Technical analysis of cross-rates. (Anton Hanzenko)

EUR GBP (current price: 0.8780)

- Support levels: 0.8730 (minimum of the last months), 0.8650, 0.8530.

- Resistance levels: 0.8810, 0.8900, 0.9050 (November 2016 maximum).

- Computer analysis: MACD (12, 26, 9) (signal- upward movement): the indicator is above 0, the signal line is in the body of the histogram. RSI (14) is in the neutral zone. IchimokuKinkoHyo (9,26,52) (signal- upward movement): the Tenkan-sen line is above the Kijun-sen line, the price is in the cloud.

- The main recommendation: sale entry is started from 0.8790,0.8810, 0.8830.

- Alternative recommendation: buy entry is started from 0.8760, 0.8730, 0.8700.

The euro pound pair is traded with a strengthening on the growth of optimism about the euro, but the overall downtrend persists. So, it is likely that the pair’s decline will be resumed.

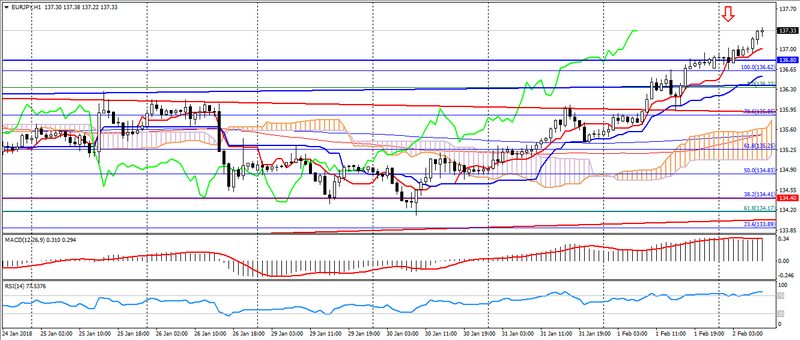

EUR JPY (current price: 137.30)

- Support levels: 134.40 (September 2017 maximum) 131.40, 127.40.

- Resistance levels: 136.80 (October 2015 maximum), 139.00 (August 2015 maximum), 140.90.

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is above 0, the signal line is in the histogram. RSI (14) is in overbought zone. IchimokuKinkoHyo (9,26,52) (signal – upward movement): Tenkan-sen line is above of Kijun-sen, the price is higher than the cloud.

- The main recommendation: sale entry is started from 137.50, 137.80, 138.00.

- Alternative recommendation: buy entry is started from 137.20, 136.80, 136.50.

The euro yen is growing on the yen’s sale off, which was caused by the verbal intervention of the Bank of Japan. And it is limited to a significant overbought and three-year highs.

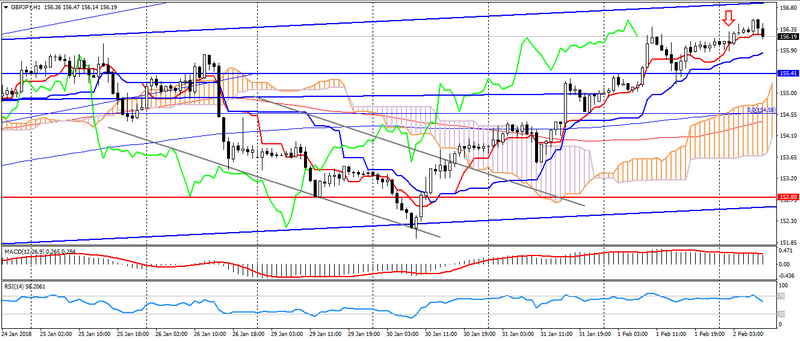

GBP JPY (current price: 156.30)

- Support levels: 152.80 (September 2017 maximum), 150.00, 147.00.

- Levels of resistance: 155.40, 158.00, 160.30.

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is above 0, the signal line is in the body of the histogram. RSI (14) is in the neutral zone. IchimokuKinkoHyo (9,26,52) (signal – upward movement): the Tenkan-sen line is above the Kijun-sen line, the price is higher than the cloud.

- The main recommendation: sale entry is started from 156.80, 157.00, 157.30.

- Alternative recommendation: buy entry is started from 156.00, 155.80, 154.40.

The pound yen pair also strengthened on the yen’s sell-off, but the odor was limited to the existing uptrend, which may indicate a correction from zone 156.80.

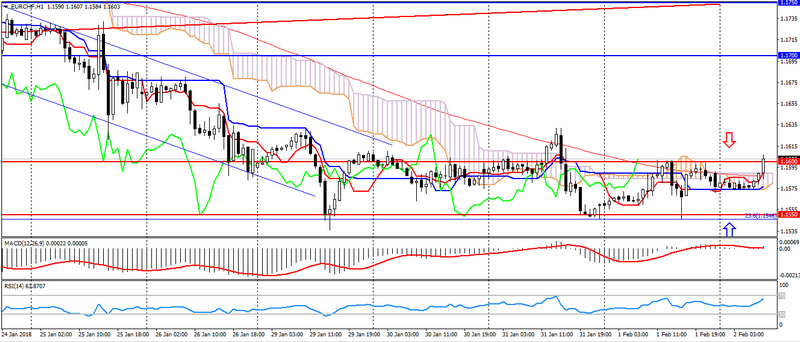

EUR CHF (current price: 1.1600)

- Support levels: 1.1600 (December 2017 minimum), 1.1550 (November 2017 minimum), 1.1500.

- Resistance levels: 1.1700 (the maximum of the current year), 1.1750, 1.1800.

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is above 0, the signal line is in the body of the histogram. RSI (14) is in the neutral zone. IchimokuKinkoHyo (9,26,52) (signal- upward movement): the Tenkan-sen line is above the Kijun-sen line, the price is higher than the cloud.

- The main recommendation: sale entry is started from 1.1600, 1.1630, 1.1650.

- Alternative recommendation: buy entry is started from 1.1550, 1.1520, 1.1500.

The euro franc is still traded in a sideways trend, keeping the potential for strengthening.