Тechnical analysis of currency pairs (Anton Hanzenko)

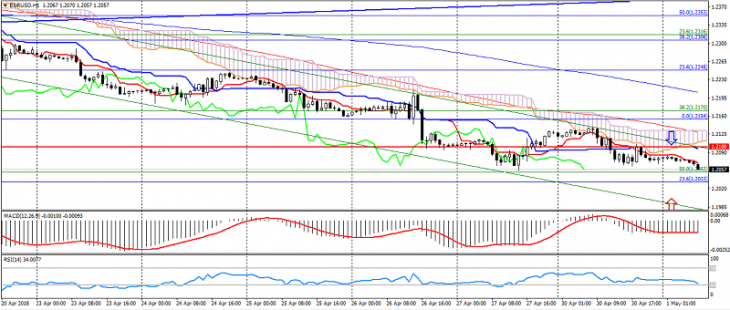

EUR USD (current price: 1.2060)

- Support levels: 1.2100 (September 2017 maximum), 1.1900, 1.1700.

- Resistance levels: 1.2600, 1.2750 (March 2013 minimum), 1.2270 (November 2014 minimum).

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is below 0, the signal line is in the body of the histogram. RSI (14) is in the slight oversold zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): the Tenkan-sen line is below the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is started from 1.2090, 1.2110, 1.2140.

- Alternative recommendation: buy entry is started from 1.2050, 1.2020, 1.1980.

The euro dollar pair keeps the downward dynamics, having received support at the level of 1.2030-00.

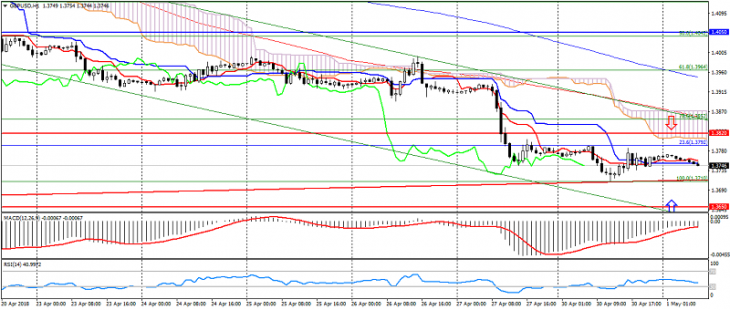

GBP USD (current price: 1.3740)

- Support levels: 1.3820, 1.3650 (September 2017 maximum), 1.3450.

- Resistance levels: 1.4050, 1.4350, 1.4500.

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is below 0, the signal line has left the body of the histogram. RSI (14) is in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): the line Tenkan-sen is near the line Kijun-sen, the price is below the cloud.

- The main recommendation: sale entry is started from 1.3790, 1.3820, 1.3850.

- Alternative recommendation: buy entry is started from 1.3710, 1.3680, 1.3650.

The British pound remains under pressure, limited to a bull divergence and support of 1.3700.

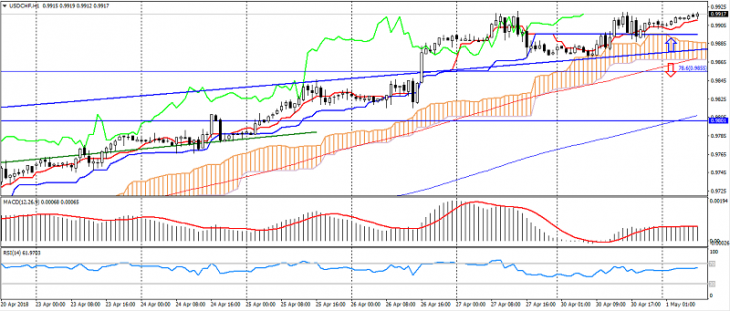

USD CHF (current price: 0.9920)

- Support levels: 0.9250 (August 2015 minimum), 0.9150, 0.9050 (May 2015 minimum).

- Resistance levels:, 0.9550, 0.9800, 1.0030 (November 2017 maximum).

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is above 0, the signal line is in the body of the histogram. RSI (14) is in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): the Tenkan-sen line is above the Kijun-sen line, the price is higher than the cloud.

- The main recommendation: sale entry is started from 0.9930, 0.9950, 0.9970.

- Alternative recommendation: buy entry is started from 0.9880, 0.9850, 0.9830.

The Swiss franc remains under pressure of the American, limited to oversold.

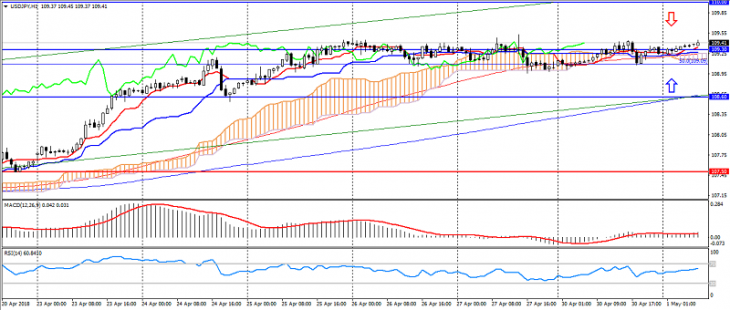

USD JPY (current price: 109.40)

- Support levels: 107.50, 106.70, 105.50.

- Levels of resistance: 108.60, 109.30, 110.00.

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is above 0, the signal line is in the body of the histogram. RSI (14) is in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): the Tenkan-sen line is above the Kijun-sen line, the price is higher than the cloud.

- The main recommendation: sale entry is started from 109.50, 109.70, 109.90.

- Alternative recommendation: buy entry is started from 109.00, 108.60, 108.30.

The pair also continues to trade in an uptrend, but is limited to flat.

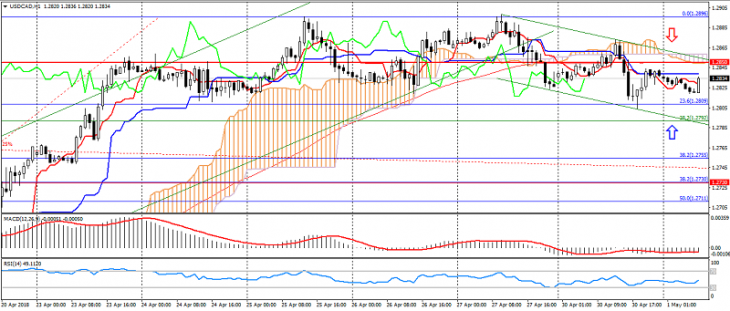

USD CAD (current price: 1.2830)

- Support levels: 1.2950, 1.2730, 1.2600.

- Resistance levels: 1.3030, 1.3150, 1.3280.

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is below 0, the signal line is in the body of the histogram. RSI (14) is in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): the Tenkan-sen line is below the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is started from 1.2850, 1.2880, 1.2900.

- Alternative recommendation: buy entry is started from 1.2810, 1.2800, 1.2780.

The pair went into a correction phase, but is limited to the expectation of data on the US trade confrontation.

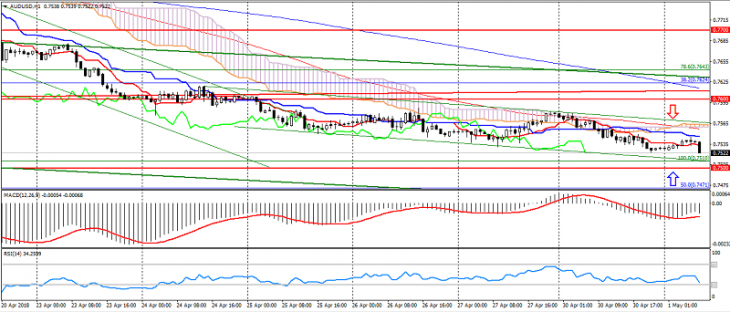

AUD USD (current price: 0.7520)

- Support levels: 0.7700 (March 2017 maximum), 0.7600, 0.7500.

- Resistance levels: 0.7820, 0.7900, 0.7980.

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is below 0, the signal line has left the body of the histogram. RSI (14) is in the oversold zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): the Tenkan-sen line is below the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is started from 0.7560, 0.7580, 0.7600.

- Alternative recommendation: buy entry is started from 0.7500, 0.7480, 0.7460.

The Australian remains under pressure of possible risks associated with the trade confrontation, but is limited to a decrease in bullish divergence and oversold.

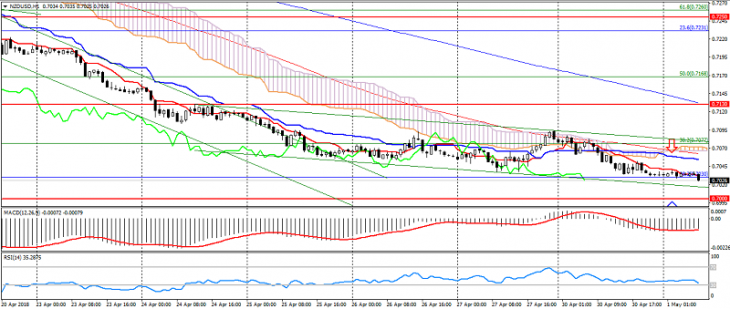

NZD USD (current price: 0.7020)

- Support levels: 0.7250, 0.7130 (August 2017 minimum), 0.7000.

- Resistance levels: 0.7380, 0.7450, 0.7550 (2017 maximum).

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is below 0, the signal line is in the body of the histogram. RSI (14) is in the oversold zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): the Tenkan-sen line is below the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is started from 0.7060, 0.7080, 0.7100.

- Alternative recommendation: buy entry is started from 0.7000, 0.6980, 0.6950.

The New Zealand dollar also appeared under pressure, limited to psychology of 0.7000.

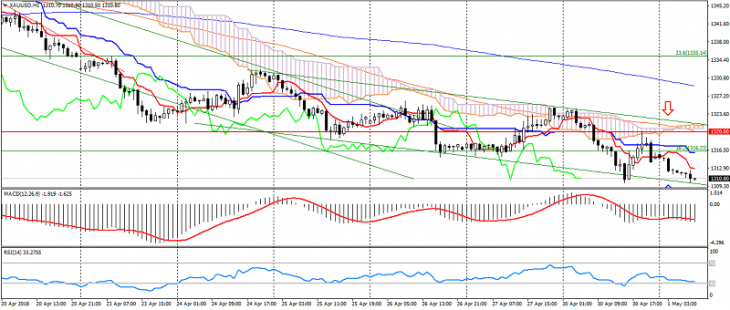

XAU USD (current price: 1310.00)

- Support levels: 1320.00, 1303.00, 1280.00.

- Resistance levels: 1355.00 (May May 2016 maximum), 1374.00, 1290.00 (March 2016 maximum).

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is below 0, the signal line is in the body of the histogram. RSI (14) is in the oversold zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): the Tenkan-sen line is below the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is started from 1316.00, 1320.00, 1323.00.

- Alternative recommendation: buy entry is started from 1308.00, 1305.00, 1300.00.

Gold still remains under the pressure of a downtrend, which confirms bullish divergence.