Перспективы евро исходя из политики ЕЦБ

Опуская такие факторы риска как торговые войны США и процесс выхода Великобритании из ЕС, монетарная политика Европейского центрального банка (ЕЦБ) остаётся крайне мягкой и такой, которая выступает основным фактором к снижению евро. Конечно, стоит отметить непростую мировую экономическую ситуацию, не говоря о внутренних проблемах еврозоны во Франции, и не говоря о показателях экономики еврозоны.

Не несмотря на всё это, политика ЕЦБ выступает основополагающим фактором слабости евро. На это указывает понижение прогнозов по росту экономики и инфляции в еврозоне. Основным фактором продолжает выступать политика реинвестирования, что выступает опережающим фактором того, что ЕЦБ не будет повышать ставки.

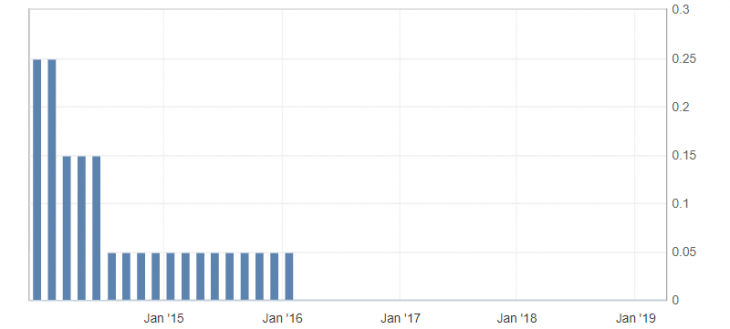

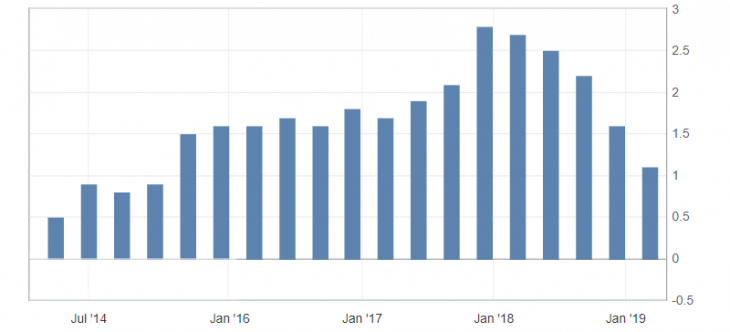

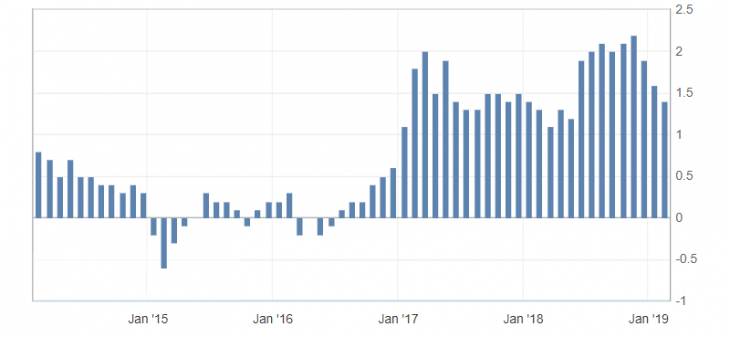

Проведем параллель между процентными ставками еврозоны и ключевыми параметрами, на которые опирается ЕЦБ, ВВП и инфляцию.

Рис. 1. График процентной ставки ЕЦБ

Рис. 2. График ВВП еврозоны

Рис. 3. График индекс потребительских цен (ИПЦ) в еврозоне

В таком случае повышение ставок в еврозоне должно было припасть на начало 2017 и 2018 годов. Этого не случилось из-за программы стимулирования. В условиях сохранения существующей нисходящей динамики ВВП и инфляции в еврозоне, которая прослеживается на графиках, стоило ожидать в большей мере снижения ставок от ЕЦБ, чем их повышения.

Придерживание политики нулевых ставок ЕЦБ продолжит оказывать давление на единую валюту. А значит евро останется под давлением против доллара США, как более доходной валюты, что и прослеживается на рынке.

Технически валютная пара EUR/USD остается в нисходящем тренде 2018 года. Ключевая поддержка евро против доллара США расположилась возле минимумов ноября 2018 (1.1210) и марта 2019 (1.1180).

Пробитие данной зоны поддержки укажет на новую волны распродажи евро против доллара США и откроет дорогу к уровням поддержки 1.1100 и 1.1070-50. Это фактически не выступает значимым ограничением на более длительную перспективу и при сохранении мягкой политики ЕЦБ.

Подытожив, можно сказать, что ЕЦБ в условиях сохранения существующего правительства и макроэкономической ситуации, больше склонно к сохранению или даже снижению ставок в текущем году, чем к повышению ставок и ужесточению монетарной политики.

Антон Ганзенко