Тechnical analysis of currency pairs (Anton Hanzenko)

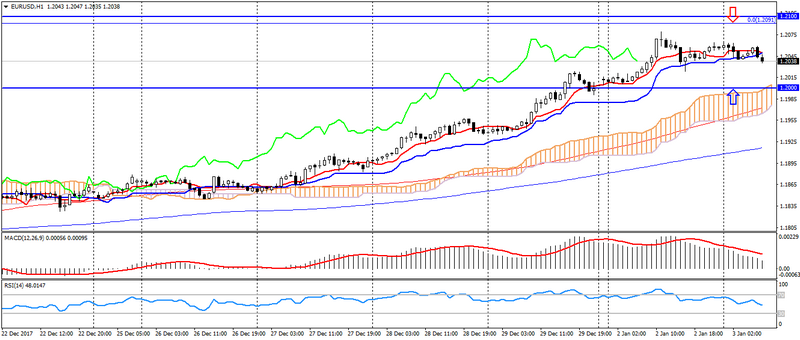

EUR USD (current price: 1.2030)

- Support levels: 1.1700 (August 2015 maximum), 1.1600 (2016 maximum), 1.1470.

- Levels of resistance: 1.2000, 1.2100, 1.2270 (November 2014 minimum).

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is above 0, the signal line has left the body of the histogram. RSI (14) is in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): the Tenkan-sen line is above the Kijun-sen line, the price is higher than the cloud.

- The main recommendation: sale entry is started from 1.2070, 1.2100, 1.2030.

- Alternative recommendation: buy entry is started from 1.2000, 1.1960, 1.1920.

Euro is traded with a slight decrease based on the correction after the growth on Monday, but still maintains an upward trend.

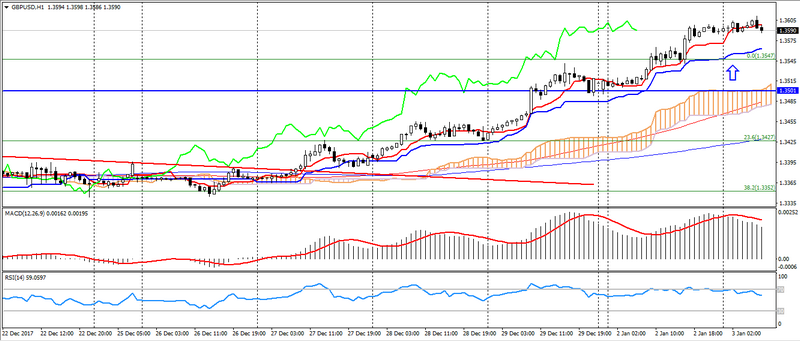

GBP USD (current price: 1.3590)

- Support levels: 1.3140, 1.2900, 1.2740 (August 2017 minimum).

- Resistance levels: 1.3500, 1.3660, 1.3830 (February 2016 minimum).

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is above 0, the signal line has left the body of the histogram. RSI (14) is in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): the Tenkan-sen line is above the Kijun-sen line, the price is higher than the cloud.

- The main recommendation: sale entry is started from 1.3610, 1.3660, 1.3700.

- Alternative recommendation: buy entry is started from 1.3550, 1.3500, 1.3450.

The British pound also appreciably strengthened due to the weakness of the American, but is limited to overbought.

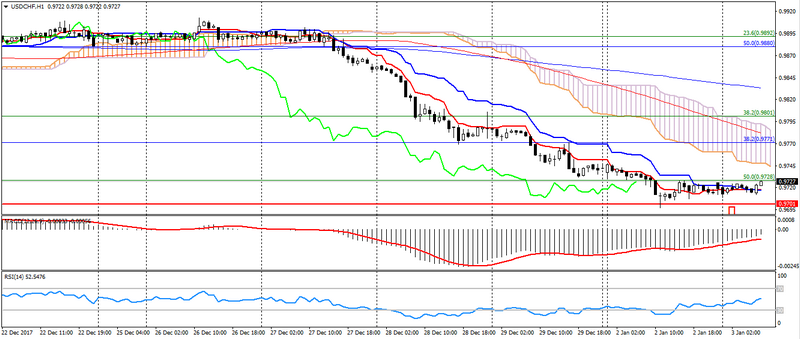

USD CHF (current price: 0.9720)

- Support levels: 0.9700, 0.9600, 0.9530.

- Resistance levels: 1.0000, 1.0050, 1.0100 (May maximum).

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is below 0, the signal line has left the body of the histogram. RSI (14) is in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): the Tenkan-sen line is below the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is started from 0.9770, 0.9800, 0.9840.

- Alternative recommendation: buy entry is started from 0.9700 (MA 100), 0.9680, 0.9740.

The Swiss franc is also traded with a strengthening on the flight of investors from risks, limited to overbought.

USD JPY (current price: 112.30)

- Support levels: 108.90, 108.10 (April 2017 minimum), 107.30 (2017 minimum).

- Resistance levels: 113.70, 114.50 (July 2017 maximum), 115.00.

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is below 0, the signal line has left the body of the histogram. RSI (14) is in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): the Tenkan-sen line is below the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is started from 112.80, 113.10, 113.50.

- Alternative recommendation: buy entry is started from 112.00, 111.60 (MA 200), 111.20.

The Japanese yen gained support from investors’ flight from risks, but is limited to overbought.

USD CAD (current price: 1.2520)

- Support levels: 1.2200, 1.2060 (2017 minimum), 1.1950 (2015 minimum).

- Resistance levels: 1.2780 (August 2017 maximum), 1.3000, 1.3160.

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is above 0, the signal line is in the body of the histogram. RSI (14) is in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): the Tenkan-sen line is below the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is started from 1.2550, 1.2590, 1.2620 (MA 100).

- Alternative recommendation: buy entry is started from 1.2500, 1.2480, 1.2460.

The Canadian dollar is traded with a strengthening on the positive dynamics of raw materials and the decline of the American.

AUD USD (current price: 0.7810)

- Support levels: 0.7740, 0.7320 (2017 minimum), 0.7120.

- Resistance levels: 0.8120 (2017 maximum), 0.8200, 0.8290 (2014 maximum).

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is above 0, the signal line has left the body of the histogram. RSI (14) is in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (flat signal): the Tenkan-sen line is below the Kijun-sen line, the price is higher than the cloud.

- The main recommendation: sale entry is started from 0.7840, 0.7880, 0.7900.

- Alternative recommendation: buy entry is started from 0.7800, 0.7780, 0.7760.

The Australian remains in an uptrend, but noticeably slowed down due to the overbought and correction.

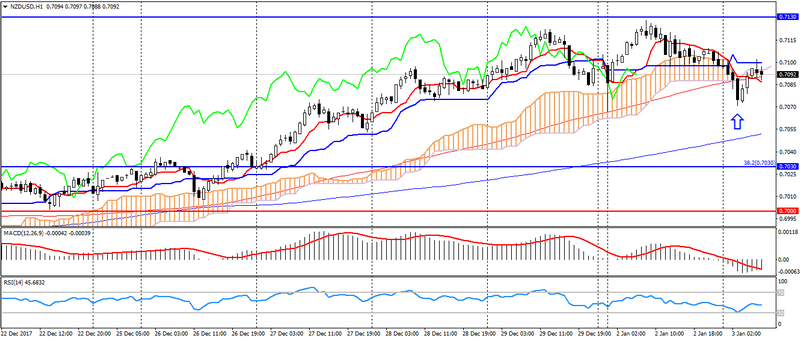

NZD USD (current price: 0.7090)

- Support levels: 0.7000, 0.6930, 0.6820 (the minimum of the current year).

- Resistance levels: 0.7380, 0.7450, 0.7550 ( 2017 maximum).

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is below 0, the signal line is in the body of the histogram. RSI (14) is in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): the Tenkan-sen line is below the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is started from 0.7130, 0.7150, 0.7180.

- Alternative recommendation: buy entry is started from 0.7070, 0.7050, 0.7030.

The New Zealand dollar is traded with a decrease in the correction of positions.

XAU USD (current price: 1213.00)

- Support levels: 1250.00, 1226.00, 1200.00.

- Resistance levels: 1340.00, 1355.00, 1374.00 (2016 maximum).

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is above 0, the signal line has left the body of the histogram. RSI (14) is in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): the Tenkan-sen line is above the Kijun-sen line, the price is higher than the cloud.

- The main recommendation: sale entry is started from 1318.00, 1320.00, 1325.00.

- Alternative recommendation: buy entry is started from 1310.00, 1306.00, 1298.00.

Gold maintains an upward trend, but is limited to a significant overbought.