Emerging markets and their prospects: Turkish lira (TRY)

We continue the series of articles devoted to emerging markets, previously it was about the Russian ruble, the Mexican peso and the South African rand. Today in the focus is next currency in the emerging market, namely the Turkish lira (TRY).

Economic data of Turkey

The economy of Turkey is one of the fastest growing economies among emerging markets. Basically, this is due to Turkey’s advantageous geographical location, the path of important economic routes, between central Europe and the East. Turkey also boasts a cheap young labor force and an inflows of foreign investment.

The share of Turkey’s GDP is shifted towards services and trade -58%, the biggest part of which falls on the tourism. Industry occupies – 33%, and agriculture – 9%. At the same time, industry, like the agricultural sector, remains very significant. Thus, the agricultural sector remains the leading export industry.

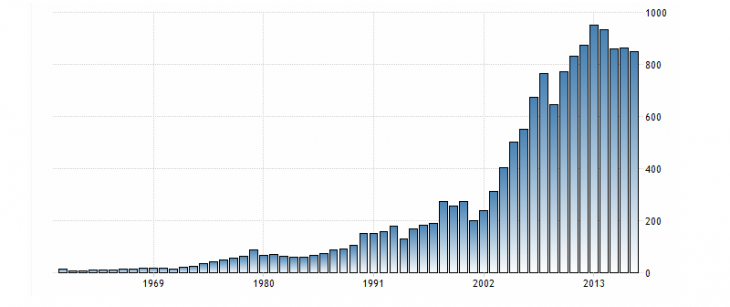

Fig. 1. Turkish GDP chart

As can be seen from the chart of Turkey’s GDP, since 2000, GDP has rapidly accelerated due to cheap labor and the relocation of production from Europe.

The factor that indicates the prospects for investment in the Turkish economy is the profitability of 10-year-old state bonds of Turkey. Since 2018, profitability has rapidly accelerated, thereby increasing the attraction of foreign investment.

Fig. 2. The graph of profitability of 10-year-old state. bonds of Turkey

Features of the Turkish lira trade

Like most emerging market currencies, the Turkish lira is a very volatile currency. And only in rare cases, the intraday volatility of the USD/TRY pair is below 1000 points. Often, this figure exceeds 5000 points.

Fig. 3. USD/TRY chart

In addition to high volatility, another very interesting regularity can be traced on the Turkish lira, namely, the safety of the general trend. So, the downward trend in the Turkish lira is excellent for labor strategies and long-term investments, but it is worth paying attention to high volatility.

Also, the Turkish lira is a very politicized currency, which is actively affected by scandals and political risks in the region. Due to the fact that Turkey is also a tourist country in its course affects the state of the tourism sector.

Correlation of the Turkish lira with other currencies

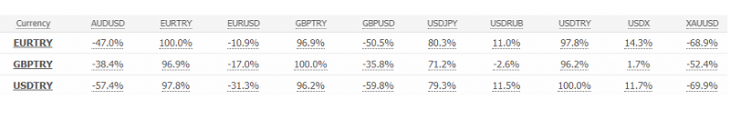

Fig. 4. Correlation table of the Turkish lira

As can be seen from the table, the lyre equally correlates with international currencies and has an inverse correlation to gold.

As a result, we can say that the Turkish lira is a very promising trading instrument due to some features, but it is not suitable for traders-beginners, despite the safety of the overall trend, because of high political influence. In this case, taking into account these features, it can become an excellent trading tool.

Anton Hanzenko