ZIGZAG – not simple properties of a simple indicator!

The ZIGZAG indicator has a very simple look, which can be simpler than a single line that interprets market movements. At the same time, this indicator is very useful both for beginners and more experienced traders despite its simplicity. It is similar in simplicity to the Fractals indicator, but also has its pros and cons.

The main task of the ZigZag indicator is to highlight significant extremes (high and low) on the price chart and connect them with a straight line. It allows:

- to highlight the main trend;

- to weed out unnecessary market noise;

- to highlight significant pivot points and lows with highs.

How to add ZIGZAG indicator to the terminal

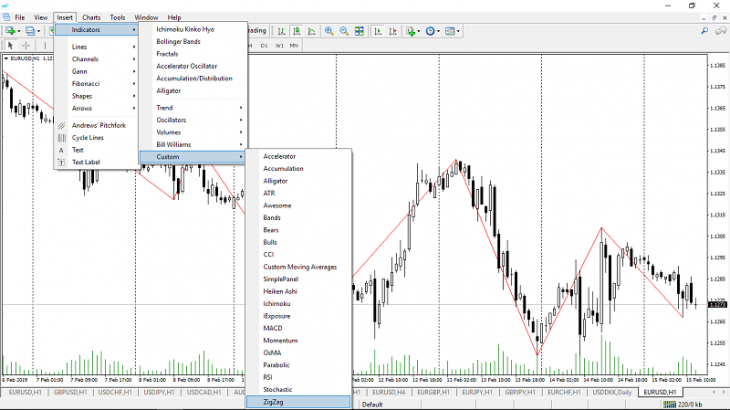

The indicator refers to the standard indicators and does not require an additional downloads. It is necessary to click on the following buttons Insert -> Indicators-> Custom-> ZigZag.

Indicator Settings

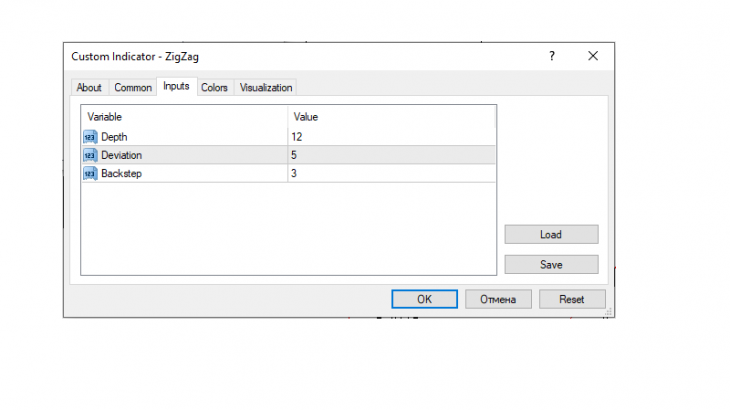

The settings of this indicator are also quite simple Like ZigZag itself and have only three variable parameters:

Depth – the minimum number of candlesticks between extremes that will limit the construction of new indicator lines during volatile trading.

Deviation – the minimum number of points in percent between the low and high of adjacent candlesticks.

Backstep – the minimum number of candlesticks between the extremes of the indicator.

Thus, with an increase in the parameters of the indicator, its sensitivity to market noise decreases and vice versa, with a decrease in the values of the parameters, the sensitivity increases.

Advantages and disadvantages of the indicator:

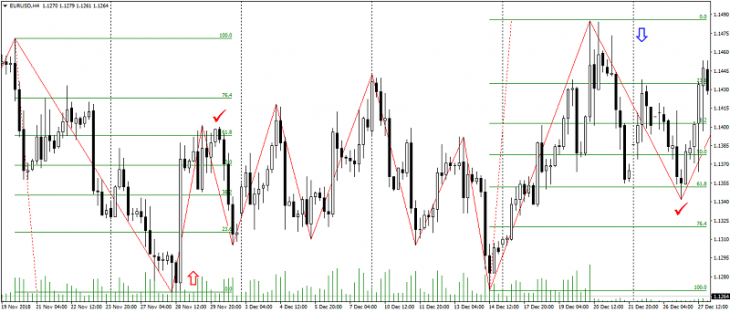

- Trend mappings

The ZigZag indicator is an excellent indicator of established trends that are excellent for trading strategies aimed at trading on correction against the main trend.

Also, this indicator can simplify significantly finding on the price chart such technical analysis patterns as “double top”, “double bottom”, “head and shoulders” and “inverted head and shoulders”.

- Significant extremes

In addition to trend lines, this indicator points to significant pivot points – extremes that can be used in further trading. Because, even with time, the resulting support and resistance levels continue to be taken into account by the market.

- Disadvantages

The main disadvantage of the ZigZag indicator is its lack of independence. That is, it is virtually impossible to use this indicator independently without auxiliary ones, which actually makes it a significant addition to most strategies.

It is worth noting a certain feature of the indicator, which can act as both a plus and a disadvantage.

ZigZag builds lines only for already formed candlesticks and at the end of the trend. It actually does not give any idea about the future movement of the market. But at the same time, even the most significant price changes will not affect the already constructed picture. Therefore, this indicator refers to those that do not change their signals over time.

The indicator is quite simple, but it can compete with a variety of complex and advanced strategies with the right approach to it.

Anton Hanzenko