US employment data

- Average hourly earnings (m / m) (September), fact 0.3%, forecast 0.3%.

- Nonfarm payrolls (September), fact 134K, forecast 185K.

- Private nonfarm payrolls (September), fact 121K, forecast 180K.

- Trade balance (Aug.), fact -53.20B, forecast -53.40B.

- Unemployment rate (September), fact 3.7%, forecast 3.8%.

The US employment report did not meet market expectations regarding US nonfarm payrolls, thereby exacerbating the pressure on the dollar, which was limited by a decrease in unemployment and a very high wage growth rate.

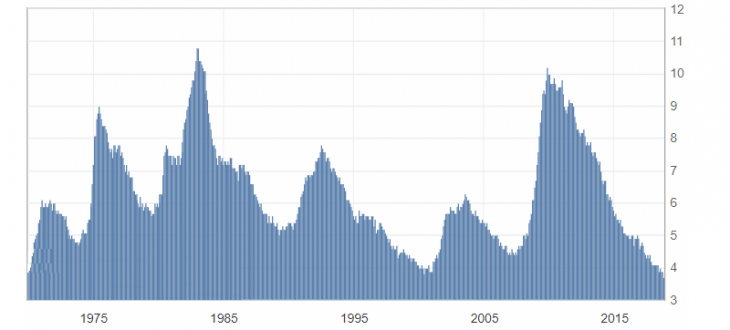

Fig. 1. US unemployment chart

The unemployment rate in the United States reached a historic low, which is certainly a positive signal, even with a slowdown in employment growth in the non-agricultural sector.

After a small decline, the US dollar index returned to a moderate growth on the ambiguous employment report in the United States, confirming its safety to growth, but limited to the side trading range from 95.70 to 96.00.

Fig. 2. The US dollar index chart. The current price is 95.80 (10-year government bonds yield is the blue line)

Hanzenko Anton

Earn with the help of the trade service on the news Erste News!

Topical articles of the trader’s blog:

- Trading with shares. Advantages and disadvantages.

- Does Monday is so hard as everybody say?

- How to trade CFD contracts with Ester Holdings Inc.?

Current Investment ideas: