An engulfing strategy. A Trend reversal.

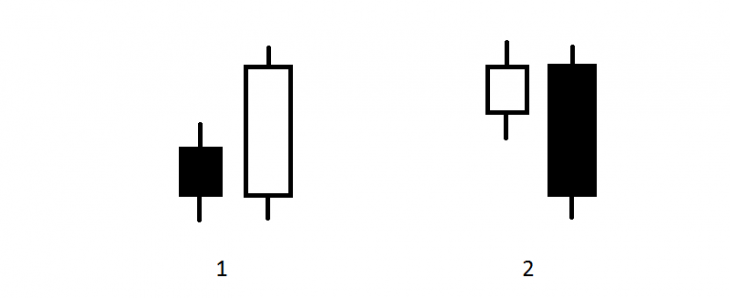

An engulfing strategy is a pattern of market movement that indicates a trend reversal. This pattern consisting of only two candlesticks, where the first has a small body of a candlestick, and the second is noticeably larger, which completely engulf the first and has the opposite direction. That is, if the first small candlestick is upward, then the next large candlestick must be downward. Conversely, the first small candlestick is downward, then the second big is upward.

- 1 – an engulfing pattern for the upward market

- 2 – an engulfing pattern for the downward market

This strategy refers to reversal strategies and indicates a trend change. For effective work out of this strategy, several important conditions must be met:

- Before this engulf, there should be a clear trend in the market. Since this pattern is reversal, a trend should be traced to our pattern. And in accordance with the trend, a corresponding pattern is formed. For the uptrend, the downward pattern, for the downward – upward.

If there is no trend with at least 3-5 candlesticks before this pattern, the movement is more like a flat, it is better to ignore this signal.

2. The body of the second candlestick should not be much larger than the first candlestick. So a very long second candlestick will indicate not only the trend reversal, but also the possibility of working out the movement and an early correction. Depending on the volatility of the trading instrument the size of the candlestick may be different. Ideally, the proportion of the first and second candlesticks should be from 1: 1.5 to 1: 3, but 1: 5 is allowed depending on the trading instrument.

This strategy is applicable for most trading tools and relies entirely on technical analysis. At the same time, its efficiency significantly increases on H1 timeframes, which is associated with less market noise and clearer signals.

Entry into the market according to an engulfing strategy is carried out by a pending order or direct entry. The entry point is taken above the extremum of the second candlestick. So for the upward pattern the high is taken, and for the downward – the low.

In the classic case, protective orders are placed in the shadows of the first candlestick. As a rule, the shadows of the first and second candlesticks in an engulfing model are located in close proximity.

There is no clear goal rule for this strategy. But according to the rules of money-management, the minimum goal is taken at least two, three times more the stop-loss.

It is recommended to rely on significant psychological levels and signals of technical indicators in the process of setting stops and goals for a higher efficiency of this strategy.

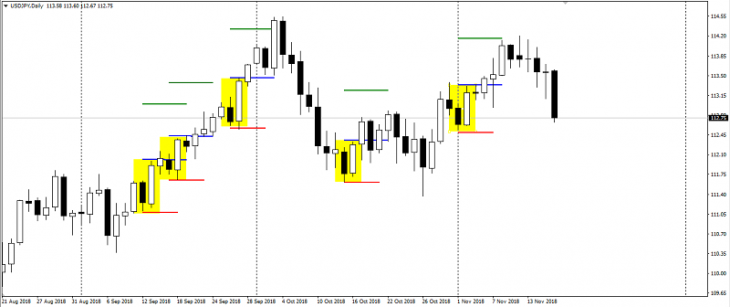

Example

In the chart, the yellow square shows an engulfing pattern, the blue line indicates the entry point, the red line indicates the protective order, and the green line indicates the targets.

Follow the trader’s blog and have a successful trading with Ester Holdings Inc.!

Anton Hanzenko