Тechnical analysis of currency pairs (Anton Hanzenko)

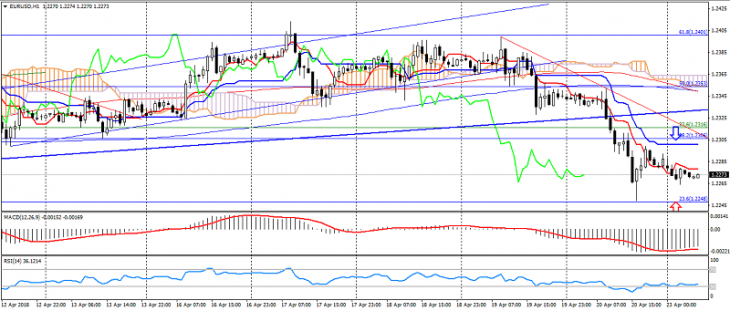

EUR USD (current price: 1.2270)

- Support levels: 1.2100 (September-September maximum), 1.1900, 1.1700.

- Resistance levels: 1.2600, 1.2750 (March 2013 minimum), 1.2270 (November 2014 minimum).

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is below 0, the signal line has left the body of the histogram. RSI (14) in the oversold zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): the Tenkan-sen line is below the Kijun-sen line, the price is below the cloud.

- The main recommendation: entrance for sale from 1.2300, 1.2330, 1.2350.

- Alternative recommendation: entry to buy from 1.2260, 1.2240, 12200.

The euro dollar remains under pressure, but is limited to a significant oversold, which may trigger a correction.

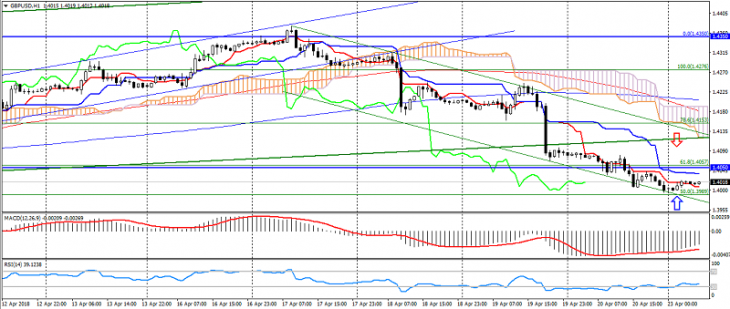

GBP USD (current price: 1.4020)

- Support levels: 1.3820, 1.3650 (September-September maximum), 1.3450.

- Resistance levels: 1.4050, 1.4350, 1.4500.

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is below 0, the signal line has left the body of the histogram. RSI (14) in the oversold zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): the Tenkan-sen line is below the Kijun-sen line, the price is below the cloud.

- The main recommendation: entrance for sale from 1.4050, 1.4090, 1.4130.

- Alternative recommendation: the entrance to the purchase is from 1.4000, 1.3960, 1.3940.

The British pound also maintains a downward trend, but at the same time it is limited to oversold.

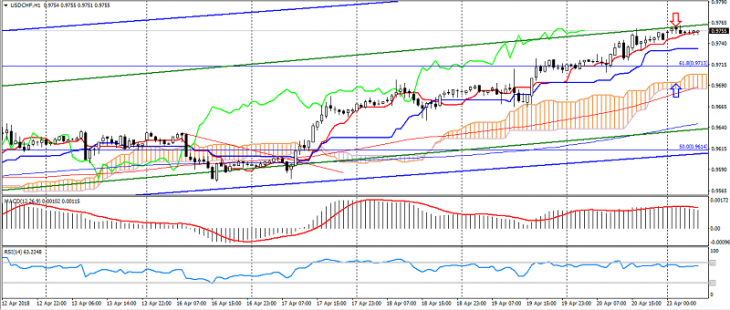

USD CHF (current price: 0.9750)

- Support levels: 0.9250 (August 2015 minimum), 0.9150, 0.9050 (May 2015 minimum).

- Resistance levels: 0.9550, 0.9800, 1.0030 (November 2017 high).

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is above 0, the signal line has left the body of the histogram. RSI (14) in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): the Tenkan-sen line above the Kijun-sen line, the price is higher than the cloud.

- The main recommendation: entry for sale from 0.9770, 0.9790, 0.9810.

- Alternative recommendation: buy-in from 0.9730, 0.9700, 0.9670.

The Swiss franc remains under pressure throughout the spectrum of the market to reduce risks, but at the same time it is limited to oversold.

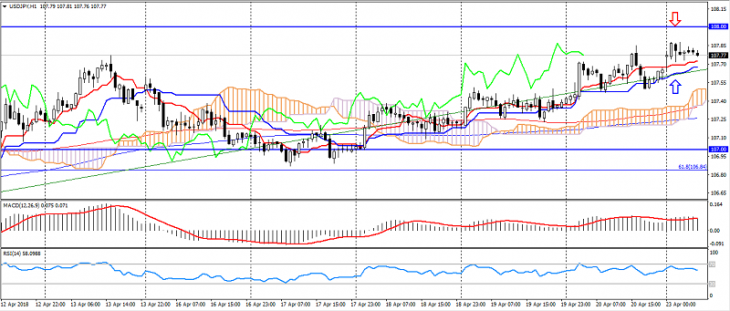

USD JPY (current price: 107.80)

- Support levels: 105.50, 104.50, 103.40.

- Levels of resistance: 107.00, 108.00, 108.60.

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): indicator above 0, signal line in the body of the histogram. RSI (14) in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): the Tenkan-sen line above the Kijun-sen line, the price is higher than the cloud.

- The main recommendation: entrance for sale from 108.00, 108.20, 108.50.

- Alternative recommendation: the entrance to the purchase is from 107.60, 107.40, 107.20.

The dollar yen pair continues to strengthen on maintaining optimism, thereby indicating the preservation of the uptrend.

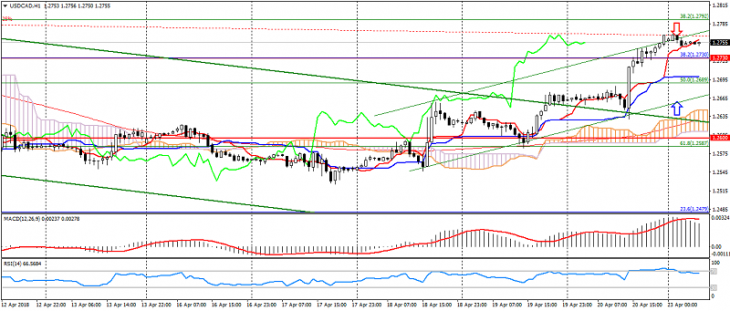

USD CAD (current price: 1.2760)

- Support levels: 1.2950, 1.2730, 1.2600.

- Resistance levels: 1.3030, 1.3150, 1.3280.

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is above 0, the signal line has left the body of the histogram. RSI (14) in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): the Tenkan-sen line above the Kijun-sen line, the price is higher than the cloud.

- The main recommendation: entrance for sale from 1.2790, 1.2820, 1.2850.

- Alternative recommendation: entry to buy from 1.2730, 1.2700, 1.2680.

The US dollar, the Canadian dollar, broke the 1.5-month downtrend, but is also limited to overbought.

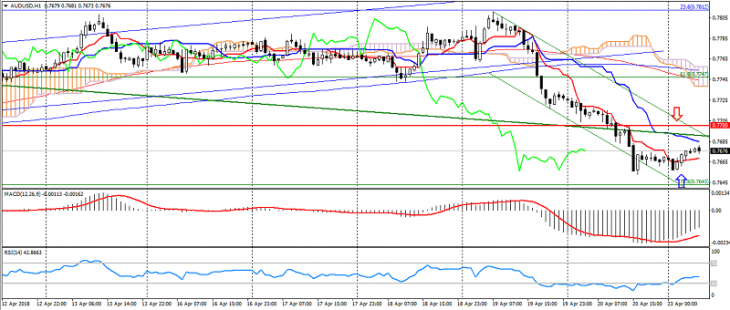

AUD USD (current price: 0.7670)

- Support levels: 0.7900, 0.7700 (March 2017 maximum), 0.7500.

