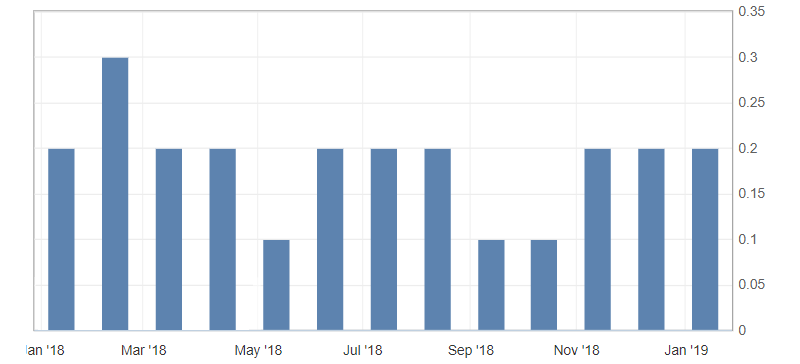

U.S. Inflation Data

- Core Consumer Price Index (CPI) (y/y) (December), fact 2.2%, forecast 2.2%.

- Core Consumer Price Index (CPI) (m/m) (December), fact 0.2%, forecast 0.2%.

- Consumer price index (CPI) (m/m) (December), fact -0.1%, forecast -0.1%.

An inflation report in the USA coincided with the forecast completely, as a result of which the upcoming statistics had practically no effect on the market. At the same time, the key indicator of the consumer price index on a monthly basis continues to be near the annual value, indicating a steady increase in inflation. Annual inflation is slightly above the target level, confirming the positive dynamics of the US economy.

Fig. 1. U.S. core consumer price index (CPI) (m/m) chart

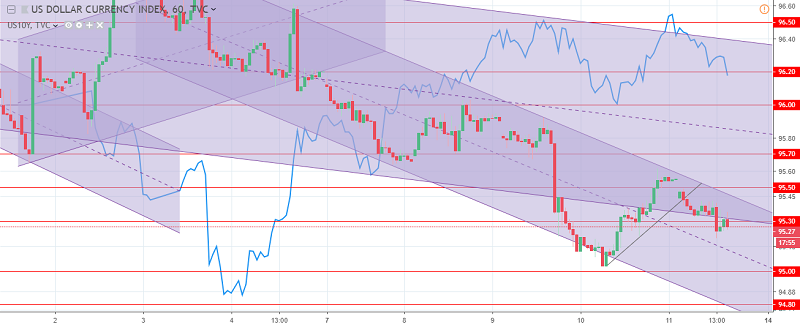

The US currency remains under the moderate pressure of a downtrend, despite very positive data on US inflation. Great support for the American dollar has a weakening of the stock markets, but political risks in the United States retain to put pressure on the dollar. The US dollar index remains under pressure from a downtrend and resistance levels: 95.30 and 95.50. Support levels: 95.00 and 94.80.

Fig. 2. The US dollar index chart. The current price is 95.30 (10-year government bonds yield is the blue line)

Read also: “The Oil market. Prospects and expectations “

Hanzenko Anton

Earn with the help of the trade service on the news Erste News!

Topical articles of the trader’s blog:

- Long-term investment in currency pairs! The GBP/USD pair!

- Geopolitical risks for the beginning of 2019! (Part 2)

- Geopolitical risks for the beginning of 2019!

Current Investment ideas: