Тechnical analysis of currency pairs (Anton Hanzenko)

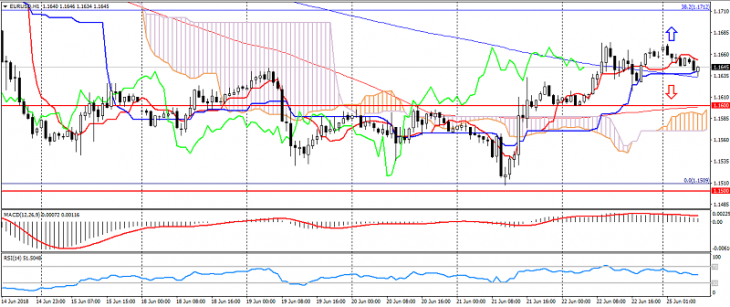

EUR USD (current price: 1.1640)

- Support levels: 1.1600, 1.1500 (local minimum), 1.1450.

- Resistance levels: 1.1750, 1.1850 (June maximum), 1.1900 (significant psychology).

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is higher than 0, the signal line has left the body of the histogram. RSI (14) in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): the Tenkan-sen line above the Kijun-sen line, the price is higher than the cloud.

- The main recommendation: sale entry is from 1.1680, 1.1700, 1.1730.

- Alternative recommendation: buy entry is from 1.1630, 1.1600, 1.1570.

The euro is trading with a slowdown, but it keeps the upward trend, despite the “double top”.

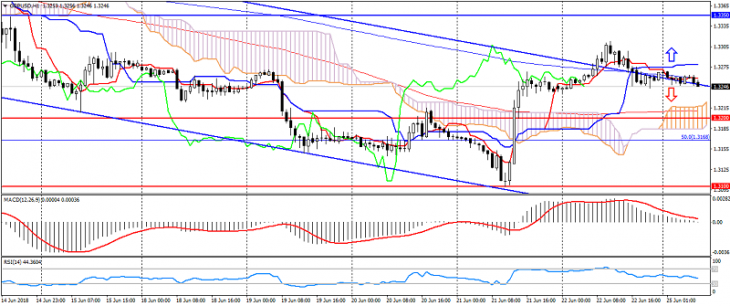

GBP USD (current price: 1.3250)

- Support levels: 1.3200, 1.3100 (the minimum of the current year), 1.3050 (November 2017 low).

- Resistance levels: 1.3350, 1.3360 (June maximum), 1.3600.

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is higher than 0, the signal line has left the body of the histogram. RSI (14) in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): the Tenkan-sen line is below the Kijun-sen line, the price is higher than the cloud.

- The main recommendation: sale entry is from 1.3310, 1.3330, 1.3350.

- Alternative recommendation: buy entry is from 1.3220, 1.3200, 1.3170.

British pound remains at the day’s opening level, limited to a downward trend.

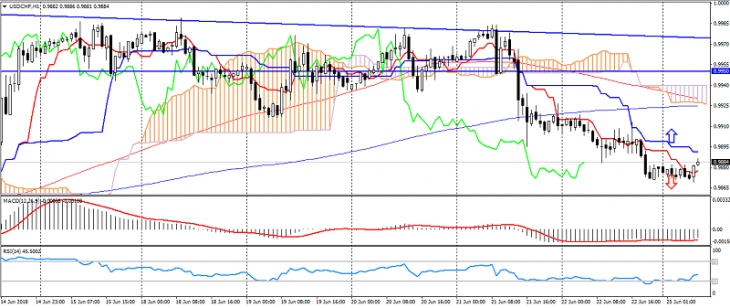

USD CHF (current price: 0.9880)

- Support levels: 0.9850, 0.9780 (June low), 0.9700.

- Resistance levels are: 0.9950, 1.0030 (May maximum), 1.0150.

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is below 0, the signal line has left the body of the histogram. RSI (14) in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): the Tenkan-sen line is below the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is from 0.9900, 0.9930, 0.9960.

- Alternative recommendation: buy entry is from 0.9860, 0.9830, 0.9800.

The US dollar Swiss franc has worked out the “double top”, and now may go for correction.

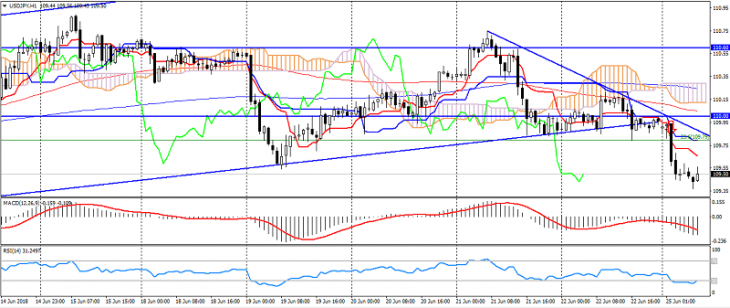

USD JPY (current price: 109.50)

- Support levels: 109.00, 108.00 (minimum of May), 107.50.

- Resistance levels: 110.00, 110.60, 111.40 (May maximum).

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is below 0, the signal line in the body of the histogram. RSI (14) in the oversold zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): the Tenkan-sen line is below the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is from 109.70, 110.00 110.30.

- Alternative recommendation: buy entry is from 109.30, 109.00, 108.80.

The US dollar the Japanese yen, accelerated the decline in the growth of risks associated with trade confrontation.

USD CAD (current price: 1.3300)

- Support levels: 1.3250, 1.3150, 1.3050 (May high).

- Resistance levels: 1.3380, 1.3450 (June maximum), 1.3540.

- Computer analysis: MACD (12, 26, 9) (signal-flat): indicator near 0. RSI (14) in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (flat signal): the Tenkan-sen line near the Kijun-sen line, the price is in the cloud.

- The main recommendation: sale entry is from 1.3350, 1.3380, 1.3400.

- Alternative recommendation: buy entry is from 1.3260, 1.3220, 1.3200.

USD/CAD pair remains in flat, thereby unloading overbought.

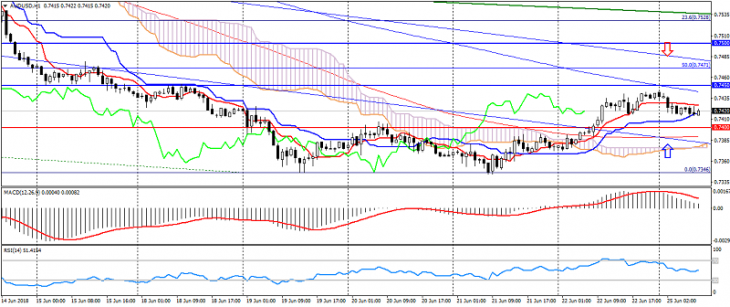

AUD USD (current price: 0.7420)

- Support levels: 0.7400, 0.7320, 0.7250.

- Resistance levels: 0.7450, 0.7500, 0.7560.

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is higher than 0, the signal line has left the body of the histogram. RSI (14) in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): the Tenkan-sen line above the Kijun-sen line, the price is higher than the cloud.

- The main recommendation: sale entry is from 0.7450, 0.7470, 0.7500.

- Alternative recommendation: buy entry is from 0.7400, 0.7380, 0.7350.

The Australian dollar is weakened by the growth of risks, but retains the potential for growth.

NZD USD (current price: 0.6890)

- Support levels: 0.6860, 0.6820, 0.6780.

- Resistance levels: 0.6930, 0.7000, 0.7050.

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is higher than 0, the signal line has left the body of the histogram. RSI (14) in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): the Tenkan-sen line above the Kijun-sen line, the price is higher than the cloud.

- The main recommendation: sale entry is from 0.6930, 0.6950, 0.6970.

- Alternative recommendation: buy entry is from 0.6970, 0.6850, 0.6820.

The New Zealand dollar is trading in a corrective uptrend.

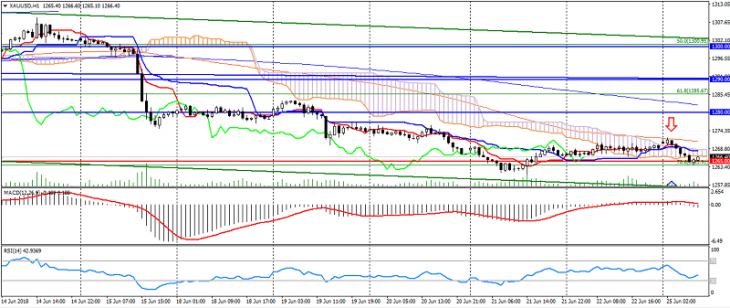

XAU USD (current price: 1266.00)

- Support levels: 1265.00, 1250.00, 1235.00.

- Resistance levels : 1280.00, 1290.00, 1300.00.

- Computer analysis: MACD (12, 26, 9) (signal-flat): indicator near 0. RSI (14) in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (flat signal): the Tenkan-sen line near the Kijun-sen line, the price is in the cloud.

- The main recommendation: sale entry is from 1273.00, 1280.00, 1285.00.

- Alternative recommendation: buy entry is from 1262.00, 1256.00, 1252.00.

Gold is limited to a downtrend, which could increase pressure on the asset.