Positive locking order as an alternative to the stop. Anton Hanzenko.

Each trader had a case when he regretted a pre-closed deal, which as a result could bring profit. Such actions are often caused by a number of events, but all of them are caused by a sense of fear of losing finance or fears of a decrease in profits on an open warrant. Today we will try to find a way to avoid such mistakes and slightly reduce the pressure of emotions on the trader’s work. In this we will be helped by the locking.

Locking – definition:

It is an alternative to the stops. Locking is an order opened in the opposite direction of the main transaction. The feature of the locking is that it must be the same volume as the main one and be opened on the same trading instrument. Locking orders are conditionally divided into negative and positive ones.

Negative lock is opened on already unprofitable transactions in order to limit losses. So when the buy position is open, the price is reduced by 30 points and the trader does not know whether this is a trend reversal or correction before growth. In this case, a negative locking order is applied. As a result, the negative lock acts as an alternative to the stop order.

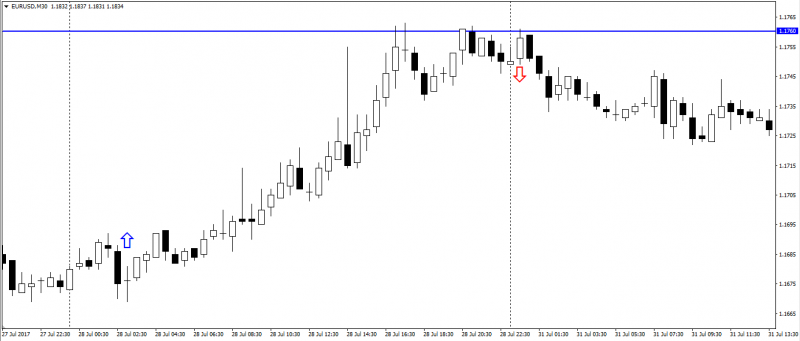

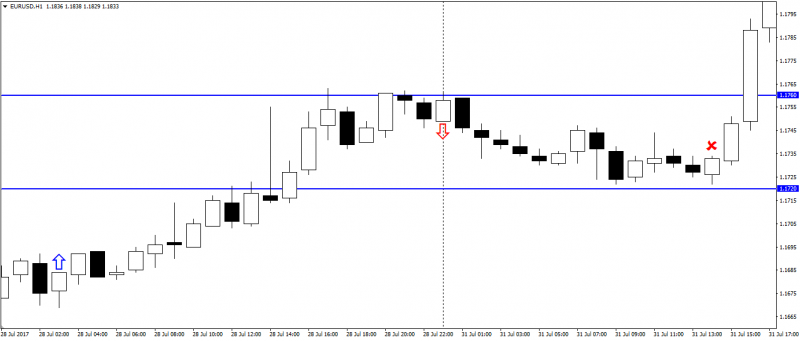

A positive lock is used on deals that are already in the black and allows you to save part of the profits, despite the possibility of changing the movement in the market. Let’s say there was such a situation that after the uptrend in which you have a purchase, a correction is forming. But one does not want to close the position because of the prospects for further growth, but also does not want to lose the earned money. In this case, a positive locking order will come to the rescue.

After the uptrend has fended off the resistance level, a positive locking order for sale will save already earned finances. Further, the correction ends and the general upward trend resumes, which leads to the closing of the positive locking order.

As a result, one stays in the open position on the trend with the saved profitable movement and get a small profit from the correction.

In addition to the fact that locking orders can act as an excellent alternative to stops and promote profit, they give the trader a unique opportunity to look at the situation without pressure of risks. This will help to draw the right conclusions and will prove that it is useful.

The disadvantage of this approach is a double spread, but as a rule, the spread is not large and does not play a significant role against the advantage of the Locking.

Hanzenko Anton

To see an article on the topic you are interested in – Write to the mail box info@esterholdings.com