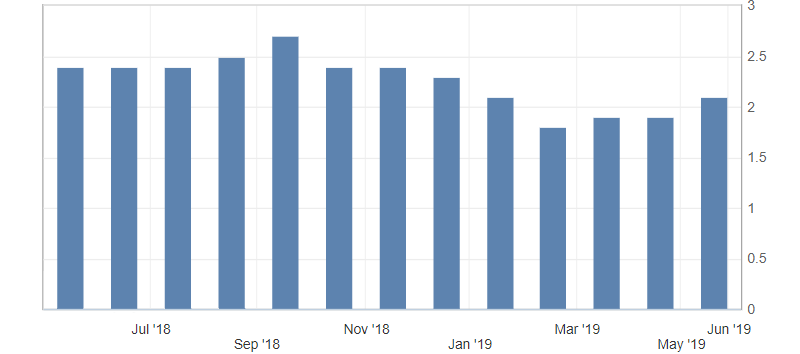

U.K. Inflation Data

- Consumer Price Index (CPI) (y/y) (Apr), fact 2.1%, forecast 2.2%.

- Consumer Price Index (CPI) (m/m) (Apr), fact 0.6%, forecast 0.7%.

- Purchasing producer price index (m/m) (Apr), fact 1.1%, forecast 1.3%.

The consumer price index in the UK rose in April, but at a noticeably slower pace than expected. In fact, the data did not affect the British pound. Thus, inflation rates in the UK improved in April, indicating a slowdown in the downward trend. But due to political risks and the preservation of very high rates, this news has a restrained influence on the British pound.

Fig. 1. U.K. consumer price index (CPI) (y) chart

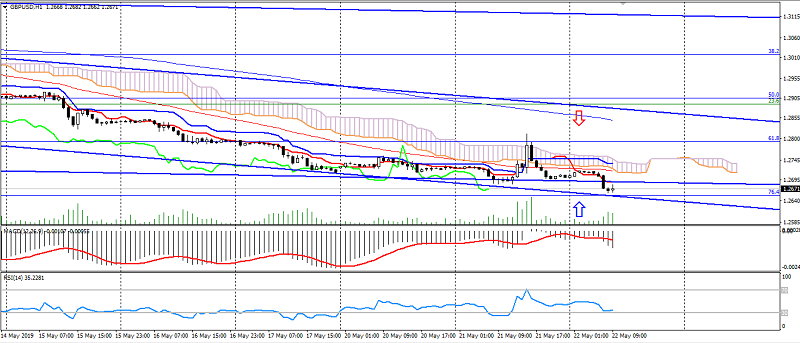

The British pound depends a lot on the political factors associated with Brexit. Under political uncertainty, the pound is more prone to decline across the market. But the increase in volatility on claims regarding Brexit is not excluded. Support levels for the GBP/USD pair: 1.2650 and 1.2630, resistance: 1.2730 and 1.2750.

Fig. 2. GBP/USD chart. Current price – 1.2670

Read also: “Three pillars of technical analysis”

Hanzenko Anton

Earn with the help of the trade service on the news Erste News!

Topical articles of the trader’s blog:

- The impact of the trade war on the US stock market

- Expectations from the AUD/USD pair for May

- Escalation of the US-China trade war and what it means for the market

Current Investment ideas: