Technical analysis of gold and silver (Alexander Sivtsov)

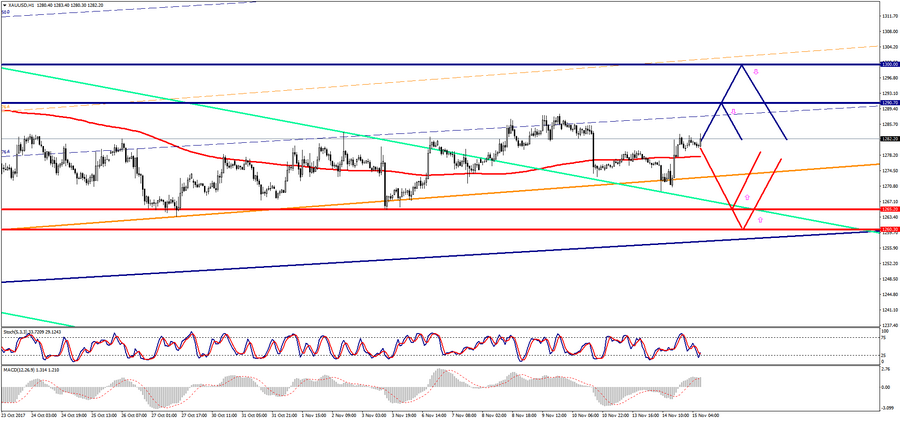

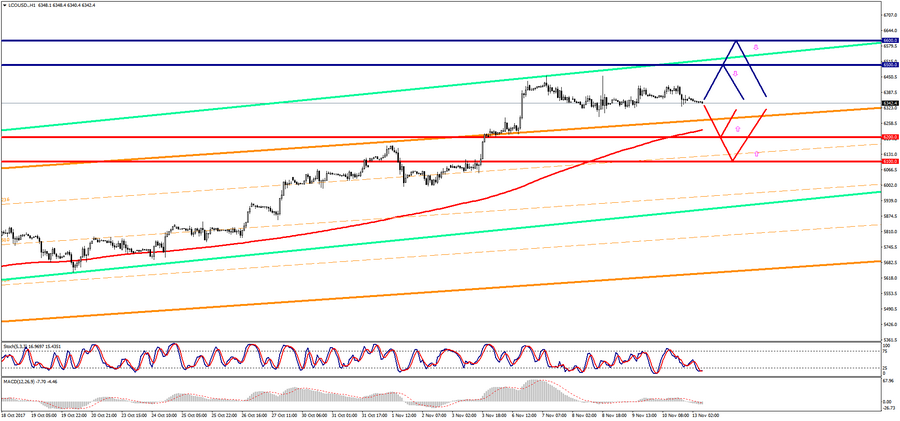

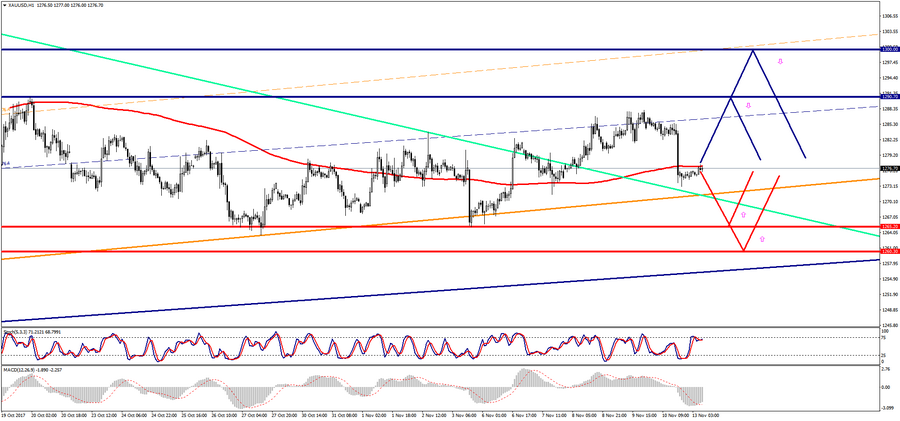

Gold chart (current price: $ 1282.20)

Gold is trading in a narrow range during the Asian session.

- Resistance 1: From $ 1290.70 (October 20 maximum)

- Resistance 2: From $ 1300.00 (psychological level)

- Support 1: From $ 1265.20 (November 3 minimum)

- Support 2: From $ 1260.30 (October 6 minimum)

Computer analysis: The Stochastic Oscillator movings on the chart H4 enter the overbought zone. One should expect the price of gold may decrease in the second half of the day.

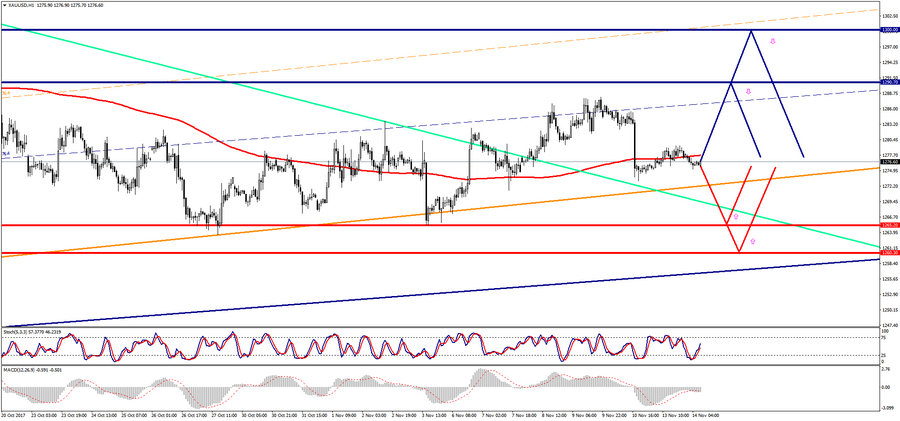

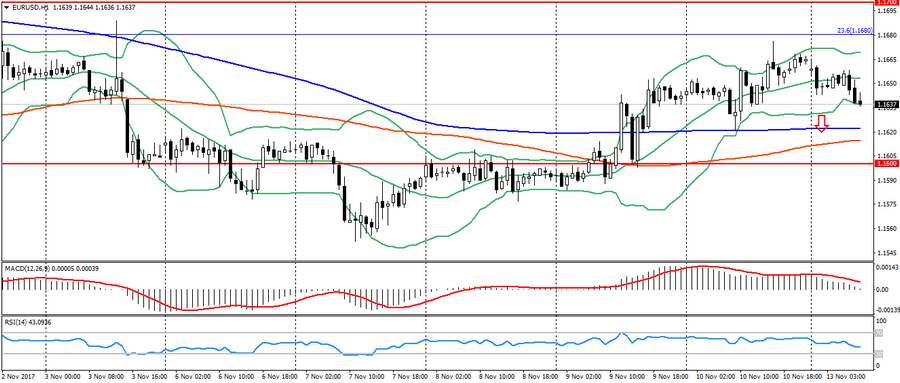

Silver chart (current price: $ 17.01)

Silver is trading with a small minus during the Asian session.

- Resistance 1: From $ 17.25 (October 20 maximum)

- Resistance 2: From $ 17.42 (October 16 maximum)

- Support 1: From $ 16.73 (November 3 minimum)

- Support 2: From $ 16.56 (October 27 minimum)

Computer analysis: The Stochastic Oscillator movings on the chart H1 are in the neutral zone. One should expect the continuation of the consolidation of the silver price.