The US dollar accelerates its decline on weak inflation data

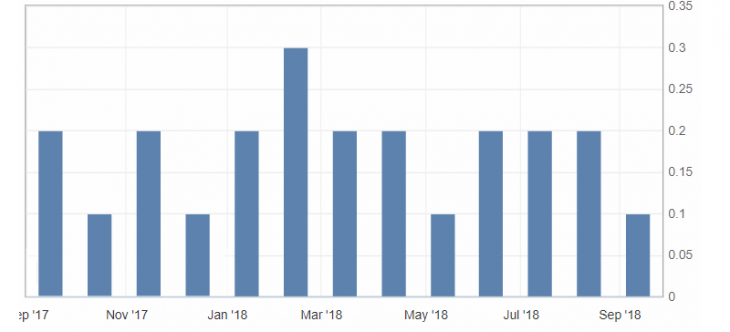

- Core consumer price index (CPI) (m / m) (Aug), fact 0.1%, forecast 0.2%.

- Core consumer price index (CPI) (y / y) (Aug), fact 2.2%, forecast 2.4%.

- Consumer price index (CPI) (m / m) (Aug), fact 0.2%, forecast 0.3%.

- Initial jobless claims, fact 204K, forecast 210K.

Inflation data in the US unexpectedly slowed in August, putting pressure on the American dollar, despite the decline in initial jobless claims.

Fig. 1. Consumer price index chart in the USA

Despite the fact that the slowdown in consumer prices is insignificant, it is a fundamental factor for raising rates in the US.

Also pressure on the dollar was provided by the press conference of the head of the ECB Draghi, that Mr. Draghi began with statements that he expected a targeted increase in inflation. At the same time, GDP growth forecasts for 2019 were down by 0.1% to 1.8%.

As a result, the dollar was under considerable pressure from weak inflation data in the US and the ECB’s optimistic rhetoric, that led to the strengthening of the euro and commodity currencies. The US dollar index rushed to the support level at 94.40, from what it is expected to repel the decline in pessimism for the American dollar.

Fig. 2. The US dollar index chart. The current price is 94.60 (10-year government bonds yield is a blue line)

Read also: “Eurozone and the state of its economy based on key economic indicators”

Andre Green

Earn with the help of the trade service on the news Erste News!

Topical articles of the trader’s blog:

- The EU and the UK are making compromises on Brexit

- Singapore dollar. Features of trade.

- How long will last the US trade war against all?!

Current Investment ideas: