Analysis of the past week

The outgoing trading week has passed, restraining the formation of narrow side channels on most major currency pairs. The main weekly volatility fell on Monday, which was caused by rising fears of the US-China trade war. The remaining week actually passed in anticipation of action in the trade war. The exception was some currencies that were traded depending on published statistics, but their dynamics to a greater extent remained limited.

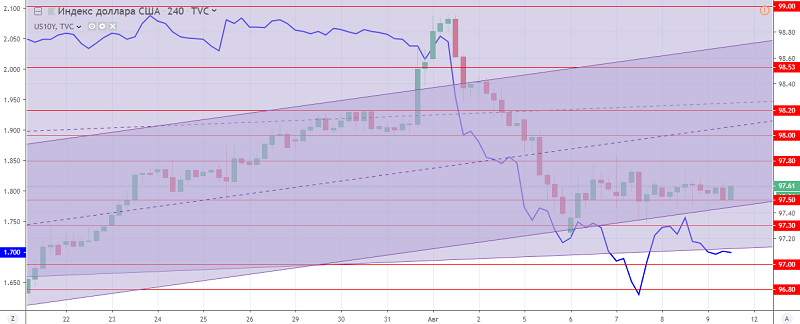

The US dollar index showed a volatility of 0.80%, the biggest part of which fell on Monday. The rest of the American dollar activity was limited by the side channel from 97.80 to 97.30, which narrowed by the end of the week. Given the restraint of the dollar index and the safety of the July uptrend, there is every reason to expect the growth of the American dollar after breaking through the levels of 97.80-98.00. The limiting factor is the US trade and political risks.

Fig. The US Dollar Index Chart H4. Current price – 97.60 (10-year government bonds yield – blue line)

Hanzenko Anton