Тechnical analysis of currency pairs (Anton Hanzenko)

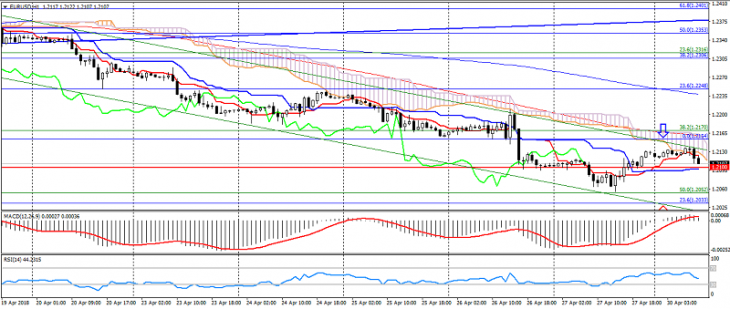

EUR USD (current price: 1.2110)

- Support levels: 1.2100 (September 2017 maximum), 1.1900, 1.1700.

- Resistance levels: 1.2600, 1.2750 (March 2013 minimum), 1.2270 (November 2014 minimum).

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is above 0, the signal line is in the body of the histogram. RSI (14) is in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): the Tenkan-sen line is above the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is started from 1.2140, 1.2160, 1.2180.

- Alternative recommendation: buy entry is started from 1.2100, 1.2080, 1.2050.

The pair maintains a downward trend, remaining limited by resistance levels: 1.2130-40 and 1.2170.

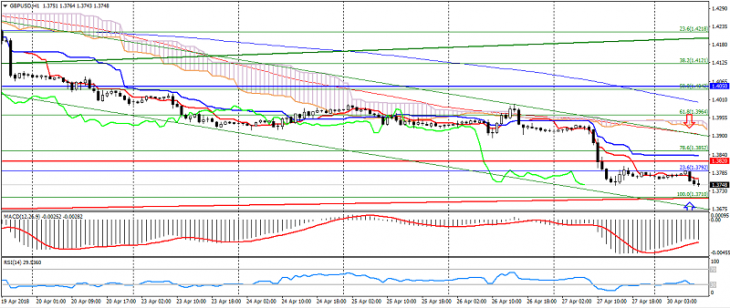

GBP USD (current price: 1.3750)

- Support levels: 1.3820, 1.3650 (September 2017 maximum), 1.3450.

- Resistance levels: 1.4050, 1.4350, 1.4500.

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is below 0, the signal line has left the body of the histogram. RSI (14) is in the oversold zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): the Tenkan-sen line is below the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is started from 1.3820, 1.3850, 1.3880.

- Alternative recommendation: buy entry is started from 1.3730, 1.3700, 1.3680.

The British pound is under pressure, but is limited to divergence and support of 1.3700.

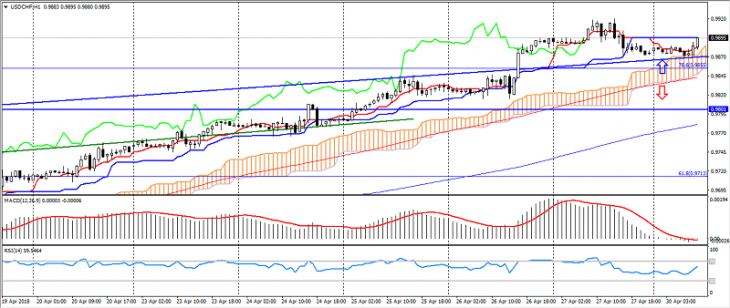

USD CHF (current price: 0.9890)

- Support levels: 0.9250 (August 2015 minimum), 0.9150, 0.9050 (May 2015 minimum).

- Resistance levels: 0.9550, 0.9800, 1.0030 (November 2017 maximum).

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is below 0, the signal line is in the body of the histogram. RSI (14) is in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): the Tenkan-sen line is below the Kijun-sen line, the price is higher than the cloud.

- The main recommendation: sale entry is started from 0.9920, 0.9950, 0.9970.

- Alternative recommendation: buy entry is started from 0.9870, 0.9850, 0.9830.

The Swiss franc remains under pressure of the American, limited to oversold.

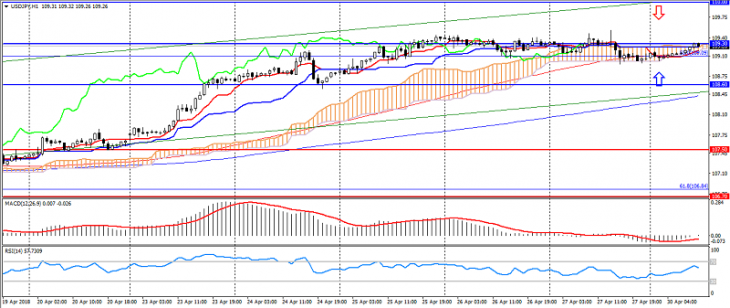

USD JPY (current price: 109.30)

- Support levels: 107.50, 106.70, 105.50.

- Levels of resistance: 108.60, 109.30, 110.00.

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is below 0, the signal line is in the body of the histogram. RSI (14) is in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): the Tenkan-sen line is below the Kijun-sen line, the price is higher than the cloud.

- The main recommendation: sale entry is started from 109.50, 109.70, 109.90.

