Technical analysis of cross-rates. (Anton Hanzenko)

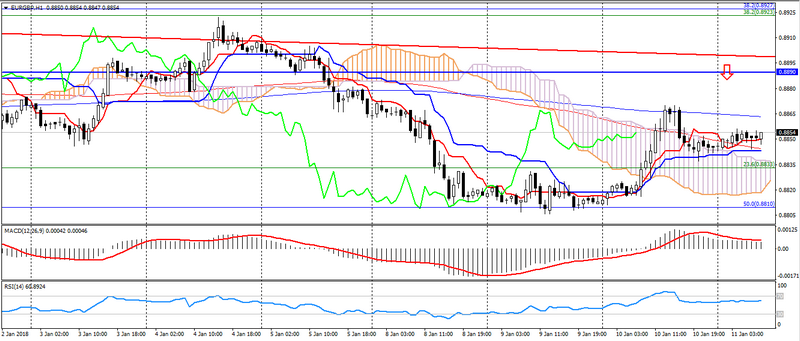

EUR GBP (current price: 0.8850)

- Support levels: 0.8730 (minimum of the last months), 0.8650, 0.8530.

- Resistance levels: 0.9020, 0.9170, 0.9300 (the maximum of the current year).

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is above 0, the signal line is in the body of the histogram. RSI (14) is in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): the Tenkan-sen line is above the Kijun-sen line, the price is higher than the cloud.

- The main recommendation: sale entry is started from 0.8860 (MA 200), 0.8890, 0.8910.

- Alternative recommendation: buy entry is started from 0.8830, 0.8800, 0.8780.

The euro pound pair is traded at the level of the opening day after a slight increase earlier, while maintaining the downside potential on the downtrend.

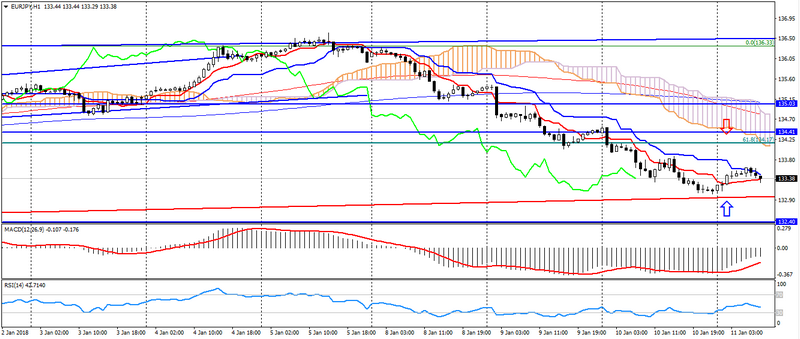

EUR JPY (current price: 133.40)

- Support levels: 131.40 (minimum of the last months), 130.50, 129.80 (Fib. 23.6 from the low of the current year).

- Resistance levels: 133.30, 134.40 (the maximum of the current year), 135.00.

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is below 0, the signal line has left the body of the histogram. RSI (14) is in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): the Tenkan-sen line is below the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is started from 133.80, 134.00, 134.70.

- Alternative recommendation: buy entry is started from 133.00, 132.80, 132.40.

The euro yen remains under considerable pressure amid the growth of the American and the strengthening of the Japanese currency, but is limited to significant support in the area of 133.00.

GBP JPY (current price: 150.60)

- Support levels: 147.00 (minimum of last months), 144.20 (Fibo, 50.0 from the low of April), 141.50.

- Resistance levels: 151.30, 152.80 (the maximum of the current year), 155.40.

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is below 0, the signal line has left the body of the histogram. RSI (14) is in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): the Tenkan-sen line is below the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is started from 151.00, 151.30, 151.70.

- Alternative recommendation: buy entry is started from 150.30, 150.00, 149.80.

The pound yen pair retains the potential to decline, but is limited to significant support at 150.50.

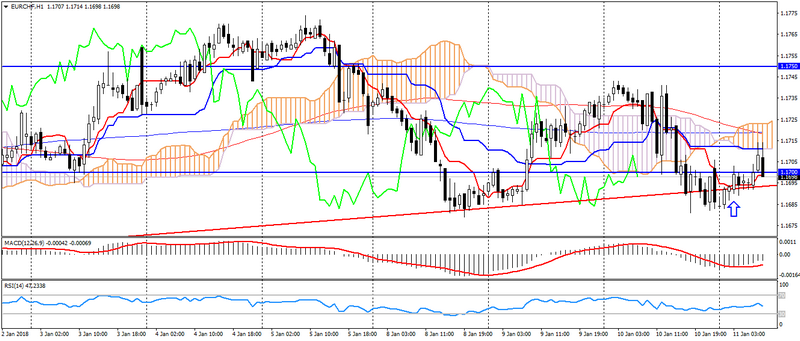

EUR CHF (current price: 1.1700)

- Support levels: 1.1500, 1.1450 (Fibo, 23.6 from the low of the current year), 1.1350.

- Resistance levels: 1.1700 (the maximum of the current year), 1.1750, 1.1800.

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is below 0, the signal line has left the body of the histogram. RSI (14) is in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): the Tenkan-sen line is below the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is started from 1.1730, 1.1750, 1.1780.

- Alternative recommendation: buy entry is started from 1.1690, 1.1680, 1.1660.

The euro franc was under pressure, but is limited by an uptrend.