Technical analysis of cross-rates. (Anton Hanzenko)

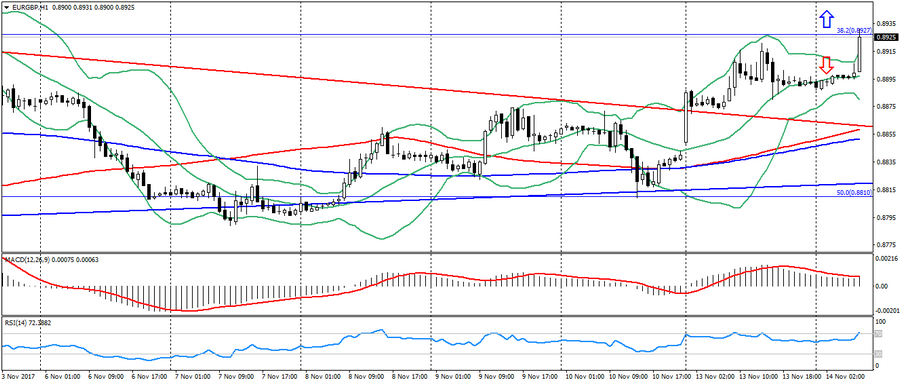

EUR GBP (current price: 0.8900)

- Support levels: 0.8730 (minimum of the last months), 0.8650, 0.8530.

- Resistance levels: 0.9020, 0.9170, 0.9300 (the maximum of the current year).

- Computer analysis: MACD (signal – upward motion): the indicator is above 0, the signal line is in the body of the histogram. RSI is in the overbought zone. Bollinger Bands (period 20): overbought, growing volatility.

- The main recommendation: sale entry is started from 0.8930 (Fibo. 38.2 from the April’s low), 0.8950, 0.8970.

- Alternative recommendation: buy entry is started from 0.8880, 0.8850, 0.8830 (MA 200).

The euro gained notable support on the preliminary data on Germany’s GDP. As a result, it approached a significant resistance level of 0.8930, the breakoutthrough of this level would indicate the possibility of further growth.

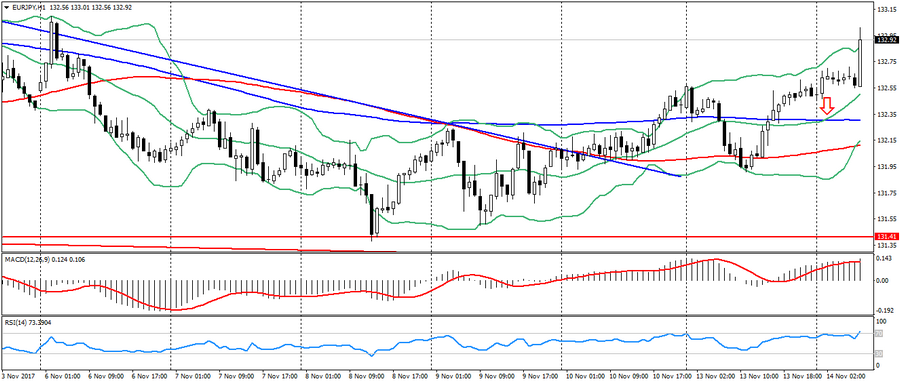

EUR JPY (current price: 132.90)

- Support levels: 131.40 (minimum of the last months), 130.50, 129.80 (Fibo. 23.6 from the low of the current year).

- Resistance levels: 133.30, 134.40 (the maximum of the current year), 135.00.

- Computer analysis: MACD (signal – upward motion): the indicator is above 0, the signal line is in the body of the histogram. RSI is in the overbought zone. Bollinger Bands (period 20): overbought, declining volatility.

- The main recommendation: sale entry is started from 132.30 (MA 200), 132.60, 132.80.

- Alternative recommendation: buy entry is started from 131.90, 131.70, 131.40.

The euro also strengthened against the yen, but is limited to overbought.

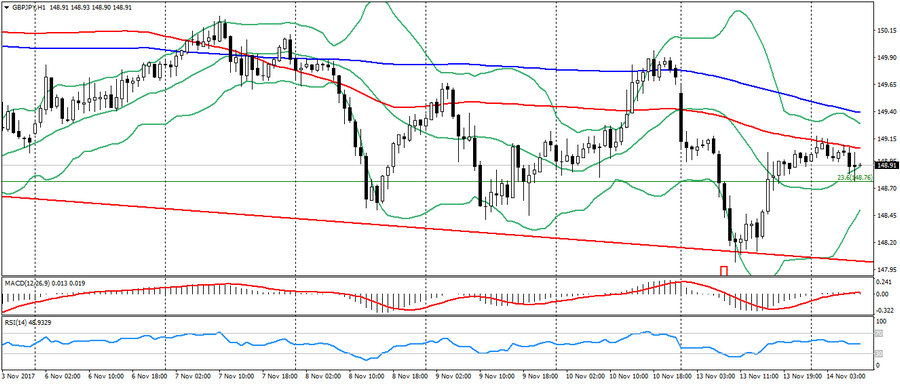

GBP JPY (current price: 148.80)

- Support levels: 147.00 (minimum of last months), 144.20 (Fibo. 50.0 from the low of April), 141.50.

- Resistance levels: 151.30, 152.80 (the maximum of the current year), 155.40.

- Computer analysis: MACD (signal – downward motion): the indicator is below 0, the signal line is in the body of the histogram. RSI is in the neutral zone. Bollinger Bands (period 20): neutral, declining volatility.

- The main recommendation: sale entry is started from 148.50 (MA 100), 148.80 (Fibo. 23.6 from the April low), 149.20.

- Alternative recommendation: buy entry is started from 148.00, 147.80, 147.50.

The pound remains under slight pressure amid political risks in the UK.

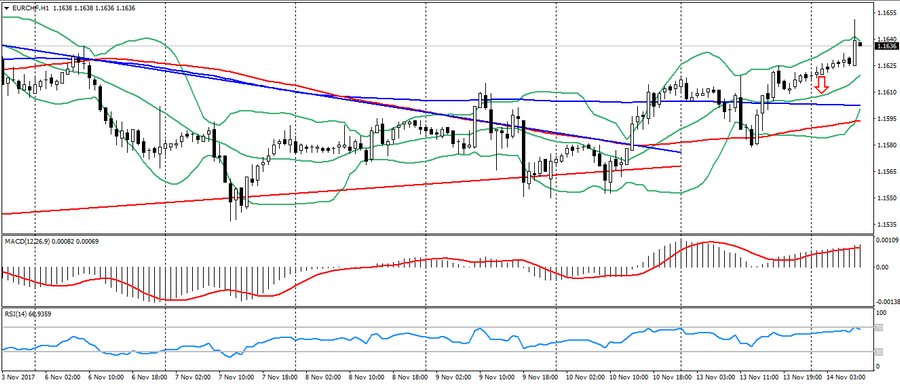

EUR CHF (current price: 1.1640)

- Support levels: 1.1500, 1.1450 (Fibo, 23.6 from the low of the current year), 1.1350.

- Resistance levels: 1.1700 (the maximum of the current year), 1.1750, 1.1800.

- Computer analysis: MACD (signal – upward motion): the indicator is above 0, the signal line is in the body of the histogram. RSI is in the overbought zone. Bollinger Bands (period 20): neutral, declining volatility.

- The main recommendation: sale entry is started from 1.1620 (the maximum of the last week), 1.1640, 1.1670.

- Alternative recommendation: buy entry is started from 1.1580 (MA 100), 1.1560, 1.1540 (local minimum).

The euro-franc pair remains under pressure, working out a “double bottom” figure, but is limited to the highs of the past two weeks.