Emerging markets and their prospects: Russian Ruble (RUB)

One of the most pronounced emerging markets remains the Russian market. At the same time, this economy belongs to developing markets. On the other hand, trading in Russian ruble is not as simple as it might seem at first glance and therefore the Russian ruble (RUB) is not suitable for beginning traders.

Economy of Russia

The Russian economy ranks 6th in the world in terms of GDP. Regarding nominal GDP, Russia ranks 12th in the world. The main source of income of the country’s budget remains the export of energy, oil and gas. This makes the Russian ruble a commodity currency. Also, Russia’s mineral wealth is rich in other metals, which occupy a significant share of the country’s exports.

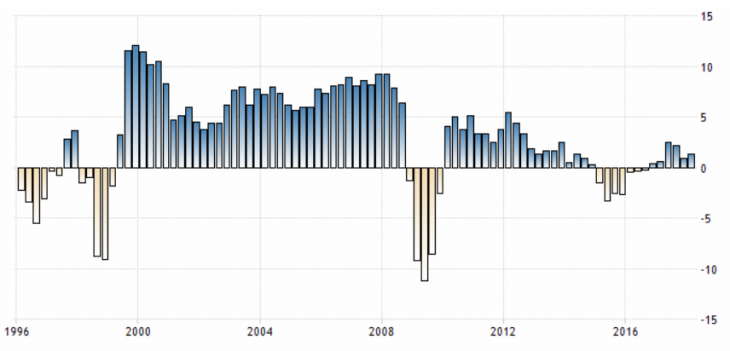

Fig. 1. Russia’s GDP growth rate (y / y)

It should be noted that the Russian economy relies more on the export of mineral resources, which makes the economy more raw than the rest. That is, the dependence of the Russian ruble on the dynamics of raw materials and directly on oil is more significant than in other commodity currencies with a market economy.

The second significant factor in the impact of the economy on the ruble’s dynamics remains geopolitics and the risks associated with it. Russia is a major geopolitical player. And due to various circumstances, often acts as a figurant of certain events, which affects the dynamics of the ruble, on the international financial market.

The main indicators of the popularity of the ruble and, accordingly, its relevance are foreign investment in the Russian economy. This indicator is determined by several metrics, such as: foreign investment, business confidence and the comfort of doing business.

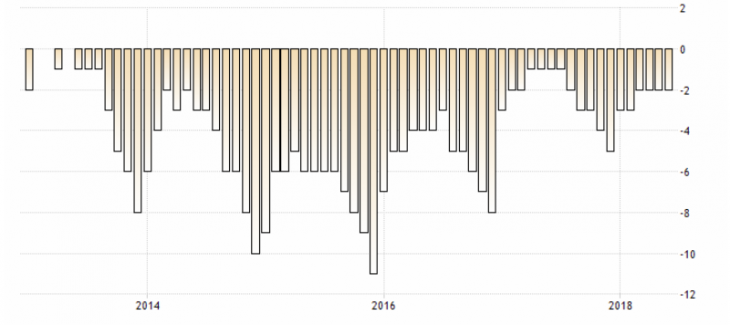

Fig. 2. Business confidence chart in Russia

Due to geopolitical risks, these indicators remain very weak, which causes the overall downward dynamics of the Russian currency.

Correlation of the ruble

Since the Russian ruble is a commodity currency, it is largely tied to the dynamics of oil. It is customary to draw a parallel with the ruble and the BRENT oil brand.

Fig. 3. USD / RUB and crude oil BRENT (blue line) chart

At the same time, the dynamics of the ruble may diverge from the dynamics of oil due to geopolitical events or fundamental factors, such as the statements of the Central Bank of Russia and the publication of influential statistics.

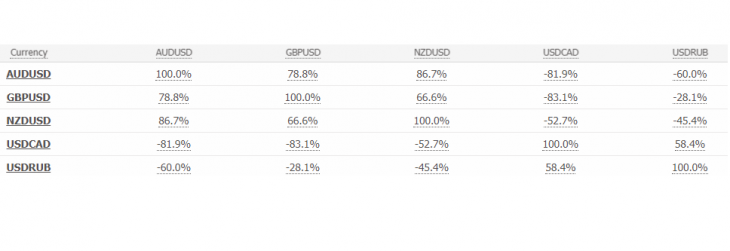

With other world commodity currencies, the Russian currency has a slight correlation, but it exists. And this correlation is much higher in periods of political calm.

Fig. 4. Correlation table

The outcome

The Russian ruble is a very difficult currency for trading, besides floating swaps and dependence on political risks, which makes this currency very difficult for beginner traders.

At the same time, like most currencies of the developing economy, it correlates good with oil, which can serve as an excellent indicator for ruble trade. But, due to instability and exposure to political risks, it is worth paying attention to political risks.

Not all tactics are suitable for the ruble, mainly for the ruble they use trend strategies. Efficiency, which can be reduced by the variable volatility of the currency.

Anton Hanzenko