U.S. employment data

- Average hourly earnings (compared to the same period last year) (y/y) (May), fact 3.1%, forecast 3.2%.

- Average hourly earnings (m/m) (May), fact 0.2%, forecast 0.3%.

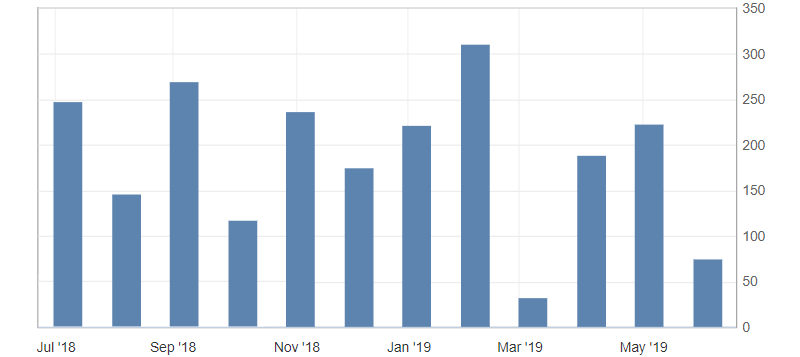

- Nonfarm payrolls (May), fact 75K, forecast 185K, previous value 224K.

- Private nonfarm payrolls (May), fact 90K, forecast 175K, previous value 205K.

- Unemployment rate (May), fact 3.6%, forecast 3.6%.

The US labor market slowed down in May, as ADP data showed. It is worth noting that the US labor market has slowed more significantly than expected. The rate of change in the number of people employed in the non-agricultural sector, in addition to the fact that it significantly decreased in May, was also revised downwards over the previous period. Additional pressure on the American dollar had data on the slowdown in wage growth.

Fig. 1. Nonfarm payrolls in the US

Against the background of weak employment data in the US, the US dollar index updated a three months low at 96.60, thereby confirming the weekly downward trend, but was limited by oversold and the overall annual upward trend. Against the background of an increase in the likelihood of lowering the US Fed rate and lowering of the US government bonds yield, the dollar index may continue to decline to support levels: 96.50 and 96.30. It is worth noting its significant oversold, which will limit the decline and may cause a correction.

Fig. The US dollar index chart. The current price is 96.60 (10-year US government bonds yield is the blue line)

Read also: “Dow Theory – Averages must confirm each other”

Hanzenko Anton

Earn with the help of the trade service on the news Erste News!

Topical articles of the trader’s blog:

- Cryptocurrency market. What is happening now and what to expect

- The main reasons for the weakening of the US dollar. Fed’s rates cut

- Should we expect the currency intervention from the Bank of Japan?

Current Investment ideas:

- Where else, if not on the banking sector! Earn with an investment idea from an Ester company’s expert!

- The best software for earnings on the technology giant’s Microsoft shares is inside! Connect!

- Hewlett-Packard shares are ready to close the gap, and we are ready to close the profits!

- Several reasons to buy Walmart shares. Use the chance to earn!