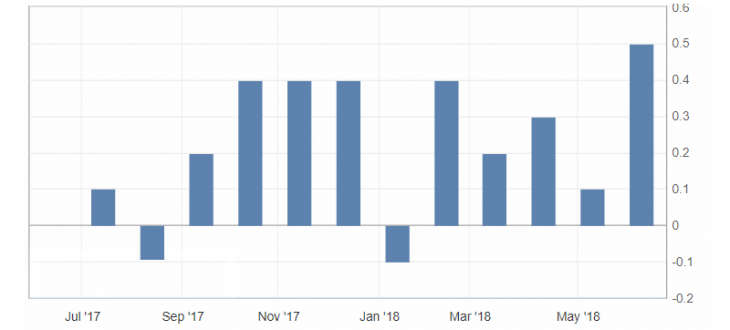

Data on producer prices in the US

- Core producer price index (PPI) in the US (m / m), fact 0.3%, forecast 0.2%.

- Producer Price Index (PPI) in the US (m / m), fact 0.3%, forecast 0.2%.

The producer price index (PPI) index in the US increased significantly in July, thus indicating an increase in targeted inflation growth in the future. Also, this indicator slightly raised the mood on the market and caused the resumption of the stock exchanges growth after a decrease in risks with the trade confrontation of the United States.

Fig. 1. Producer price index chart

In turn, with the recovery of optimism on the market, the US dollar index was under pressure, which may indicate a resumption of the downward trend for the American dollar. Support levels: 94.20 and 94.00, resistance: 94.40 and 94.60.

The US dollar index. The current price is 94.20 ( 10-year government bonds yield is a blue line)

Read also: “Ten Pluses and One Minus of Trading on the Forex Market”

Hanzenko Anton

Earn with the help of the trade service on the news Erste News!

Topical articles of the trader’s blog: