Technical analysis of cross-rates. (Anton Hanzenko)

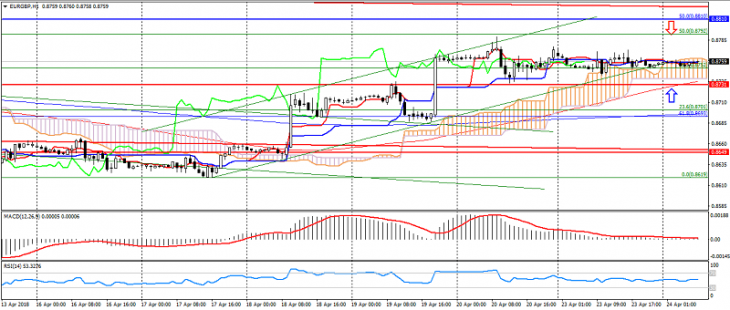

EUR GBP (current price: 0.8760)

- Support levels: 0.8730 (minimum of the last months), 0.8650, 0.8530.

- Resistance levels: 0.8810, 0.8900, 0.9050 (November 2016 maximum).

- Computer analysis: MACD (12, 26, 9) (signal-flat): the indicator is near 0. RSI (14) is in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – flat): the Tenkan-sen line is near the Kijun-sen line, the price is in the cloud.

- The main recommendation: sale entry is started from 0.8780, 0.8810, 0.8840.

- Alternative recommendation: buy entry is started from 0.8730, 0.8710, 0.8680.

The pair remains a sideways trend, maintaining an upward trend and limiting itself to the level of 0.8800-10.

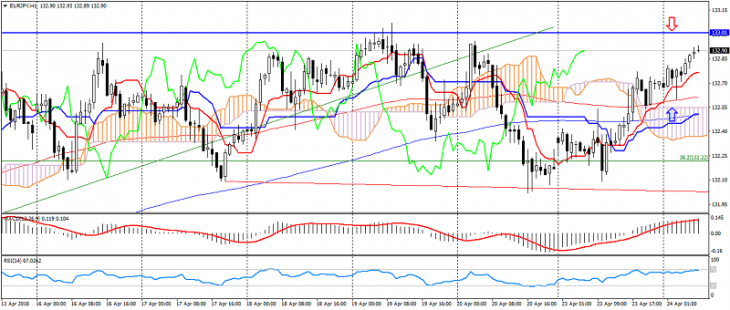

EUR JPY (current price: 132.90)

- Support levels: 130.20, 128.50, 126.80.

- Resistance levels: 133.00, 134.50, 136.80.

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is above 0, the signal line is in the body of the histogram. RSI (14) is in the overbought zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): the Tenkan-sen line is above the Kijun-sen line, the price is higher than the cloud.

- The main recommendation: sale entry is started from 133.00, 133.30, 133.50.

- Alternative recommendation: buy entry is started from 132.70, 132.50, 132.30.

The pair remains in the sideways trend, limited to the level of 133.00

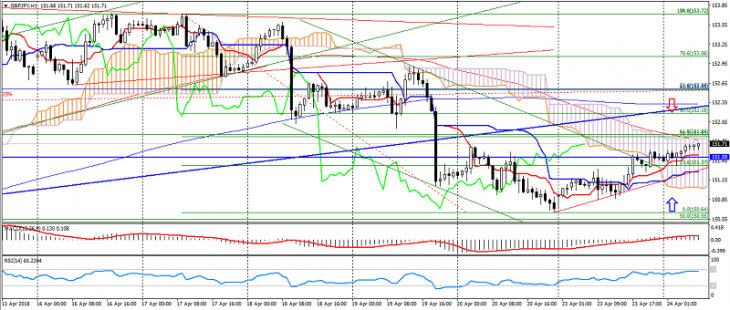

GBP JPY (current price: 151.70)

- Support levels: 146.00, 144.50, 143.50.

- Resistance levels: 148.00, 150.00, 151.50.

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is above 0, the signal line is in the body of the histogram. RSI (14) is in the overbought zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – flat): the Tenkan-sen line is above the Kijun-sen line, the price is in the cloud.

- The main recommendation: sale entry is started from 152.00, 152.30, 152.50.

- Alternative recommendation: buy entry is started from 151.40, 150.20, 150.00.

The pair went into a correction phase on the weakness of the yen.

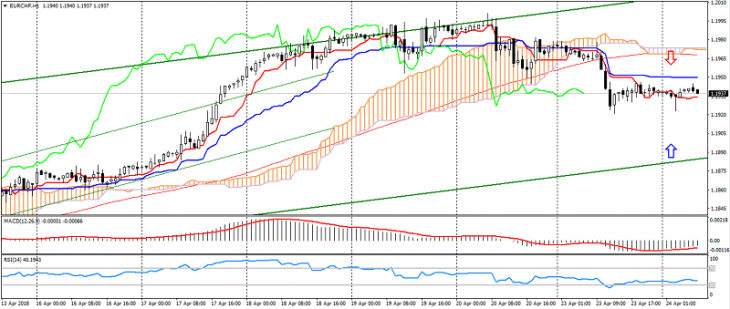

EUR CHF (current price: 1.1940)

- Support levels: 1.1500, 1.1450, 1.1400.

- Resistance levels: 1.1600, 1.1700 (the maximum of the current year), 1.1800.

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is below 0, the signal line has left the body of the histogram. RSI (14) is in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): the Tenkan-sen line is below the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is started from 1.1950, 1.1970, 1.2000.

- Alternative recommendation: buy entry is started from 1.1920, 1.1900, 1.1880.

The euro went into the correction phase on the repulsion from the upper border of the rising channel.