Trading against the trend using examples. Anton Hanzenko

Every trader has heard the saying “Trend is your friend” and there is no point in arguing with it , as trading in a clearly pronounced trend is more profitable and safer. But a clear trend in the market – not a frequent phenomenon. And for a number of reasons, even if it is traced, they can not always be used because of the short duration. Not to mention that most of the trends are very ambiguous.

On the other hand, everyone knows that a strong movement is not possible without correction or recoil. Then a contradiction arises in the statement “Trend is your friend”. Also, there are no eternal trends that have not changed for others. Therefore, we can say that trading against the trend is possible, if you really want and for this there are some reasons!

At once I will note that when trading against a trend, even explicitly expressed, it is worth remembering about the risks: the trend can resume at any moment! Considering this, it is necessary to build realizable plans.

- So, trading against the trend should be accompanied by understated expectations. Since the generally accepted rules in this case have an extremely low probability of development. So, the rule of placing the stop to profit is 1 to 2 or 1 to 3, most likely, it will not work and it is worth using stop sizes to profit 1 to 1.

- It rarely happens that the correction is justified at 100%.

- Do not in any way neglect the security of the deposit without using stop orders. Because it is fraught with a full drain.

- We must always remember that we went against the trend and realistically assess the situation on the market. At the same time, you should not overlook this deal, constantly assessing the situation on the market.

- Do not trick yourself with false expectations for a trend reversal. If the situation has changed, close the deal.

Trading Against a Trend: Let’s consider an example!

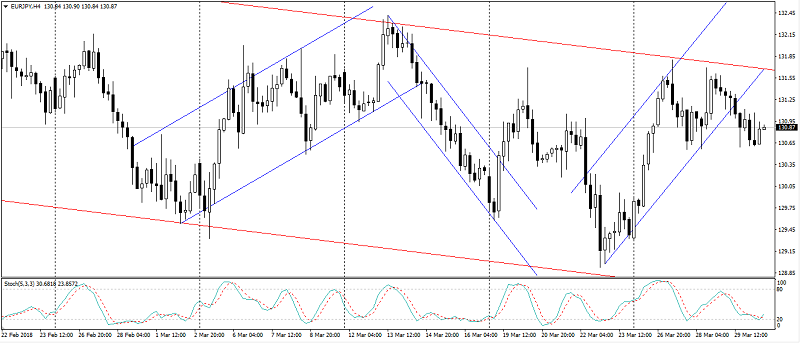

Correction on the trend or against strong movement can be calculated using a variety of methods (overbought/oversold, candle formations, Fibonacci retracement, strong levels, etc.). There is no sense in the methods and depths in them, the main thing is that you trust them and know how to use them correctly.

Thus, in the figure above, an example of a clearly expressed downward trend is shown, where oversold signals served as a signal for correction, and the targets were calculated with the help of Fibonacci levels. But this corrective movement was put in the framework of the trend, which also should be taken into account when trading against the trend.

In the case of no apparent trend or uncertainty in the market, trade against the trend is significantly more complicated.

In this case, it would be good to earn at least on the trend, not to mention correction!

To sum up:

- If you decide to go against the trend – determine the trend that clearly exists and you enter the correction, which is confirmed by other signals, and it has not yet developed itself. If something is wrong – do not climb into the market, wait for entry points on the trend.

- We always remember that we are trading against the trend and the standard goals probably will not be fully justified.

- Do not blindly believe that the price will go to your side for no apparent reason. Always look for confirmation of the entry into the transaction, even if you are trading exclusively on a trend.

- Do not forget about protective orders and money management!

It is very difficult to forecast what can happen during trading, not to mention trading against the trend. Therefore, always follow the rules of strategy and money management, soberly assessing the risks!

Anton Hanzenko