Oil Technical Analysis (Alexander Sivtsov)

Oil is trading in the green zone during the Asian session.

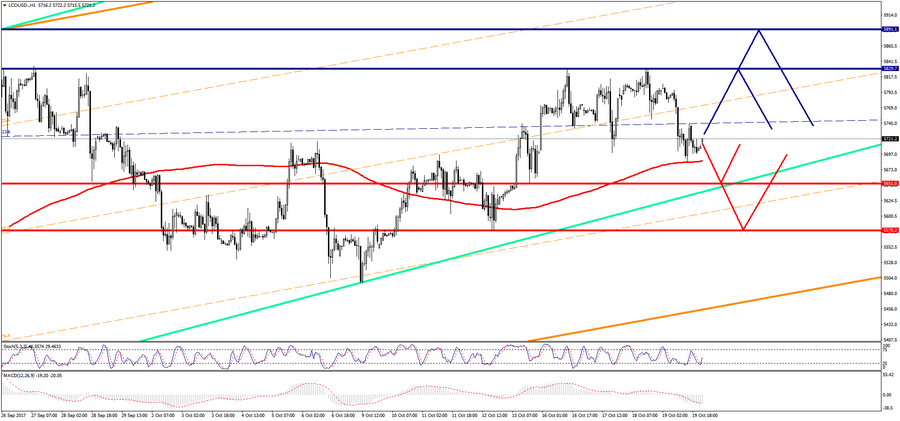

Brent (current price: $ 5721.2 per 100 barrels)

Brent is trading above the zero mark during the Asian session.

Resistance 1: From $ 5829.70 (maximum of October 16)

Resistance 2: From $ 5891.10 (maximum of September 26)

Support 1: With $ 5651.00 (Support Up line of channel on H1)

Support 2: From $ 5578.20 (minimum of October 12)

Computer analysis: The movings of the Stochastic Oscillator indicator on the price chart of D1 are in the overbought zone. Also, according to the MACD indicator on the D1 chart, a bearish divergence is formed. Based on this data, there remains the possibility of further reducing of the Brent price.

WTI (current price: $ 5171.4 per 100 barrels)

WTI trades above the zero mark during the Asian session.

Resistance 1: From $ 5260.20 (maximum of October 16)

Resistance 2: From $ 5,290.70 (maximum of September 28)

Support 1: From $ 5100.00 (psychological level)

Support 2: From $ 5039.60 (minimum of October 12)

Computer analysis: Just like Brent, on the D1 chart, Stochastic Oscillator movings are in the overbought zone. The MACD indicator on the D1 chart forms a bearish divergence, which is why one should expect a further decline in the price of the WTI brand.