Analysis of the past week

As a result of the outgoing week, the US dollar remains under the pressure against a basket of major competitors. The pressure on the American dollar is from optimistic expectations regarding trade negotiations and expectations of the US Federal Reserve rates cuts. This forced the US dollar index to update the October low and slowed the uptrend in the dollar, which has been traced since July of this year. The weekly volatility of the American dollar was 1%.

The British pound also showed a significant increase in volatility in addition to the US dollar. The pound has strengthened across the market on reduced risks of a tough Brexit. The reason for the pound’s growth was the statement by British Prime Minister B. Johnson, who announced the imminent provision of a plan to resolve the Irish status.

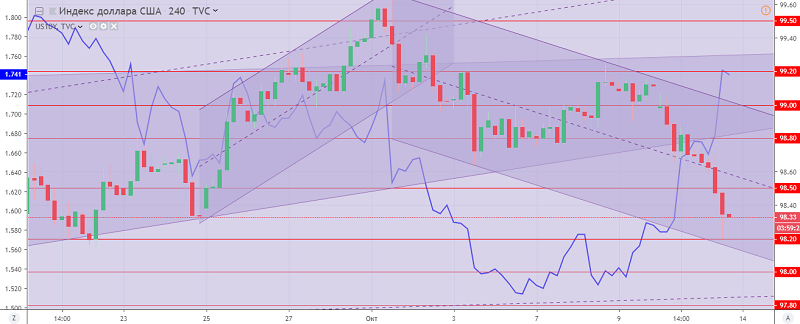

The US dollar index closes the week with the formation of a downward trading channel, limiting itself to significant oversold and indicating a potential for decline after growth. Significant resistance is located at the levels: 98.80, 99.00 and 99.20; Support: 98.20, 98.00 and 97.80.

Fig. The US Dollar Index Chart H4. Current price – 98.30 (10-year government bonds yield – blue line)

Hanzenko Anton