U.S. data

- Core durable goods orders (m/m) (January), fact -0.1%, forecast 0.1%.

- Core Producer Price Index (PPI) (m/m) (Feb), fact 0.1%, forecast 0.2%.

- Durable goods orders (m/m) (Jan), fact 0.4%, forecast -0.5%.

- Producer Price Index (PPI) (m/m) (Feb), fact 0.1%, forecast 0.2%.

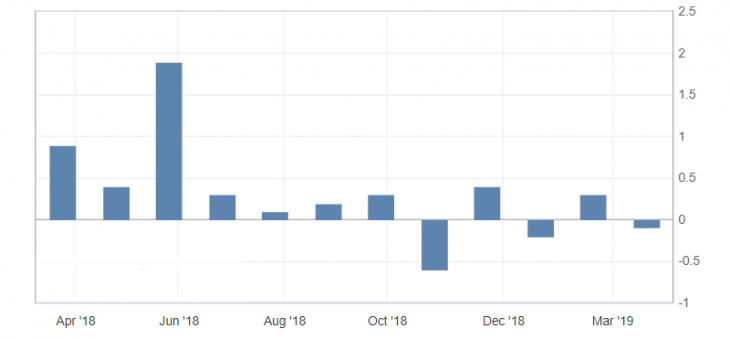

The news block in the US turned out to be very negative due to lower durable goods orders and slower growth in producer prices, indicating a slowdown in the US inflation. Of particular concern are the data on core durable goods orders (m), which confirm the deceleration of the US economy in recent times.

Fig. 1. U.S. core durable goods orders (m) chart

The reaction of the US dollar remains very restrained on the published statistics, due to the full concentration of the market on the UK data. The main decline of the American dollar throughout the day can be traced against gold, which indicates the investors’ flight from risks. Further decline in the US dollar index will be limited to the support level of 96.70-80.

Fig. 2.The US dollar index chart. The current price is 96.90 (10-year government bonds yield is the blue line)

Read also: “The lock: one more time about the ways out”

Hanzenko Anton

Earn with the help of the trade service on the news Erste News!

Topical articles of the trader’s blog:

- 3 major mistakes of traders-beginners

- Emerging markets and their prospects

- The US Dollar Index (DXY) as an auxiliary indicator for trading in commodity currencies

Current Investment ideas: