Analysis of the past week

The outgoing week was very volatile due to significant statistics, including meetings of the Central Bank of Australia and New Zealand, and the publication of employment data in Canada. At the release of these news users of Erste News could make good money.

In addition to the planned news, a significant impact on the market was provided by data on the aggravation of the US-China trade relations. So, at the beginning of the week, the US President D. Trump announced the intention to introduce new duties on Chinese goods, which was caused by China’s reluctance to make trade agreements. The reaction of China was not long in coming and the response duties will also be accepted, the representative of China said.

As a result, the outgoing week can be called a week of investors’ flight from risks in the exacerbation of the US-China trade opposition. But amid renewed optimism in the background areas of Asia and Europe, the US dollar moved from safe to risky currencies, which caused the decline of American dollar in the second half of the week.

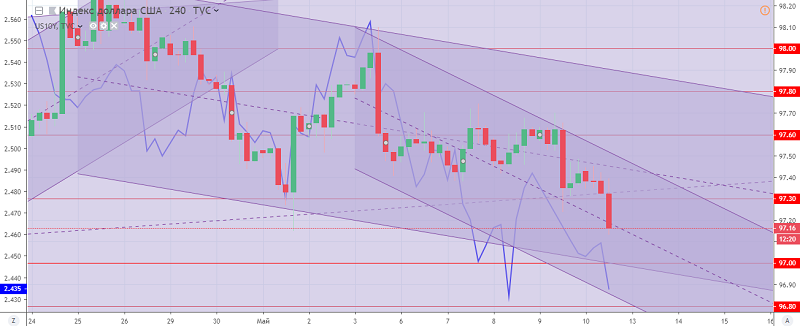

As a result, the US dollar index for the week closes trading with a decline, losing about 0.30% from the opening of the week. It should be noted that the beginning of the week was very optimistic for the American dollar. A break through the dollar support index of 97.30 opens the way to the support levels of 97.00 and 96.80. Resistance is located at levels: 97.30 and 97.50.

Fig. 2. The US dollar index H4 chart. The current price is 97.10 (10-year government bonds yield is the blue line)

Hanzenko Anton