U.S. Employment Data

- Average hourly earnings (m/m) (oct), fact 0.2%, forecast 0.3%.

- Nonfarm payrolls (October), fact 128K, forecast 89K.

- Private nonfarm payrolls (October), fact 131K, forecast 80K.

- Unemployment rate (oct), fact 3.6%, forecast 3.6%.

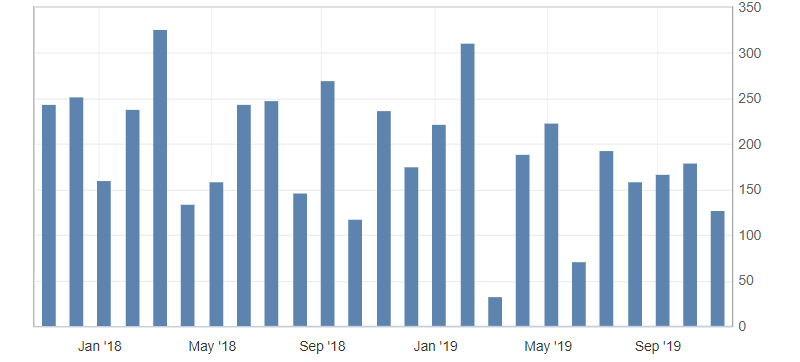

The US Employment Report showed continued strength of the labor market in the United States. Thus, a key indicator of the employment level and new jobs exceeded market expectations and amounted to 128 thousand. It is also worth to note the revised data for September to an increase of 44 thousand. Wage growth slowed, which could increase inflation concerns. It is also worth noting the downward trend in the number of people employed in the non-agricultural sector.

Fig. 1. U.S. Non-Farm Employment Chart

The US employment report for October can be considered positive. This has supported the US dollar index. At the same time, the main growth of the American dollar is traced against the currencies against which he was resold. Despite the positive employment data, the US dollar index is limited by optimism in the market and the results of the US Federal Reserve meeting, limited by resistance levels: 97.50 and 97.60, and support levels: 97.30 and 97.20.

Fig. 2. The US dollar index chart. Current price – 97.40 (10-year US government bonds yield – blue line)

Read also: “What is expected from the June Federal Reserve meeting”

Hanzenko Anton

Earn with the help of the trade service on the news Erste News!

Topical articles of the trader’s blog:

- Increased transportation costs: a driver for rising oil prices

- An uncertainty about Brexit is increasing

- Aggravation of the US – eurozone trade tension

Current Investment ideas: