Should we expect the currency intervention from the Bank of Japan?

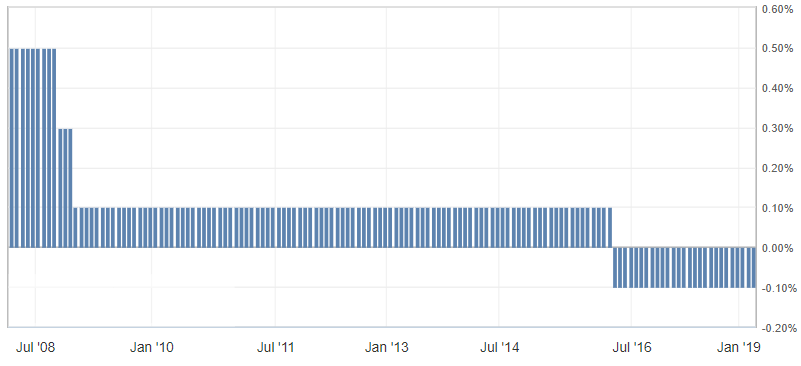

Historically, the Bank of Japan has an ultra-soft monetary policy. Key interest rates of the Central Bank remain at the level of 0.1% from the beginning of 2016. The 10-year Japanese government bonds yield is fixed at 0%. This allows the Bank of Japan to adhere to a soft monetary policy and restrain the growth of the Japanese yen.

Fig. Bank of Japan Interest Rates Chart

At the same time as the ultra-soft monetary policy, the Japanese yen is considered the safe haven currency. It is resorted to under conditions of market risk or uncertainty. As a result, with an exacerbation of the market risks, the Japanese yen receives significant support.

Such behavior of the yen is very beneficial for traders and investors, but it is extremely unprofitable for the management of the Bank of Japan, which faces many problems, adhering to a super-soft monetary policy with the strengthening of the national currency. It discourages exports. Therefore, the Central Bank often uses the currency intervention.

Currency intervention – the actions of the central bank (CB) of the country, aimed at changing the value of the national currency in order to bring the exchange rate to what is necessary for the central bank. In the course of currency intervention, the purchase or sale of financial assets is carried out.

Also regarding the practice of the Bank of Japan, the expression “verbal currency intervention” appeared, which implies a statement by the representative of the Central Bank about intentions to conduct actions regarding currency intervention in the future. This is regarded by the market as well as real currency intervention. In this case, the actual actions are not the fact that they will be carried out. Such actions carry a short-term effect on the market, but may be sufficient.

In the face of growing global geopolitical risks around the US-China trade opposition, and the exacerbation of political risks in Europe, the Japanese yen has strengthened significantly in recent weeks against most of its main competitors.

Chart: Japanese candlesticks – USD/JPY, blue line – GBP/JPY, red line – EUR/JPY.

From the graph above, it can be seen that the yen is near multi-month highs against the US dollar and annual highs against the euro and the British pound.

At the same time, the rhetoric of the Bank of Japan remains very mild, focusing on the continued maintenance of low interest rates. There are also rumors in the foreign exchange market that the Central Bank is going to buy about 400 million US dollars this year as part of the repayment of government bonds. As a result, it can serve as currency interventions of the Bank of Japan, aimed at depreciation the national currency.

Anton Hanzenko