Candlestick Analysis – Continuation Patterns. Part 1.

The article will deal with one of the candlestick patterns, which is a signal for the continuation of the current trend in the market. Movement continuation patterns are strong, as trading in them implies that the transaction will be concluded along a trend, reducing possible risks.

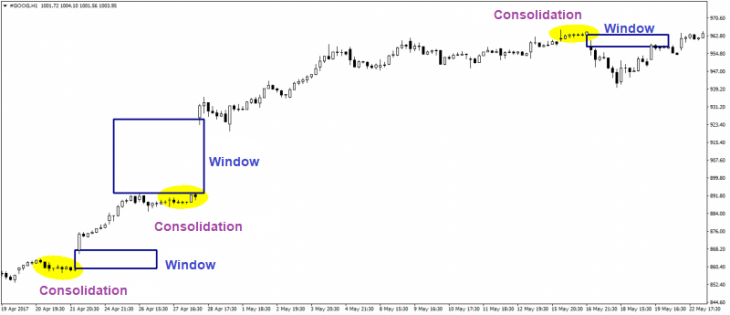

Movement Continuation Patterns – Window Candlestick Pattern

A window is the same Gap (gap), as it is called in the Western School of Technical Analysis. According to the convictions of the western trading school, the price should close the gap, and therefore many traders often enter into a deal opposite to the gap, hoping to close it, but often the windows give signals about the continuation of the current trend.

The window represents a significant difference between the closing price and the opening of two consecutive candlesticks, in connection with which an empty area between these candlesticks is formed on the chart, which is called the “price gap”.

Window features:

- The formation of windows allows long-term trade, while trade is conducted in the direction of the formation of the window. When forming the window up – purchase deals are made. When forming the window down – the tool is sold.

- The levels at which the window was formed are strong levels of support or resistance, from which you can trade also.

According to the Japanese trading school, the window is very powerful when the market wakes up. In other words, out of consolidation. When forming a window after consolidation, the candlestick pattern will be most effective and the market can enter without additional confirmation. It is also worth considering that the narrower the flat the stronger the pattern will be.

In the figure above, Google shares are taken as an example, the point is that windows in the stock market are more frequent than in the foreign exchange market, which increases the number of transactions and the total amount of profit when trading with this candlestick pattern.

Note: When trade using the windows, it is worth considering that this pattern works more effectively in a trend, although the pattern itself is excellent against it. Also, do not forget about the foundation, since gaps in the market are often formed on the basis of significant fundamental factors, the assessment of which will help to predict how strong and long the price movement can continue after the window has been formed.

You can study more detailed this candlestick pattern and learn how to trade using it, after completing a course of training with specialists of Еster Holdings Inc.

Alexander Sivtsov