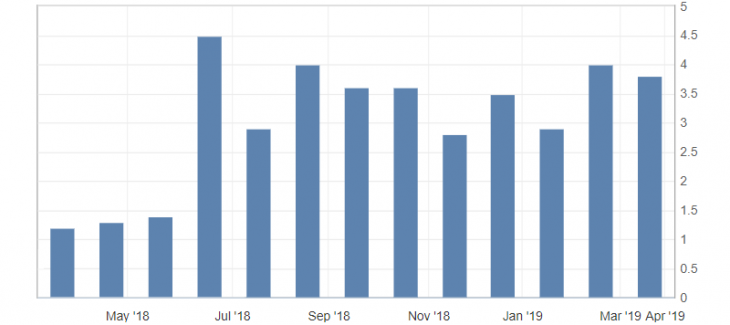

U.K. Retail Sales

- Core Retail Sales (m/m) (Feb), fact 0.2%, forecast -0.4%.

- Core Retail Sales (y/y) (Feb), fact 3.8%, forecast 3.3%.

- Retail Sales (m/m) (Feb), fact 0.4%, forecast -0.4%.

- Retail sales (y/y) (Feb), fact 4.0%, forecast 3.3%.

Data on retail sales in the UK in February unexpectedly increased, indicating the growth of this indicator, that shows the prospects for increased inflation. The overall year-on-year dynamics slowed down less significantly than expected, indicating a restrained upward trend.

Fig. 1. U.K. retail sales (y) chart

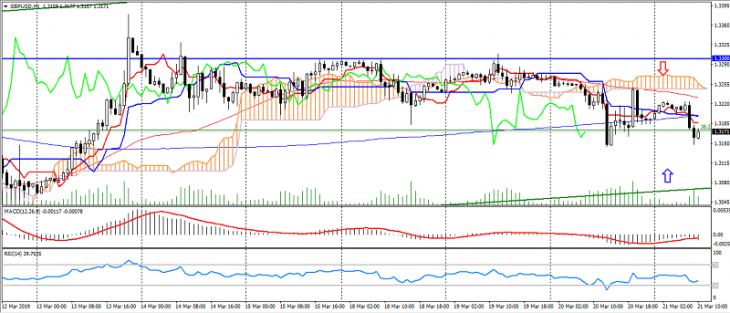

The British pound almost did not respond to optimistic data on retail sales in the UK. The limiting factor for the British pound remains the expectation of the Bank of England meeting results, which is likely to keep a low position on Brexit risks, and that can also be seen in the restrained downward dynamics of the pound on the correction of positions before the news.

The GBP/USD pair is limited by resistance levels: 1.3250 and 1.3300, support: 1.3100 and 1.3050.

Fig. 2. GBP/USD chart. Current price – 1.3170

Read also: “Incidents of the 21st century that had an impact on the financial market”

Hanzenko Anton

Earn with the help of the trade service on the news Erste News!

Topical articles of the trader’s blog:

- Prospects for Boeing shares after the planes crash

- The US Dollar Index (DXY) as an auxiliary indicator for trading in safe haven currencies

- 3 major mistakes of traders-beginners

Current Investment ideas: