U.S. data

- Export Price Index (m/m) (May), fact -0.2%, forecast -0.1%.

- Import price index (m/m) (May), fact -0.3%, forecast -0.2%.

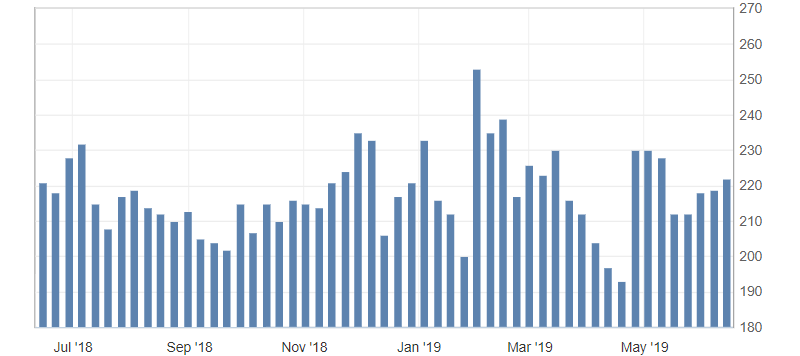

- Initial jobless claims, fact 222K, forecast 216K.

The US data turned out to be noticeably worse than the forecasts, putting moderate pressure on the US currency. Data on import and export indices slowed down significantly in May, thereby putting pressure on consumer inflation in the United States, also showing moving of this indicator to the negative zone, indicating a recession in consumer prices in the United States. The number of initial applications for unemployment benefits also raises concerns about the labor market, while maintaining the growth dynamics of primary applications for benefits.

Fig. 1. Initial jobless claims in the US

The US dollar index did not actually respond to weak statistics, which was caused by the continued concentration of the market on trade war data and the factual weakness of the US data in the price of the dollar earlier. The dollar index continues to trade below the resistance level of 97.00, remaining under the pressure of correction after growth. Against the background of weak data and general pessimism, the US currency remains prone to decline. Support levels: 96.80 and 96.70.

Fig. 2. The US dollar index chart. The current price is 97.00 (10-year US government bonds yield is the blue line)

Read also: “Fundamental Analysis: Employment Report and its Impact

on the dynamics of the national currency”

Hanzenko Anton

Earn with the help of the trade service on the news Erste News!

Topical articles of the trader’s blog:

- U.S. trade opposition. What are the risks

- Political risks are escalating around candidates for the Prime Minister in the UK

- Cryptocurrency market. What is happening now and what to expect

Current Investment ideas:

- Where else, if not on the banking sector! Earn with an investment idea from an Ester company’s expert!

- The best software for earnings on the technology giant’s Microsoft shares is inside! Connect!

- Hewlett-Packard shares are ready to close the gap, and we are ready to close the profits!

- Several reasons to buy Walmart shares. Use the chance to earn!