- Alternative recommendation: buy entry is started from 109.00, 108.60, 108.30.

The pair continues to trade in an uptrend, but is limited to flat.

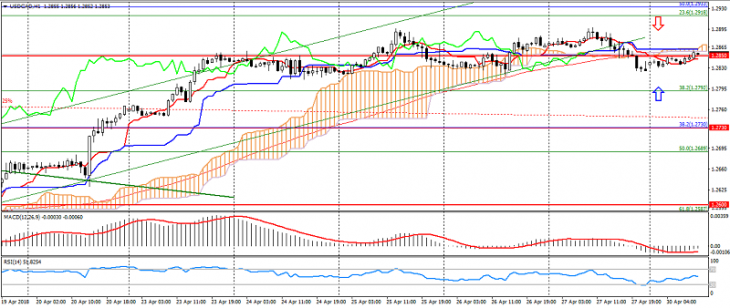

USD CAD (current price: 1.2850)

- Support levels: 1.2950, 1.2730, 1.2600.

- Resistance levels: 1.3030, 1.3150, 1.3280.

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is below 0, the signal line has left the body of the histogram. RSI (14) is in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – flat): the Tenkan-sen line is near the Kijun-sen line, the price is in the cloud.

- The main recommendation: sale entry is started from 1.2890, 1.2920, 1.2950.

- Alternative recommendation: buy entry is started from 1.2820, 1.2800, 1.2780.

The pair remains in flat, indicating a slowdown in the uptrend.

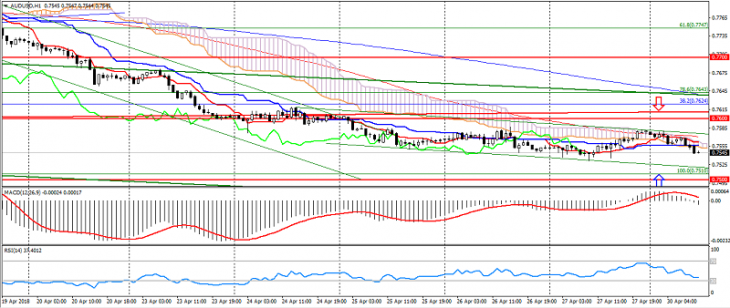

AUD USD (current price: 0.7550)

- Support levels: 0.7700 (March 2017 maximum), 0.7600, 0.7500.

- Resistance levels: 0.7820, 0.7900, 0.7980.

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is above 0, the signal line has left the body of the histogram. RSI (14) is in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): the Tenkan-sen line is above the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is started from 0.7570, 0.7600, 0.7630.

- Alternative recommendation: buy entry is started from 0.7520, 0.7500, 0.7480.

The Australian slowed down the decline against the American, but continues to remain under pressure.

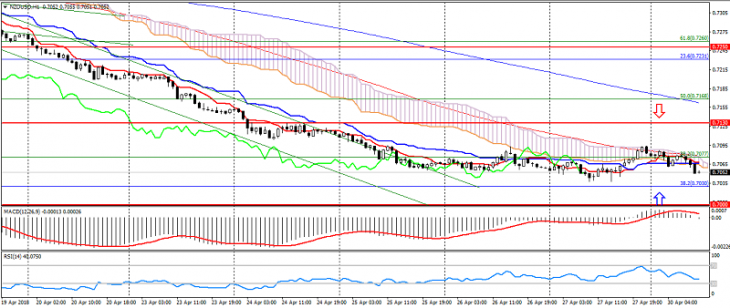

NZD USD (current price: 0.7050)

- Support levels: 0.7250, 0.7130 (August 2017 minimum), 0.7000.

- Resistance levels: 0.7380, 0.7450, 0.7550 (2017 maximum).

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is above 0, the signal line is in the body of the histogram. RSI (14) is in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): the Tenkan-sen line is below the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is started from 0.7090, 0.7130, 0.7180.

- Alternative recommendation: buy entry is started from 0.7030, 0.7000, 0.6970.

The New Zealand dollar moves in a sideways trend, limited to psychology of 0.7000.

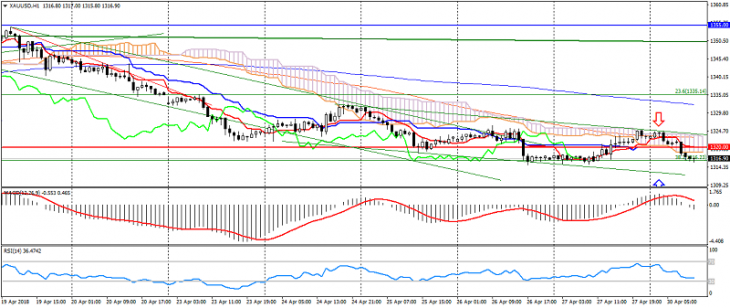

XAU USD (current price: 1316.00)

- Support levels: 1320.00, 1303.00, 1280.00.

- Resistance levels: 1355.00 (May May 2016 maximum), 1374.00, 1290.00 (March 2016 maximum).

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is above 0, the signal line is in the body of the histogram. RSI (14) is in the oversold zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): the Tenkan-sen line is below the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is started from 1320.00, 1325.00, 1328.00.

- Alternative recommendation: buy entry is started from 1314.00, 1311.00, 1308.00.

Gold remains under pressure of the American, limited to a minimum of the month at 1320.00-1315.00 and oversold.