- Resistance levels: 0.8120 (2017 maximum), 0.8200, 0.8290 (2014 maximum).

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is below 0, the signal line has left the body of the histogram. RSI (14) in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): the Tenkan-sen line is below the Kijun-sen line, the price is below the cloud.

- The main recommendation: entrance for sale from 0.7700, 0.7720, 0.7740.

- Alternative recommendation: buy-in from 0.7660, 0.7640, 0.7620.

The Australian remains under pressure to reduce the cost of raw materials, thereby returning to the overall downward trend.

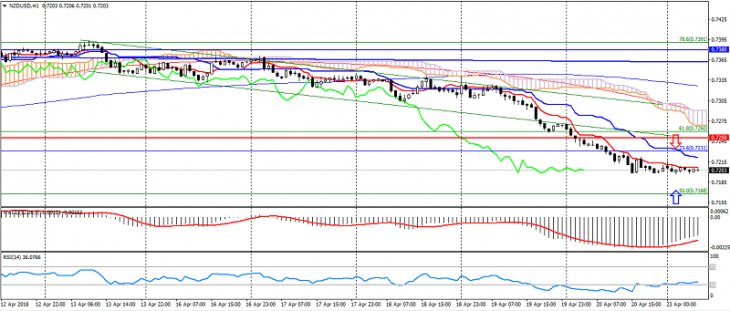

NZD USD (current price: 0.7200)

- Support levels: 0.7250, 0.7130 (the minimum of August 2017), 0.7000.

- Resistance levels: 0.7380, 0.7450, 0.7550 (maximum of 2017).

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is below 0, the signal line has left the body of the histogram. RSI (14) in the oversold zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): the Tenkan-sen line is below the Kijun-sen line, the price is below the cloud.

- The main recommendation: entrance for sale from 0.7230, 0.7250, 0.7280.

- Alternative recommendation: buy-in from 0.7180, 0.7160, 0.7140.

The New Zealand dollar slowed down at the beginning of the week, thereby unloading oversold indicators.

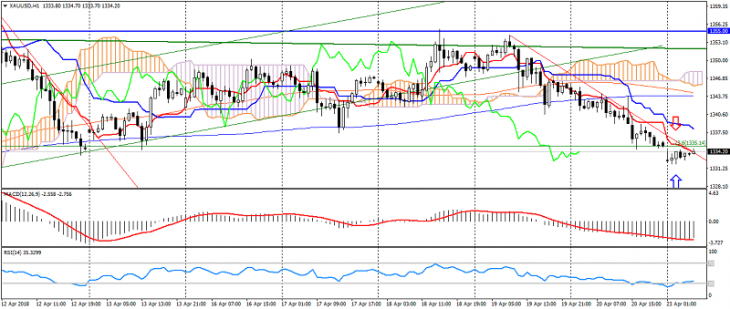

XAU USD (current price: 13341.00)

- Support levels: 1320.00, 1303.00, 1280.00.

- Resistance levels: 1355.00 (May May 2016 maximum), 1374.00, 1290.00 (March 2016 maximum).

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is below 0, the signal line in the body of the histogram. RSI (14) in the oversold zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): the Tenkan-sen line is below the Kijun-sen line, the price is below the cloud.

- The main recommendation: entrance for sale from 1337.00, 1340.00, 1344.00.

- Alternative recommendation: the entrance to the purchase from 1332.00, 1329.00, 1327.00.

Gold remains under the pressure of the American, despite the considerable oversold.