Тechnical analysis of currency pairs (Anton Hanzenko)

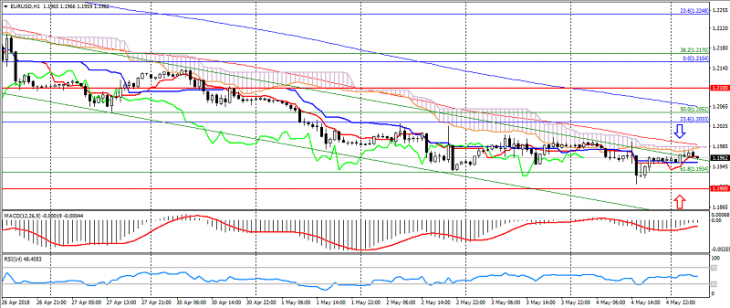

EUR USD (current price: 1.1960)

- Support levels: 1.2100 (September 2017 maximum), 1.1900, 1.1700.

- Resistance levels: 1.2600, 1.2750 (March 2013 minimum), 1.2270 (November 2014 minimum).

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is below 0, the signal line has left the body of the histogram. RSI (14) is in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): the Tenkan-sen line is above the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is started from 1.1980, 1.2000, 1.2030.

- Alternative recommendation: buy entry is started from 1.1940, 1.1900, 1.1880.

The euro dollar continues to trade in a downtrend, while showing some slowdown in correction and low activity.

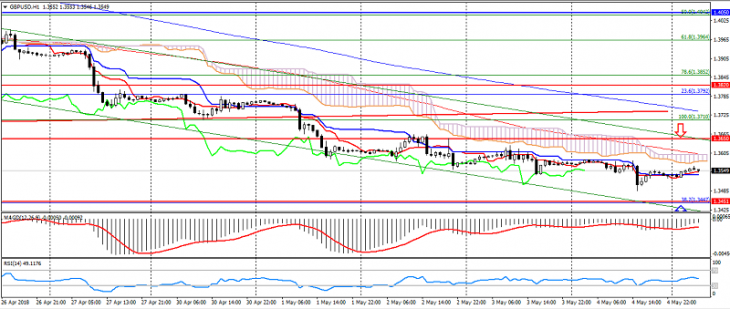

GBP USD (current price: 1.3550)

- Support levels: 1.3820, 1.3650 (September 2017 maximum), 1.3450.

- Resistance levels: 1.4050, 1.4350, 1.4500.

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is below 0, the signal line has left the body of the histogram. RSI (14) is in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): the line Tenkan-sen is near the line Kijun-sen, the price is below the cloud.

- The main recommendation: sale entry is started from 1.3600, 1.3640, 1.3660.

- Alternative recommendation: buy entry is started from 1.3480, 1.3450, 1.3420.

The British pound is also restrained at the beginning of the day and remains in a downward trend.

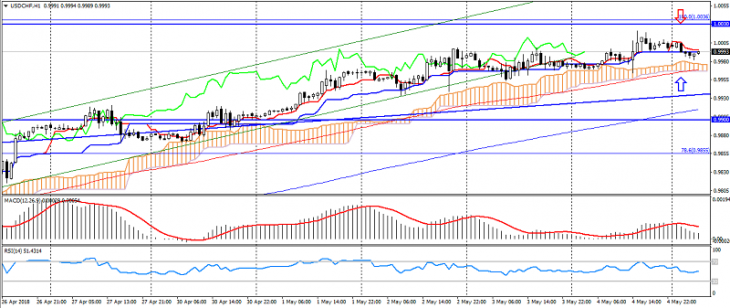

USD CHF (current price: 0.9960)

- Support levels: 0.9750, 0.9600, 0.9450.

- Resistance levels:, 0.9900, 1.0030, 1.0150.

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is higher than 0, the signal line has left the body of the histogram. RSI (14) is in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): the Tenkan-sen line is above the Kijun-sen line, the price is higher than the cloud.

- The main recommendation: sale entry is started from 1.0030, 1.0050, 1.0080.

- Alternative recommendation: buy entry is started from 0.9960, 0.9930, 0.9900.

The Swiss franc is limited to the highs of October last year 1.0030.

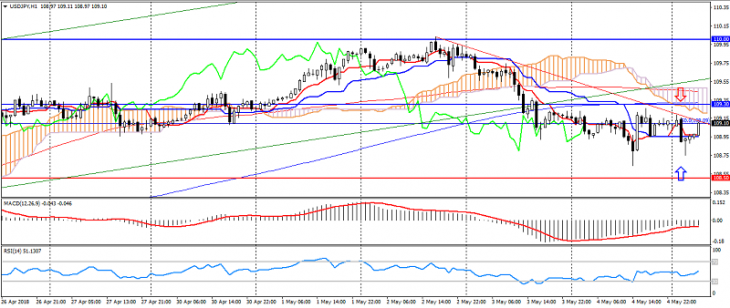

USD JPY (current price: 109.10)

- Support levels: 108.50, 107.50, 106.70.

