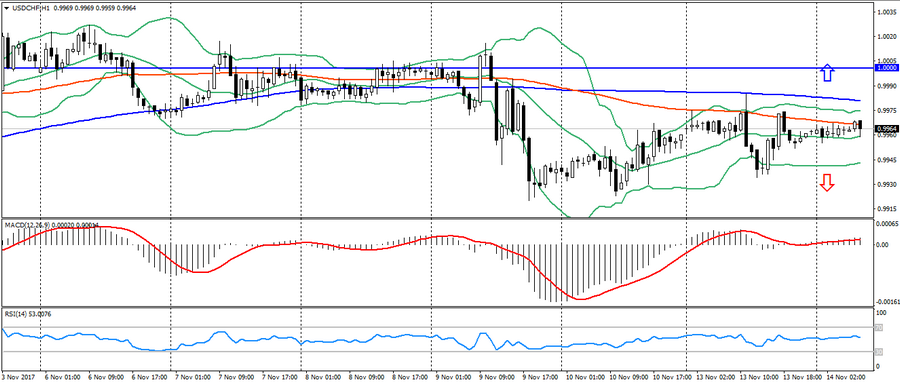

USD CHF (текущая цена: 0.9960)

- Уровни поддержки: 0.9700, 0.9600, 0.9530.

- Уровни сопротивления:, 1.0000, 1.0050, 1.0100 (максимум мая).

- Компьютерный анализ: MACD (сигнал – восходящее движение): индикатор выше 0, сигнальная линия в теле гистограммы. RSI в нейтральной зоне. Bollinger Bands (период 20): нейтрально, снижающаяся волатильность.

- Основная рекомендация: вход на продажу от 0.9980 (MA 200), 1.0000, 1.0020.

- Альтернативная рекомендация: вход на покупку от 0.9940, 0.9920, 0.9900.

Швейцарский франк остаётся торговаться на уровне открытия дня, тем самым сохраняя боковой тренд на неопределённости рынка.

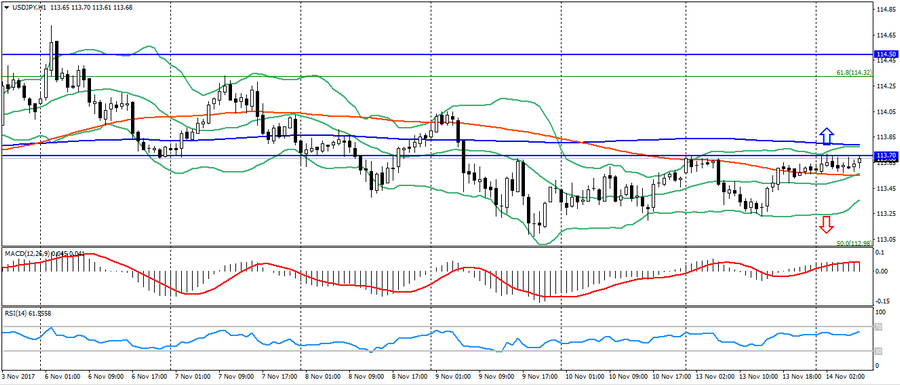

USD JPY (текущая цена: 113.70)

- Уровни поддержки: 108.90, 108.10 (минимум апреля 2017 года), 107.30 (минимум 2017 года).

- Уровни сопротивления: 113.70, 114.50 (максимум июля 2017 года), 115.00.

- Компьютерный анализ: MACD (сигнал – восходящее движение): индикатор выше 0, сигнальная линия в теле гистограммы. RSI в нейтральной зоне. Bollinger Bands (период 20): нейтрально, снижающаяся волатильность.

- Основная рекомендация: вход на продажу от 113.70, 113.90, 114.10.

- Альтернативная рекомендация: вход на покупку от 113.20, 112.90 (Фибо. 50.0 от максимума декабря 2016 года), 112.60.

Японская иена немного ослабла, несмотря на сохранение неопределённости. Дальнейшее укрепление пары возможно на отработке фигуры «двойное дно».

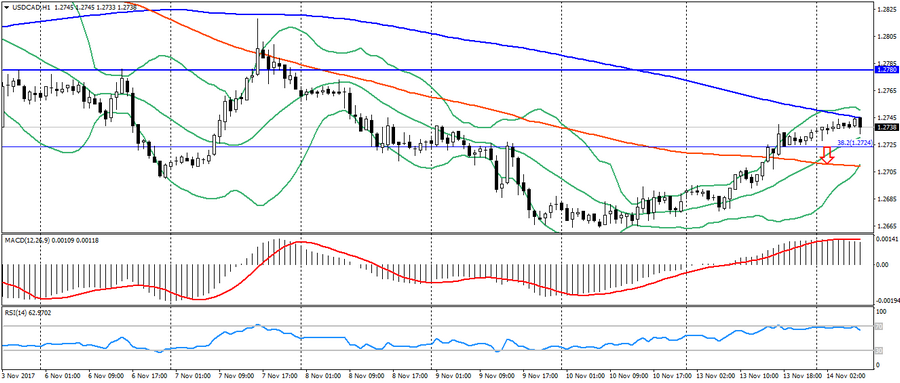

USD CAD (текущая цена: 1.2740)

- Уровни поддержки: 1.2200, 1.2060 (минимум 2017 года), 1.1950 (минимум 2015 года).

- Уровни сопротивления: 1.2780 (максимум августа 2017), 1.3000, 1.3160.

- Компьютерный анализ: MACD (сигнал – нисходящее движение): индикатор выше 0, сигнальная линия вышла с тела гистограммы. RSI в нейтральной зоне. Bollinger Bands (период 20): нейтрально, растущая волатильность.

- Основная рекомендация: вход на продажу от 1.2750 (MA 200), 1.2780, 1.2820.

- Альтернативная рекомендация: вход на покупку от 1.2710 (MA 100), 1.2670, 1.2650.

Канадский доллар остаётся под давлением в начале дня на негативной динамике сырья, но ограничивается значительной перепроданностью.

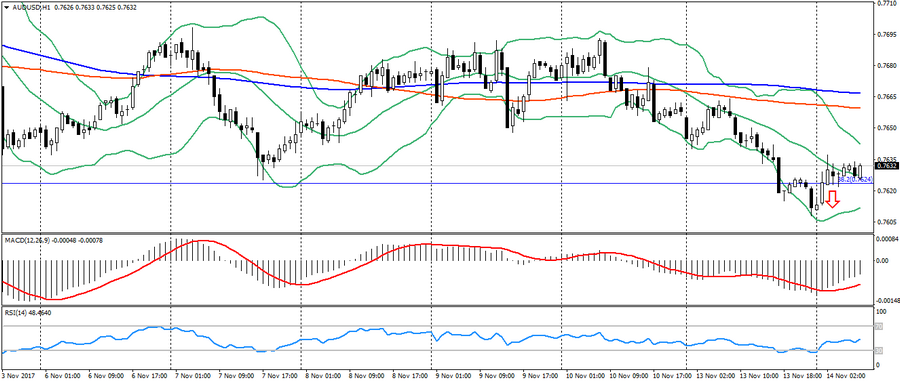

AUD USD (текущая цена: 0.7630)

- Уровни поддержки: 0.7740, 0.7320 (минимум 2017 года), 0.7120.

- Уровни сопротивления: 0.8120 (максимум 2017 года), 0.8200, 0.8290 (максимум 2014 года).

- Компьютерный анализ: MACD (сигнал – восходящее движение): индикатор ниже 0, сигнальная линия вышла с тела гистограммы. RSI в нейтральной зоне. Bollinger Bands (период 20): нейтрально, снижающаяся волатильность.

- Основная рекомендация: вход на продажу от 0.7640, 0.7660 (MA 200), 0.7690.

- Альтернативная рекомендация: вход на покупку от 0.7610, 0.7590, 0.7570.

Австралиец немного укрепился в начале дня на данных по Австралии, но продолжает оставаться под давлением общего снижения сырьевых валют.

