BoC meeting minutes

- Interest rate decision, fact 1.75%, forecast 1.75%.

As expected, the Bank of Canada retained key interest rates unchanged. The general tone of the Central Bank remained restrained negative. Thus, the Bank of Canada expects a decline in the consumer price index in the third quarter. The main concerns are related to trade conflicts, which caused a restrained tone for the Central Bank of Canada.

At the moderate tone of the Bank of Canada, the Canadian dollar reacted with a sharp decline against its main competitors. Such a movement was mainly connected with the position of the Bank of Canada, which took a waiting position.

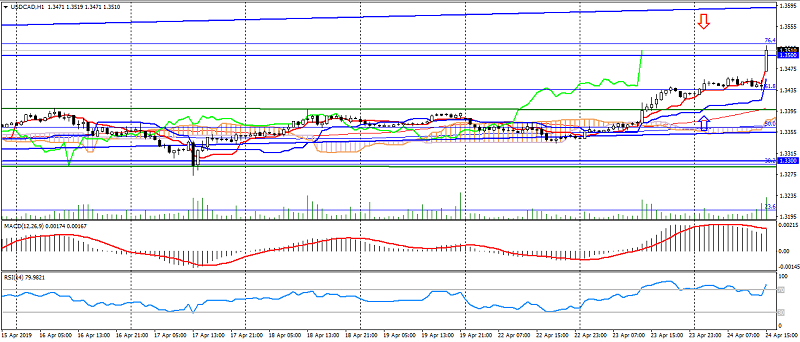

The USD/CAD pair has updated a high at 1.3520, thereby confirming the three-month upward trend, but will be limited to overbought and resistance levels: 1.3520 1.3550.

Fig. USD/CAD chart. Current price – 1.3510

Read also: “Make a profitable business – appreciating the strengths of the stock,

Commodity and Currency Markets “

Hanzenko Anton

Earn with the help of the trade service on the news Erste News!

Topical articles of the trader’s blog:

- Expectations from the USD/JPY for the end of April – early May

- U.S. and E.U. Trade War

- Gold: results and forecasts

Current Investment ideas: