Eurozone Inflation Data

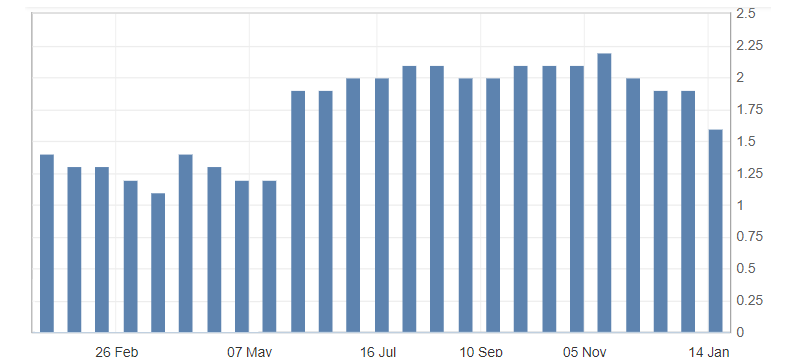

- Core Consumer Price Index (CPI) (y/y) (December), fact 1.0%, forecast 1.0%.

- Consumer Price Index (CPI) (m/m) (December), fact 0.0%, forecast -0.2%.

- Consumer Price Index (CPI) (y/y) (December), fact 1.6%, forecast 1.6%.

An inflation report in the eurozone for December was restrained positive, which was caused by an unexpected increase in the consumer price index on a monthly basis. At a time when this indicator year on year continues to slow down and maintain a downward trend, which caused a restrained influence of this report on the euro and kept concerns about inflation in the eurozone.

Fig. 1. Eurozone consumer price index (CPI) (y/y) chart

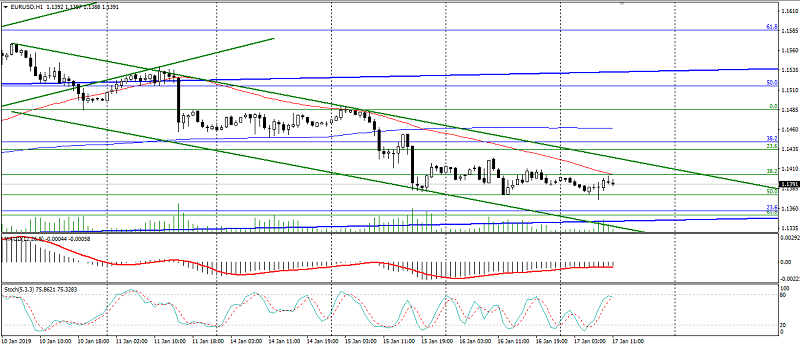

The euro has not actually responded to the restrained data on inflation in the eurozone, retaining the downward dynamics on maintaining political risks in Europe and confirming keeping the downward dynamics in the EUR/USD pair, which is limited to support levels: 1.1380 and 1.1350, resistance: 1.1410 and 1.1430.

Fig. 2. EUR/USD chart. Current price – 1.1390

Read also: “Reserve Bank of New Zealand and prospects for its monetary policy”

Hanzenko Anton

Earn with the help of the trade service on the news Erste News!

Topical articles of the trader’s blog:

- Geopolitical risks for the beginning of 2019! (Part 3)

- Long-term investment in currency pairs! The GBP/USD pair!

- Geopolitical risks for the beginning of 2019! (Part 2)

Current Investment ideas: