Технический анализ кросс-курсов. (Антон Ганзенко)

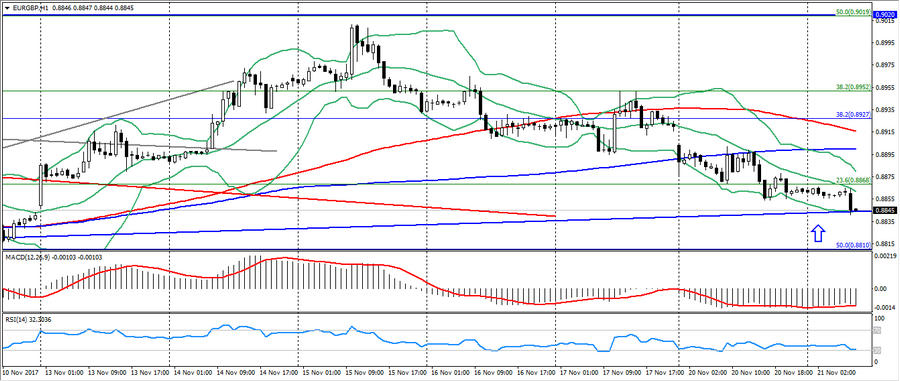

EUR GBP (текущая цена: 0.8840)

- Уровни поддержки: 0.8730 (минимум последних месяцев), 0.8650, 0.8530.

- Уровни сопротивления: 0.9020, 0.9170, 0.9300 (максимум текущего года).

- Компьютерный анализ: MACD (сигнал – нисходящее движение): индикатор ниже 0, сигнальная линия в теле гистограммы. RSI в зоне перепроданности. Bollinger Bands (период 20): перепроданность, снижающаяся волатильность.

- Основная рекомендация: вход на продажу от 0.8870,0.8900 (MA 200), 0.8930.

- Альтернативная рекомендация: вход на покупку от 0.8830, 0.8810 (Фибо. 50.00 от минимума апреля), 0.8790.

Нисходящая динамика кросс-курса остаётся в силе, но ограничивается значимой поддержкой на уровне 0.8840-10.

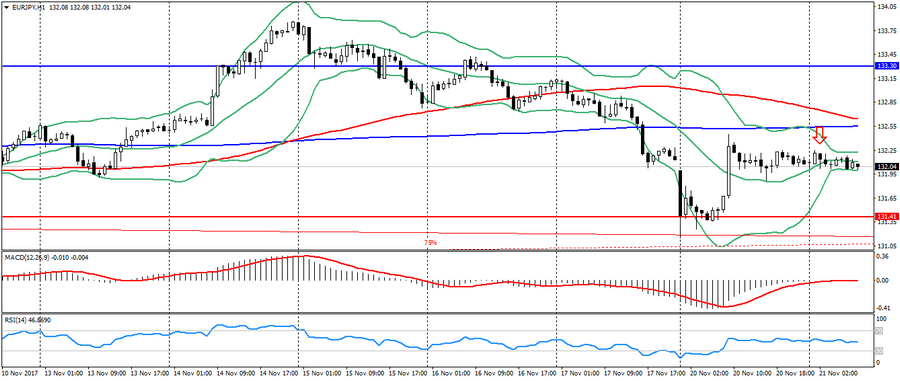

EUR JPY (текущая цена: 132.00)

- Уровни поддержки: 131.40 (минимум последних месяцев), 130.50, 129.80 (Фибо. 23.6 от минимума текущего года).

- Уровни сопротивления: 133.30, 134.40 (максимум текущего года), 135.00.

- Компьютерный анализ: MACD (сигнал – флэт): индикатор возле 0. RSI в нейтрально зоне. Bollinger Bands (период 20): нейтрально, низкая волатильность.

- Основная рекомендация: вход на продажу от 131.90, 132.50 (MA 200), 132.90.

- Альтернативная рекомендация: вход на покупку от 131.40, 131.00 (минимум ноября), 130.60.

Евро иена продолжает оставаться под давлением, несмотря на неоднозначность по еврозоне и формирование флэта на кроссе.

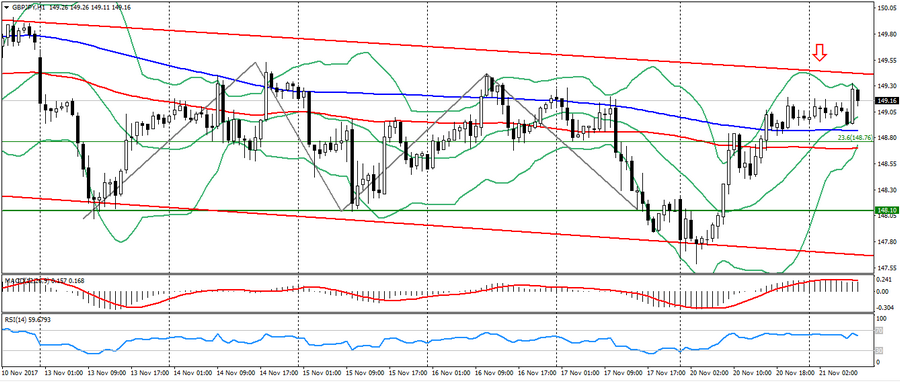

GBP JPY (текущая цена: 149.20)

- Уровни поддержки: 147.00 (минимум прошлого месяцев), 144.20 (Фибо. 50.0 от минимума апреля), 141.50.

- Уровни сопротивления: 151.30, 152.80 (максимум текущего года), 155.40.

- Компьютерный анализ: MACD (сигнал – восходящее движение): индикатор выше 0, сигнальная линия вышла с тела гистограммы. RSI в нейтральной зоне. Bollinger Bands (период 20): нейтрально, снижающаяся волатильность.

- Основная рекомендация: вход на продажу от 148.60, 148.80(MA 100), 148.90(MA 200).

- Альтернативная рекомендация: вход на покупку от 148.10, 147.80, 147.50.

Фунт иена остаётся возле значимого сопротивления, что указывает на возможность возвращения пары в канал.

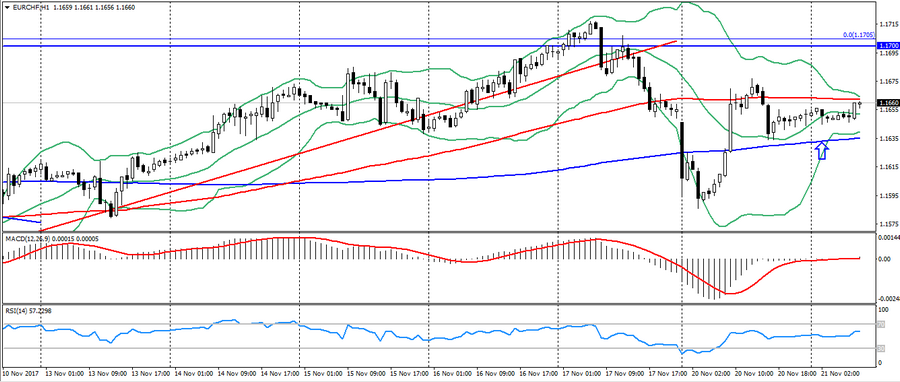

EUR CHF (текущая цена: 1.1660)

- Уровни поддержки: 1.1500, 1.1450 (Фибо. 23.6 от минимума текущего года), 1.1350.

- Уровни сопротивления: 1.1700(максимум текущего года), 1.1750, 1.1800.

- Компьютерный анализ: MACD (сигнал – восходящее движение): индикатор выше 0, сигнальная линия в теле гистограммы. RSI в нейтральной зоне. Bollinger Bands (период 20): нейтрально, низкая волатильность.

- Основная рекомендация: вход на продажу от 1.1660 (MA 100), 1.1700, 1.1730.

- Альтернативная рекомендация: вход на покупку от 1.1600, 1.1570, 1.1550.

Пара евро франк продолжает сохранять восходящую динамику в рамках общего восходящего тренда.