Technical analysis of cross-rates. (Anton Hanzenko)

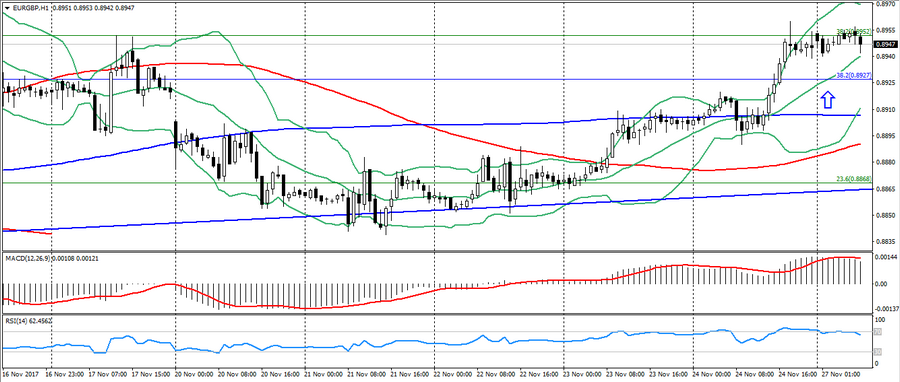

EUR GBP (current price: 0.8950)

- Support levels: 0.8730 (minimum of the last months), 0.8650, 0.8530.

- Resistance levels: 0.9020, 0.9170, 0.9300 (the maximum of the current year).

- Computer analysis: MACD (signal – downward motion): the indicator is higher than 0, the signal line has left the body of the histogram. RSI is in the overbought zone. Bollinger Bands (period 20): neutral, declining volatility.

- The main recommendation: sale entry is started from 0.8930 (Fibo, 38.2 from the April’s low), 0.8950, 0.8970.

- Alternative recommendation: buy entry is started from 0.8880 (MA 100), 0.8850, 0.8830.

This cross is trading in a flat, correcting after growth and maintaining an upward trend.

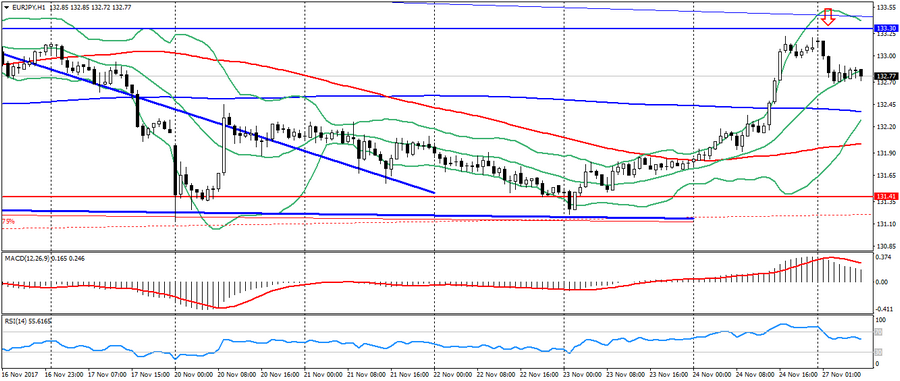

EUR JPY (current price: 132.80)

- Support levels: 131.40 (minimum of the last months), 130.50, 129.80 (Fibo. 23.6 from the low of the current year).

- Resistance levels: 133.30, 134.40 (the maximum of the current year), 135.00.

- Computer analysis: MACD (signal – downward motion): the indicator is higher than 0, the signal line has left the body of the histogram. RSI is in the neutral zone. Bollinger Bands (period 20): neutral, declining volatility.

- The main recommendation: sale entry is started from 131.80, 132.00 (MA 100), 132.40 (MA 200).

- Alternative recommendation: buy entry is started from 131.40, 131.00 (November minimum), 130.60.

The euro-yen was under pressure of correction and the growth in demand for safe harbor assets.

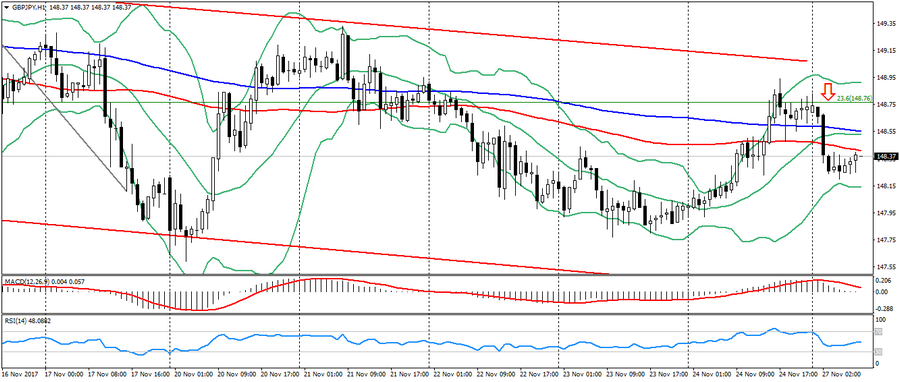

GBP JPY (current price: 148.30)

- Support levels: 147.00 (minimum of last months), 144.20 (Fibo, 50.0 from the low of April), 141.50.

- Resistance levels: 151.30, 152.80 (the maximum of the current year), 155.40.

- Computer analysis: MACD (signal – downward motion): the indicator is higher than 0, the signal line has left the body of the histogram. RSI is in the neutral zone. Bollinger Bands (period 20): neutral, growing volatility.

- The main recommendation: sale entry is started from 148.40 (MA 100), 148.60 (MA 200), 148.80.

- Alternative recommendation: buy entry is started from 148.00, 147.80, 147.50.

The pound-yen keeps a downward trend, after the British’s growth last week.

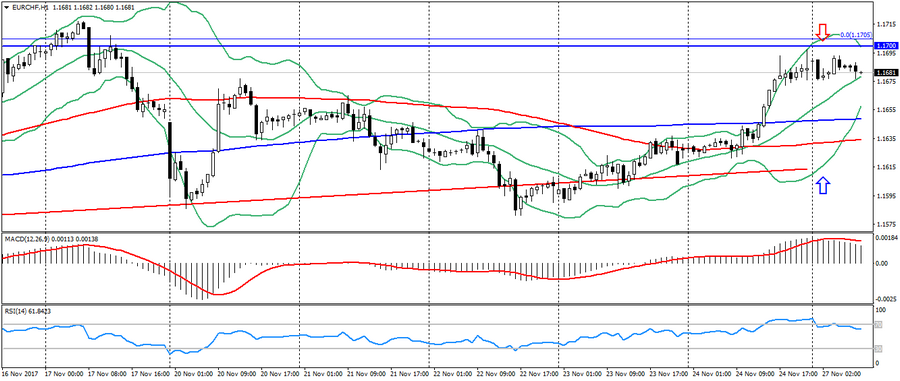

EUR CHF (current price: 1.1680)

- Support levels: 1.1500, 1.1450 (Fibo, 23.6 from the low of the current year), 1.1350.

- Resistance levels: 1.1700 (the maximum of the current year), 1.1750, 1.1800.

- Computer analysis: MACD (signal – downward motion): the indicator is higher than 0, the signal line has left the body of the histogram. RSI is in the neutral zone. Bollinger Bands (period 20): neutral, low volatility.

- The main recommendation: sale entry is started from 1.1650 (MA 200), 1.1660, 1.1680.

- Alternative recommendation: buy entry is started from 1.1600, 1.1580, 1.1560.

The euro-franc is growing, but is limited to psychology 1.1700.