Дані по Великобританії

Блок новин по Великобританії виявився вельми позитивним, враховуючи менш стрімке уповільнення обробної промисловості Великобританії та скорочення негативного сальдо торгового балансу, докладніше про дані новини дивіться у стрічці новин. Основним показником, що зберігає побоювання є сальдо торгового балансу, яке, незважаючи на зниження дефіциту, продовжує зберігати спадну динаміку.

У світлі останніх подій, переговорів по Brexit і показників сальдо торгового балансу, які вказують на значну залежність Великобританії від ЄС, побоювання по фунту можуть поновитися. Особливо гостру реакцію ринку варто очікувати щодо нових торговельних відносин між королівством і єврозоною.

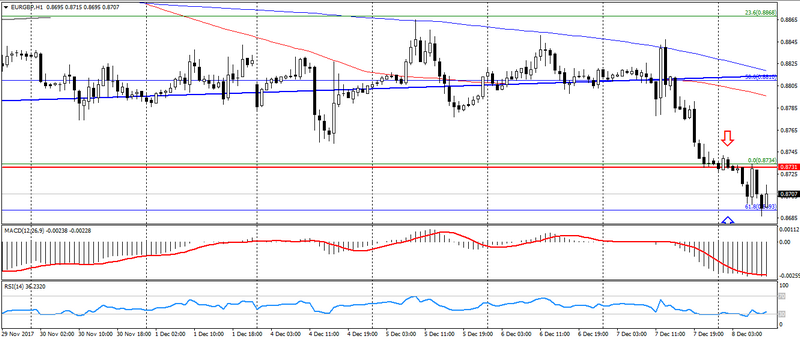

В результаті, пара EUR/GBP продовжує торгуватися біля мінімуму червня на оптимізмі по фунту, але подальше зміцнення британця залишається обмеженим перекупленістю британця. Тому варто очікувати формування бокового тренду. Приводом до односпрямованого руху можуть стати нові дані по Brexit. Рівні підтримки: 0.8690 та 0.8650, опору: 0.8740 та 0.8760.

Графік EUR/GBP. Поточна ціна – 0.8700

Ганзенко Антон