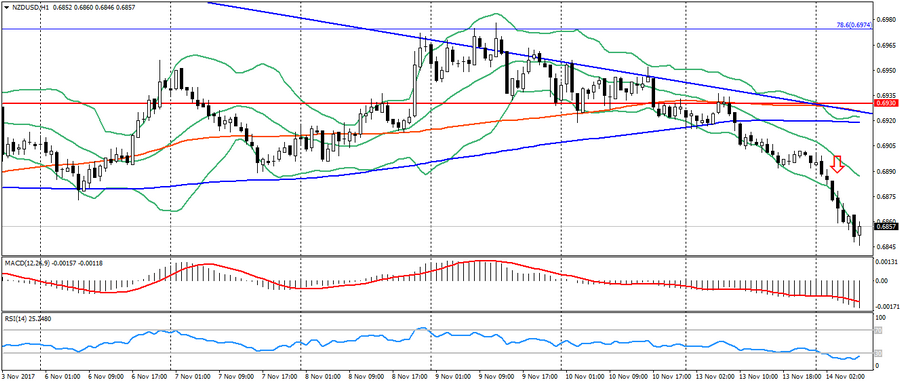

NZD USD (текущая цена: 0.6860)

- Уровни поддержки: 0.7000, 0.6930, 0.6820 (минимум текущего года).

- Уровни сопротивления: 0.7380, 0.7450, 0.7550 (максимум 2017 года).

- Компьютерный анализ: MACD (сигнал – нисходящее движение): индикатор ниже 0, сигнальная линия в теле гистограммы. RSI в зоне перепроданности. Bollinger Bands (период 20): перепроданность, растущая волатильность.

- Основная рекомендация: вход на продажу от 0.6880, 0.6900, 0.6920 (MA 200).

- Альтернативная рекомендация: вход на покупку от 0.6850, 0.6830, 0.6820 (минимум октября).

Новозеландский доллар остаётся торговаться возле месячного минимума на снижении фондовых индексов и стоимости сырья. После стремительного снижения возможна коррекция.

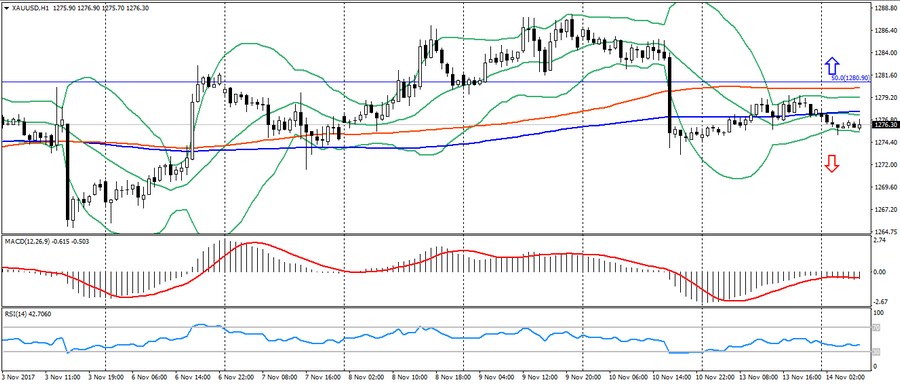

XAU USD (текущая цена: 1276.00)

- Уровни поддержки: 1250.00, 1226.00, 1200.00.

- Уровни сопротивления: 1340.00, 1355.00, 1374.00 (максимум 2016 года).

- Компьютерный анализ: MACD (сигнал – нисходящее движение): индикатор ниже 0, сигнальная линия в теле гистограммы. RSI в нейтральной зоне. Bollinger Bands (период 20): нейтрально, снижающаяся волатильность.

- Основная рекомендация: вход на продажу от 1290.00 (Фибо. 50.0 от минимума июля), 1294.00, 1287.00.

- Альтернативная рекомендация: вход на покупку от 1274.00, 1270.00, 1268.00.

Золото немного ослабло в начале дня, но по-прежнему торгуется очень сдержанно во флэте, что вызвано неоднозначностью рынка.