- Levels of resistance: 109.30, 110.00, 110.50.

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is below 0, the signal line is in the body of the histogram. RSI (14) is in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): the Tenkan-sen line is below the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is started from 109.30, 109.50, 109.80.

- Alternative recommendation: buy entry is started from 108.90, 108.70, 108.50.

The pair reversed the upward trend in the growth of risks associated with ambiguous US statistics.

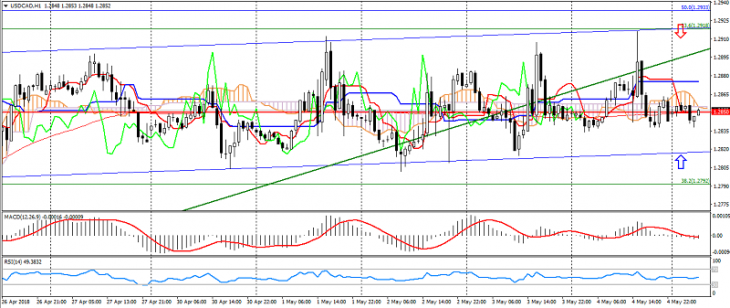

USD CAD (current price: 1.2850)

- Support levels: 1.2950, 1.2730, 1.2600.

- Resistance levels: 1.3030, 1.3150, 1.3280.

- Computer analysis: MACD (12, 26, 9) (signal-flat): the indicator is near 0. RSI (14) is in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): the Tenkan-sen line is below the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is started from 1.2880, 1.2910, 1.2940.

- Alternative recommendation: buy entry is started from 1.2830, 1.2800, 1.2780.

The pair remains in a sideways trend.

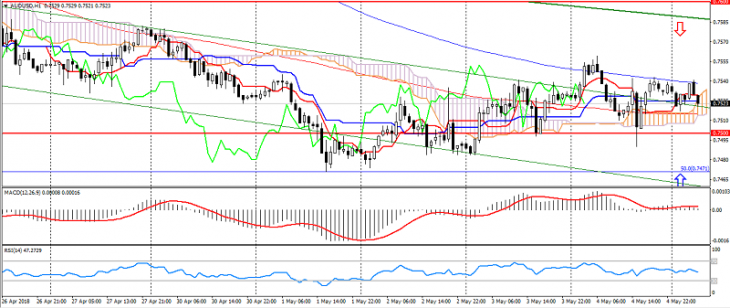

AUD USD (current price: 0.7520)

- Support levels: 0.7600, 0.7500, 0.7450.

- Resistance levels: 0.7700, 0.7820, 0.7900.

- Computer analysis: MACD (12, 26, 9) (signal-flat): the indicator is near 0. RSI (14) is in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (flat signal): the Tenkan-sen line is near the Kijun-sen line, the price is in the cloud.

- The main recommendation: sale entry is started from 0.7540, 0.7570, 0.7590.

- Alternative recommendation: buy entry is started from 0.7500, 0.7480, 0.7460.

The Australian weakens slightly early in the day, but continues to trade in a corrective uptrend.

NZD USD (current price: 0.7020)

- Support levels: 0.7130 (August 2017 minimum), 0.7000, 0.6950.

- Resistance levels: 0.7250, 0.7380, 0.7450 (2018 maximum).

- Computer analysis: MACD (12, 26, 9) (signal-flat): the indicator is near 0. RSI (14) is in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal-flat): the Tenkan-sen line is near the Kijun-sen line, the price is in the cloud.

- The main recommendation: sale entry is started from 0.7040, 0.7060, 0.7080.

- Alternative recommendation: buy entry is started from 0.7000, 0.6980, 0.6950.

The pair is limited by a downward trend, despite oversold.

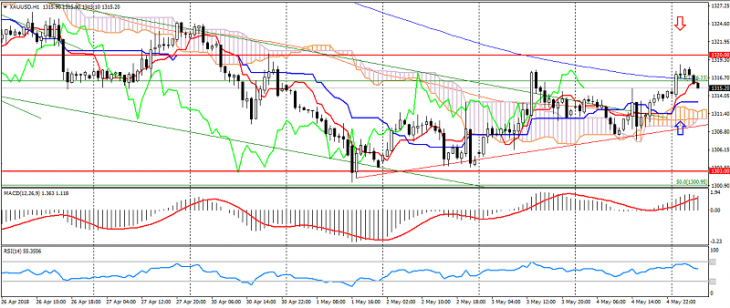

XAU USD (current price: 1315.00)

- Support levels: 1320.00, 1303.00, 1280.00.

- Resistance levels: 1355.00 (May May 2016 maximum), 1374.00, 1290.00 (March 2016 maximum).

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is above 0, the signal line is higher than the body of the histogram. RSI (14) is in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): the Tenkan-sen line is above the Kijun-sen line, the price is higher than the cloud.

- The main recommendation: sale entry is started from 1320.00, 1322.00, 1325.00.

- Alternative recommendation: buy entry is started from 1313.00, 1310.00, 1307.00.

Gold broke the downtrend on correction.