Technical analysis of cross-rates. (Anton Hanzenko)

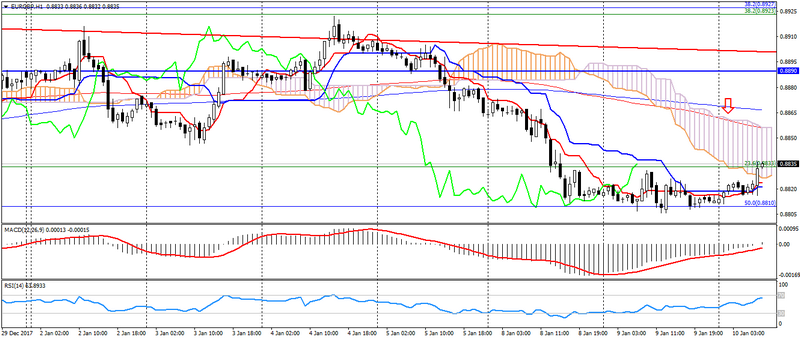

EUR GBP (current price: 0.8830)

- Support levels: 0.8730 (minimum of the last months), 0.8650, 0.8530.

- Resistance levels: 0.9020, 0.9170, 0.9300 (the maximum of the current year).

- Computer analysis: MACD (12, 26, 9) (signal – upward movement): the indicator is below 0, the signal line has left the body of the histogram. RSI (14) is in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): the Tenkan-sen line is above the Kijun-sen line, the price is in the cloud.

- The main recommendation: sale entry is started from 0.8850, 0.8870 (MA 200), 0.8890.

- Alternative recommendation: buy entry is started from 0.8810, 0.8790, 0.8770.

The euro pound pair is traded with the strengthening on correction after the decline, but is limited by a downward trend.

EUR JPY (current price: 133.60)

- Support levels: 131.40 (minimum of the last months), 130.50, 129.80 (Fib. 23.6 from the low of the current year).

- Resistance levels: 133.30, 134.40 (the maximum of the current year), 135.00.

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is below 0, the signal line is in the body of the histogram. RSI (14) is in the oversold zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): the Tenkan-sen line is below the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is started from 134.00, 134.40, 1345.70.

- Alternative recommendation: buy entry is started from 133.40, 133.20, 133.00.

The euro remains under considerable pressure amid the growth of the American and the strengthening of the Japanese currency, which may cause a general sell-off of the euro.

GBP JPY (current price: 151.10)

- Support levels: 147.00 (minimum of last months), 144.20 (Fibo, 50.0 from the low of April), 141.50.

- Resistance levels: 151.30, 152.80 (the maximum of the current year), 155.40.

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is below 0, the signal line is in the body of the histogram. RSI (14) is in the oversold zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – downward movement): the Tenkan-sen line is below the Kijun-sen line, the price is below the cloud.

- The main recommendation: sale entry is started from 151.60, 152.00, 152.60.

- Alternative recommendation: buy entry is started from 151.00, 150.60, 151.40.

A pound yen pair also accelerated the decline based on the yen’s growth and correction.

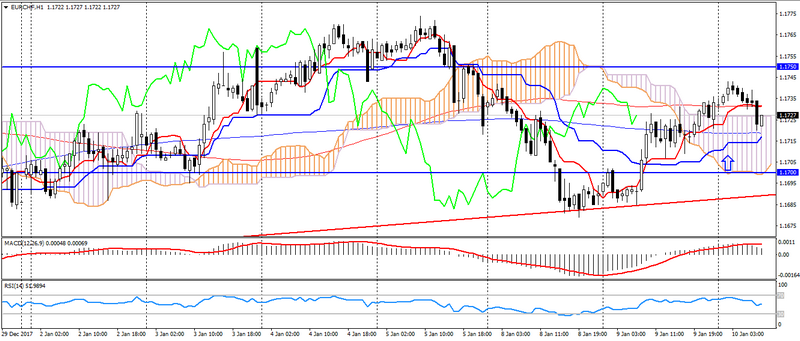

EUR CHF (current price: 1.1720)

- Support levels: 1.1500, 1.1450 (Fibo, 23.6 from the low of the current year), 1.1350.

- Resistance levels: 1.1700 (the maximum of the current year), 1.1750, 1.1800.

- Computer analysis: MACD (12, 26, 9) (signal – downward movement): the indicator is above 0, the signal line has left the body of the histogram. RSI (14) is in the neutral zone. Ichimoku Kinko Hyo (9, 26, 52) (signal – upward movement): the Tenkan-sen line is above the Kijun-sen line, the price is higher than the cloud.

- The main recommendation: sale entry is started from 1.1740, 1.1750, 1.1780.

- Alternative recommendation: buy entry is started from 1.1710, 1.1700, 1.1680.

The euro-franc pair keeps the potential to strengthen on maintaining the uptrend.