Технічний аналіз крос-курсів. (Антон Ганзенко)

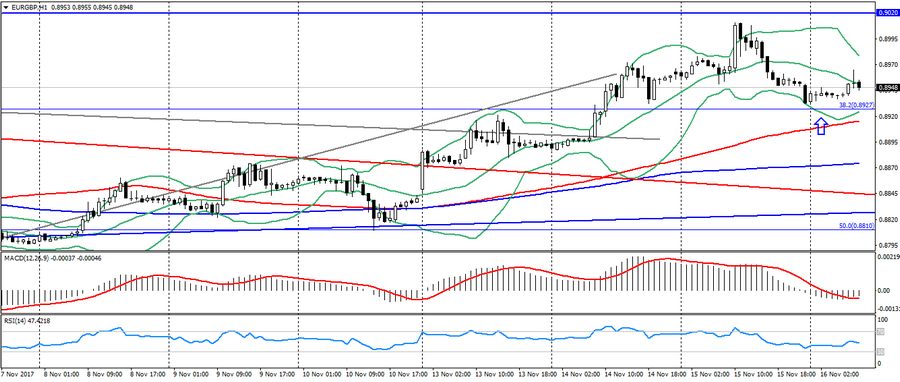

EUR GBP (поточна ціна: 0.8940)

- Рівні підтримки: 0.8730 (мінімум останніх місяців), 0.8650, 0.8530.

- Рівні опору: 0.9020, 0.9170, 0.9300 (максимум поточного року).

- Комп’ютерний аналіз: MACD (сигнал – висхідний рух): індикатор нижче 0, сигнальна лінія вийшла з тіла гістограми. RSI в нейтральній зоні. Bollinger Bands (період 20): нейтрально, знижується волатильність.

- Основна рекомендація: вхід на продаж від 0.8980,0.9000, 0.9020.

- Альтернативна рекомендація: вхід на покупку від 0.8830 (Фібо. 38.2 від мінімуму квітня), 0.8900, 0.8870 (MA 100).

Даному кросу вдалося відбитися від рівня опору 0.9020, але загальний висхідний тренд зберігається.

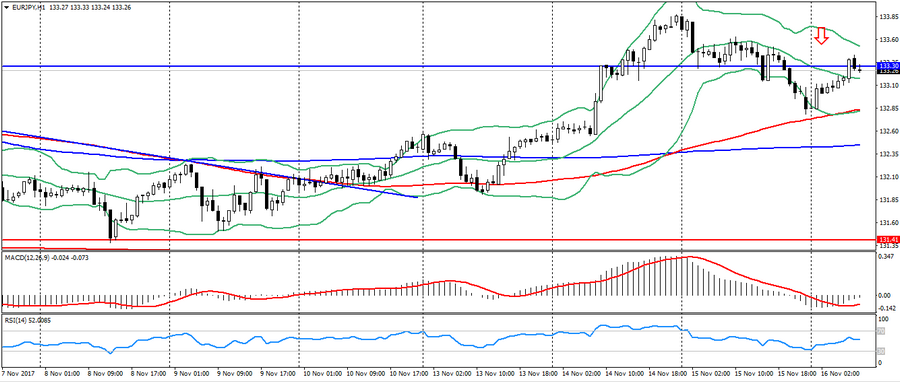

EUR JPY (поточна ціна: 133.30)

- Рівні підтримки: 131.40 (мінімум останніх місяців), 130.50, 129.80 (Фібо. 23.6 від мінімуму поточного року).

- Рівні опору: 133.30, 134.40 (максимум поточного року), 135.00.

- Комп’ютерний аналіз: MACD (сигнал – висхідний рух): індикатор нижче 0, сигнальна лінія вийшла з тіла гістограми. RSI в нейтральній зоні. Bollinger Bands (період 20): нейтрально, знижується волатильність.

- Основна рекомендація: вхід на продаж від 133.60, 133.90, 134.20.

- Альтернативна рекомендація: вхід на покупку від 133.90, 132.80, 132.40 (MA 200).

Євро єна залишається в фазі корекції після росту, обмежуючись низхідним трендом.

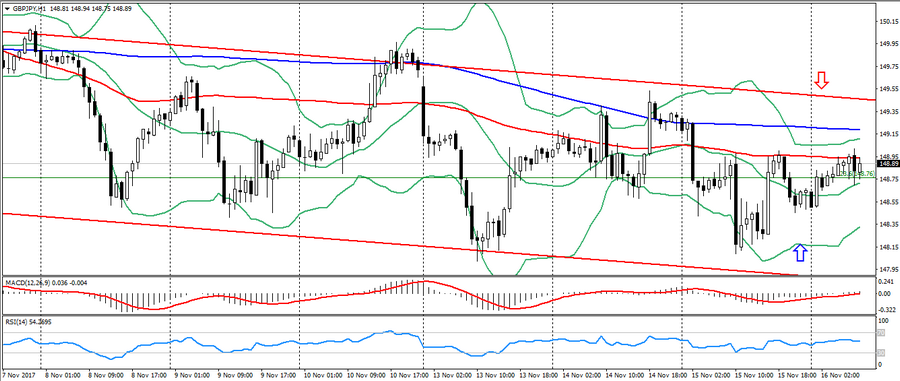

GBP JPY (поточна ціна: 148.80)

- Рівні підтримки: 147.00 (мінімум минулого місяця), 144.20 (Фібо. 50.0 від мінімуму квітня), 141.50.

- Рівні опору: 151.30, 152.80 (максимум поточного року), 155.40.

- Комп’ютерний аналіз: MACD (сигнал – спадний рух): індикатор нижче 0, сигнальна лінія в тілі гістограми. RSI в нейтральній зоні. Bollinger Bands (період 20): нейтрально, знижується волатильність.

- Основна рекомендація: вхід на продаж від 149.00 (MA 100), 149.30 (MA 200), 149.60.

- Альтернативна рекомендація: вхід на покупку від 148.60, 148.20, 147.90.

Фунт торгується в усталеним тренді.

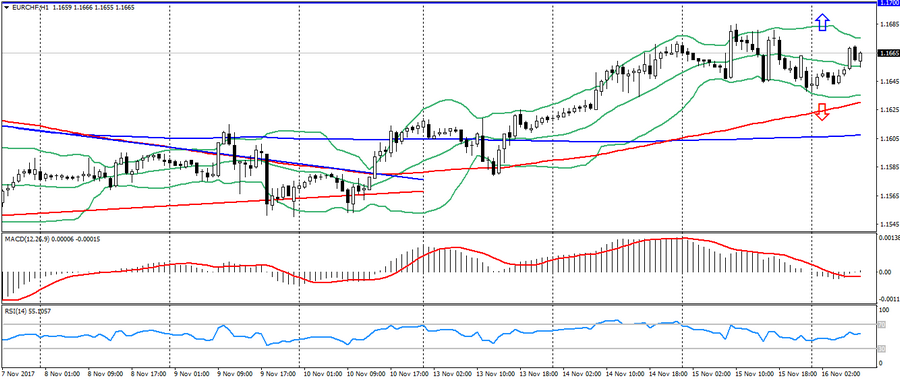

EUR CHF (поточна ціна: 1.1660)

- Рівні підтримки: 1.1500, 1.1450 (Фібо. 23.6 від мінімуму поточного року), 1.1350.

- Рівні опору: 1.1700 (максимум поточного року), 1.1750, 1.1800.

- Комп’ютерний аналіз: MACD (сигнал – висхідний рух): індикатор нижче 0, сигнальна лінія вийшла з тіла гістограми. RSI в нейтральній зоні. Bollinger Bands (період 20): нейтрально, низька волатильність.

- Основна рекомендація: вхід на продаж від 1.1670 (локальний максимум), 1.1700, 1.1730.

- Альтернативна рекомендація: вхід на покупку від 1.1630, 1.1600 (MA 100), 1.1580.

Пара євро франк торгується біля значимого опору, тим самим коректуючись перед подальшим зростанням.