Trading with CCI and Stochastic indicators

First, some words about these indicators. Both indicators are trend and help determine when an asset is overbought or oversold. The only main difference between CCI and Stochastick is that the CCI indicator is a moving average that most of the time moves between two levels of +100 and -100, which help determine overbought and oversold zones of the instrument, while the Stochastick indicator is represented by two moving averages that move between levels 80 and 20.

What is overbought or oversold instrument?

An overbought instrument is a price condition when further growth of an instrument slows down, as the number of buyers of an asset is reduced to a minimum, and the number of people willing to sell increases, while increasing the offer for the instrument, as a result of which the price goes down.

An oversold instrument is an inversely proportional overbought condition, as a result of which the price of the instrument reaches a local minima and cannot decline further, since at the moment the demand is already start to exceed supply.

Trade with the CCI indicator

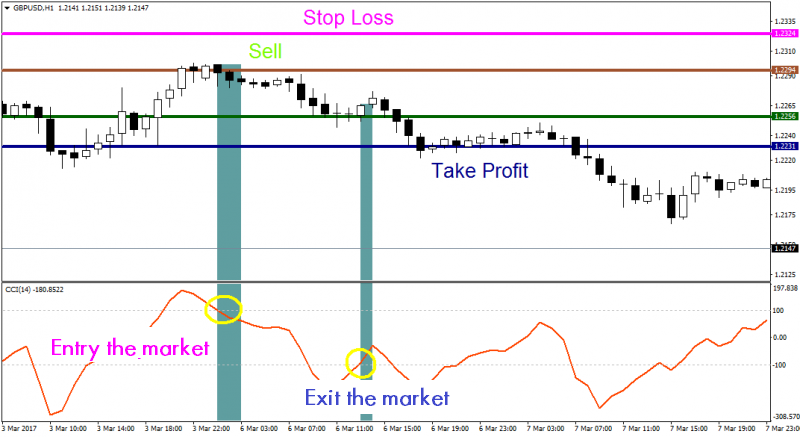

Sale entry with the CCI indicator

We sell (Sell) when the moving average goes out of the overbought zone and breaks through the level of +100 from top to bottom, while closing the bearish candlestick. We enter the market at the opening of the next candlestick. The exit from the transaction is on the opposite signal of the oscillator or on the Stop Loss or Take Profit.

Buy entry with the CCI indicator

A transaction for buy (Buy) opens when the moving average moves out of the oversold zone and crosses the -100 level from bottom to top, and the bullish candlestick closes. At the opening of the next candlestick we enter the market. The exit from the transaction occurs on the opposite signal of the oscillator or on the Stop Loss or Take Profit.

Trading with the stochastic indicator

Before you start trading using this indicator, you should change a little the standard settings of the indicator, to set levels 25 and 75, which are more optimal when using this oscillator.

Sale entry with the Stochastic indicator

We sell (Sell) when the stochastic movings cross each other in the overbought zone, and then break through level 75 from top to bottom and at the same time the bearish candlestick closes. We enter the market at the opening of the next candlestick. Exiting the market occurs at the opposite signal of the stochastic or according to the Stop Loss or Take Profit.

Buy entry with the indicator Stochastic Oscillator

We buy (Buy) when the stochastic movings cross each other in the oversold zone, and then break level 25 upwards and at the same time the bullish candlestick closes. We enter the market at the opening of the next candlestick. Exiting the market occurs at the opposite signal of the stochastic or according to the Stop Loss or Take Profit.

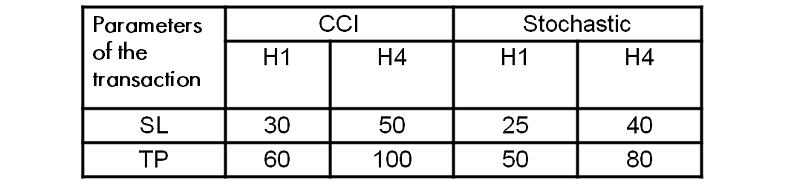

Recommended Stop Loss or Take Profit

when trading using this oscillators

Note

Since both indicators are trend, it is necessary to enter the market using these indicators only according to the trend and exclude trading in the flat, since during lateral movement the indicators can show false signals to enter the market.

If you want to learn more about trading using the CCI and Stochastic Oscillator indicators, book a training course with Ester Holdings Inc. specialists.

Alexander Sivtsov