What is expected from the US employment report for May

In the context of heightened trading risks, which caused an increase in the likelihood of lowering the US Federal Reserve rates, the US market labor report for May will have a significant impact on the Fed policy and the US dollar in general.

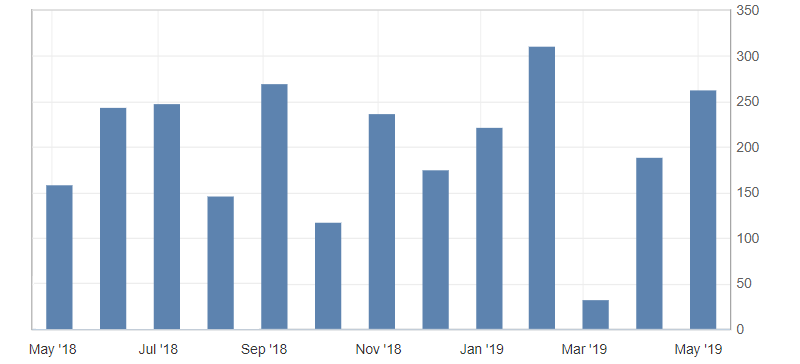

Prospects for changes in the number of people employed in the non-agricultural sector have decreased noticeably after a significant increase in April. This is the normal dynamics of the labor market and the forecast at 185K looks very optimistic after growing at 263K. Fears are caused by these changes in the number of people employed in the non-agricultural sector from ADP, published earlier and showing a huge slowdown in the US labor market. If the ADP data will be confirmed, the official jobs report in the United States may revise the previous values employed in the non-agricultural sector. In addition, indicators for May will vary in the range of 100-150K.

These figures will be much worse than forecasts and will have a significant pressure on the dollar. Also, the similar importance of the labor market will increase the likelihood of rates cut in the United States, which will also have a strong pressure on the American dollar.

The positive notes of the report can be data on wage growth, contributing to inflation, and a decrease in unemployment, which in theory could cover the decline in the number of people employed in the United States.

Fig. Nonfarm payrolls in the US

Hanzenko Anton

Earn with the help of the trade service on the news Erste News!

Topical articles of the trader’s blog:

- Cryptocurrency market. What is happening now and what to expect

- The main reasons for the weakening of the US dollar. Fed’s rates cut

- Should we expect the currency intervention from the Bank of Japan?

Current Investment ideas:

- Where else, if not on the banking sector! Earn with an investment idea from an Ester company’s expert!

- The best software for earnings on the technology giant’s Microsoft shares is inside! Connect!

- Hewlett-Packard shares are ready to close the gap, and we are ready to close the profits!

- Several reasons to buy Walmart shares. Use the chance to earn!