Technical analysis of cross-rates. (Anton Hanzenko)

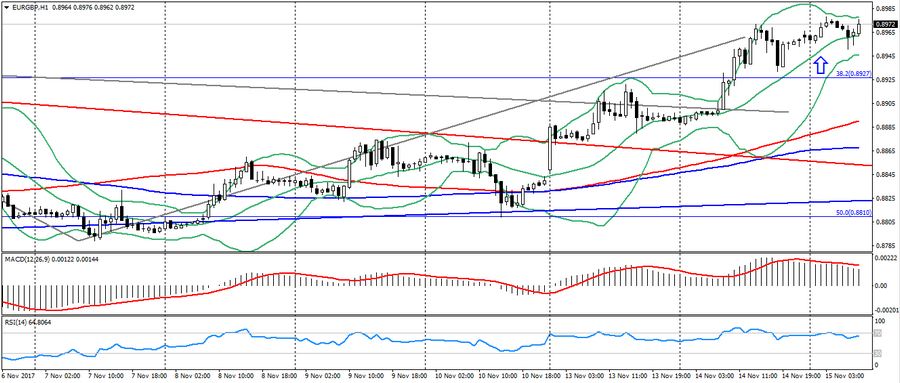

EUR GBP (current price: 0.8970)

- Support levels: 0.8730 (minimum of the last months), 0.8650, 0.8530.

- Resistance levels: 0.9020, 0.9170, 0.9300 (the maximum of the current year).

- Computer analysis: MACD (signal – downward motion): the indicator is higher than 0, the signal line has left the body of the histogram. RSI is in the overbought zone. Bollinger Bands (period 20): neutral, low volatility.

- The main recommendation: sale entry is started from 0.8980,0.9000, 0.9020.

- Alternative recommendation: buy entry is started from 0.8850, 0.8830 (Fibo. 38.2 from the April’s low), 0.8890 (MA 100).

Euro continues to work out the “double bottom” figure, thereby maintaining an upward trend.

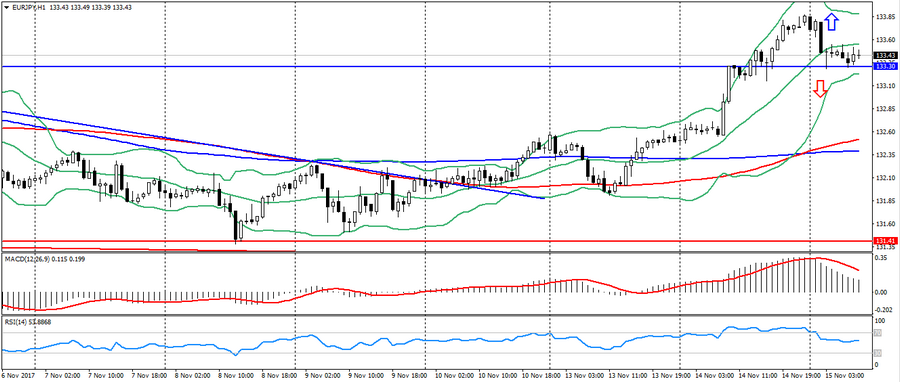

EUR JPY (current price: 133.40)

- Support levels: 131.40 (minimum of the last months), 130.50, 129.80 (Fib. 23.6 from the low of the current year).

- Resistance levels: 133.30, 134.40 (the maximum of the current year), 135.00.

- Computer analysis: MACD (signal – downward movement): the indicator is higher than 0, the signal line has left the body of the histogram. RSI is in the neutral zone. Bollinger Bands (period 20): neutral, growing volatility.

- The main recommendation: sale entry is sarted from 133.80, 134.20, 134.40.

- Alternative recommendation: buy entry is started from 133.90, 132.80, 132.40 (MA 200).

The euro-yen weakened due to the ubiquitous growth of the Japanese currency, supported by positive data on the overbought of the Japanese and European .

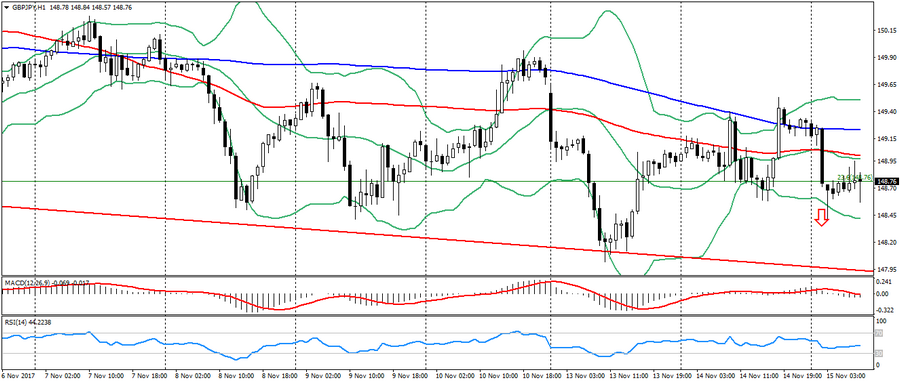

GBP JPY (current price: 148.70)

- Support levels: 147.00 (minimum of last months), 144.20 (Fibo. 50.0 from the low of April), 141.50.

- Resistance levels: 151.30, 152.80 (the maximum of the current year), 155.40.

- Computer analysis: MACD (signal – downward motion): the indicator is below 0, the signal line is in the body of the histogram. RSI is in the neutral zone. Bollinger Bands (period 20): neutral, growing volatility.

- The main recommendation: sale entry is started from 149.00 (MA 100), 149.30 (MA 200), 149.60.

- Alternative recommendation: buy entry is started from 148.60, 148.20, 147.90.

The pound also weakened under yen’s pressure and moved into the consolidation phase, but retains the potential to decline.

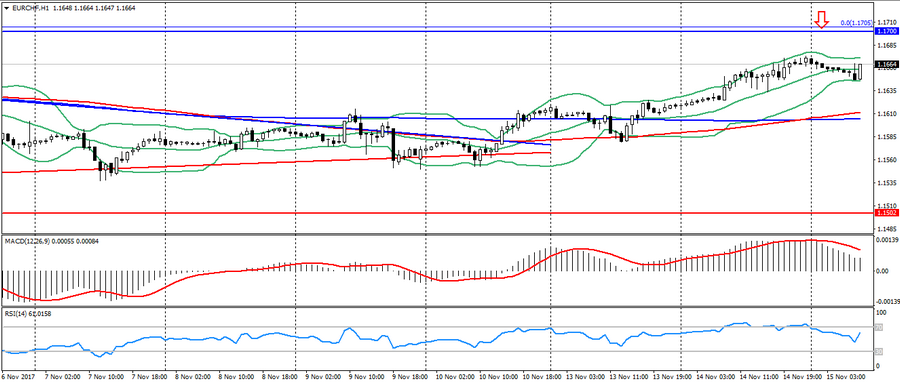

EUR CHF (current price: 1.1660)

- Support levels: 1.1500, 1.1450 (Fibo. 23.6 from the low of the current year), 1.1350.

- Resistance levels: 1.1700 (the maximum of the current year), 1.1750, 1.1800.

- Computer analysis: MACD (signal – downward movement): the indicator is higher than 0, the signal line has left the body of the histogram. RSI is in the neutral zone. Bollinger Bands (period 20): neutral, low volatility.

- The main recommendation: sale entry is started from 1.1670 (local maximum), 1.1700, 1.1730.

- Alternative recommendation: buy entry is started from 1.1630, 1.1600 (MA 100), 1.1580.

The euro-franc pair is trading near significant resistance, thereby adjusting before further growth.